I noted in the Weekend Wrap-Up that 90% of our gains have come in one day each week.

I noted in the Weekend Wrap-Up that 90% of our gains have come in one day each week.

I also pointed out that a vast majority of those gains occur in very thinly-traded futures, where unregulated (or jokingly regulated) traders can trade a few thousand index shares and move the US market values by Trillions of dollars. That’s why you often see the title "Just Another Manic Monday" starting my weeks, because it is often manic (as in upbeat for irrational reasons) and, as noted by Trader Mark in his post last night – it’s pretty darned ordinary at this point. In fact, anything less than a 1.28% gain on a Monday is below average.

So we are going to be back to testing our breakout levels early in the week and the volume should be low enough to allow a run back to last week’s highs. International traders took advantage of the Nikkei being closed and used the low Asian trading volume to make a statement on the Hang Seng, driving that market up over 200 points after lunch, improving on a 175-point gapped up open that has been flatlining until that final 90 minutes. It was another commodity-led rally as the dollar dove back to 88.5 Yen and right back to $1.4975 to the Euro (where we shorted the Euro last week) and $1.66 to the Pound. This led gold to fresh highs at $1,167 and copper touched $3.20 along with oil getting back to $78.50 – all tempting shorts but we’re happy to watch this nonsense from the sidelines after getting a bit more cashy ahead of the holiday.

The big market-moving news in Asia was a rumor that a researcher under China’s State Council reportedly said the Chinese economy was likely to expand more than 10% in the fourth quarter. That’s all it takes, you know – I know a guy who knows a guy who heard a guy who works in China said things are good there and BOOM – the Dow gains 100 points. Forget the fact that a 10% gain in China’s entire economy is just $400Bn US Dollars – see this excellent NYTimes China/US compariston chart to get a better picture of how the two nations stack up and also please read the excellent article from Marshall Auerback this weekend, "Should America Kowtow to China?" to get a great perspecitve on the money game.

The big market-moving news in Asia was a rumor that a researcher under China’s State Council reportedly said the Chinese economy was likely to expand more than 10% in the fourth quarter. That’s all it takes, you know – I know a guy who knows a guy who heard a guy who works in China said things are good there and BOOM – the Dow gains 100 points. Forget the fact that a 10% gain in China’s entire economy is just $400Bn US Dollars – see this excellent NYTimes China/US compariston chart to get a better picture of how the two nations stack up and also please read the excellent article from Marshall Auerback this weekend, "Should America Kowtow to China?" to get a great perspecitve on the money game.

"The market still has upward momentum as there’s expectation that Beijing won’t likely launch any monetary tightening measures by the year end," said Guosen Securities analyst Wang Junqing. "Investors will likely remain cautious until they confirm U.S. sales results after Black Friday," said Min Sang-il at E*Trade Securities, referring to the traditional start of the holiday shopping season, falling on Nov. 27 this year. "Stocks’ valuations look less attractive after the Kospi broke above 1600 last week."

As you can see from the above sketch on Saturday Night Live this weekend, Obama’s trip to China did nothing to support the dollar, either overseas or in the minds of US investors. We expected the National Debt to become more of an issue as the year winds down and Congress if forced to raise our debt ceiling over $12Tn, which we expect will have a negative effect on shopping but the initial effect is to weaken the dollar and that trade is being used to boost the markets at the moment. We went into the weekend 55% bearish and, like last Monday, we’re happy to play the silly upside momentum while it lasts but mainly, this is another great opportunity to place some downside bets.

Europe is flying as well (also gapped up pre-market and flat since) and, like last week, we’ll be keeping our eye on DAX 5,750 (now 5,749) to give us a proper sign that international stocks are breaking higher while the FTSE 5,250 (now 5,330) would be our bearish signal if it doesn’t hold up.

Europe is flying as well (also gapped up pre-market and flat since) and, like last week, we’ll be keeping our eye on DAX 5,750 (now 5,749) to give us a proper sign that international stocks are breaking higher while the FTSE 5,250 (now 5,330) would be our bearish signal if it doesn’t hold up.

Europe is also flying on a commodity-led rally as the only consumer spending we can really count on is the involuntary spending that occurs every time these International Financial Terrorists manage to hold our vital resources hostage and drive up the cost of the things that the global population can’t live without – whether or not there is any actual increase in demand. It’s good to know that, no matter how bad things get of the consumer, we can always FORCE them to pop another $50Bn into the global GDP by raising the price of oil a couple of bucks (and, what do you know, we’re up $2 since Friday’s close!).

Some traders said the dollar may have come under pressure on comments by Federal Reserve Bank of St. Louis President James Bullard that he would prefer to keep the central bank’s asset-buying program active beyond its current cutoff date. In an interview with Dow Jones Newswires Sunday, Mr. Bullard said he wants to see the central bank effort to buy mortgage-backed securities maintained beyond the end of the first quarter of 2010. Barclays Capital analysts said Mr. Bullard’s comments suggest "that the Fed will continue to underwrite the rally in risk and would leave the USD drowning in liquidity," while minutes of the Fed’s policy meeting should also be supportive of further dollar weakness.

Speaking of the Fed – Two Fed Governors (Steindel and Strauss) were on the team that put together the analysis for the National Association for Business Economics (NABE) – another one of those market-moving reports that is released to members ahead of the general public. Reaffirming last month’s call that the Great Recession is over, NABE panelists have marked up their predictions for economic growth in 2010 and expect performance to exceed its long-term trend. “While the recovery has been jobless so far, that should soon change. Within the next few months, companies should be adding instead of cutting jobs,” said NABE President Lynn Reaser, chief economist at Point Loma Nazarene University.

Speaking of the Fed – Two Fed Governors (Steindel and Strauss) were on the team that put together the analysis for the National Association for Business Economics (NABE) – another one of those market-moving reports that is released to members ahead of the general public. Reaffirming last month’s call that the Great Recession is over, NABE panelists have marked up their predictions for economic growth in 2010 and expect performance to exceed its long-term trend. “While the recovery has been jobless so far, that should soon change. Within the next few months, companies should be adding instead of cutting jobs,” said NABE President Lynn Reaser, chief economist at Point Loma Nazarene University.

While that does all sound very exciting, panelists also predict a relatively sluggish consumer upturn but look for a sizable housing rebound, low inflation, and further rise in stock prices. Importantly, panelists are mostly (though not entirely) optimistic that the Federal Reserve’s policies will not lead to higher inflation. At the same time, NABE panelists are “EXTREMELY” concerned about high federal deficits over the next five years.

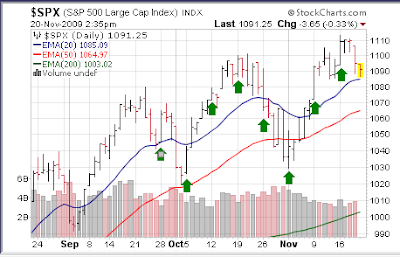

We’re planning on taking it easy on this short, holiday week. It will be interesting to see how our chart levels play out. If they can hold near last week’s highs today, we should get a good pop in the Nikkei, which will finally be good for our EWJ calls, that have been terrible so far. Jan $8 calls are just $1.35 with very little premium and are a nice way to play a pop in the global economy. The nice kicker on EWJ is that they actually benefit from a dollar bounce, which still might happen one day. Meanwhile, our chart levels are:

| Dow | S&P | Nasdaq | NYSE | Russell | Trans | HSI | Nikkei | FTSE | DAX | |

| Fri Close | 10,318 | 1,091 | 2,146 | 7,084 | 584 | 1,842 | 22,771 | 9,497 | 5,333 | 5,750 |

| 2.5% Up | 10,575 | 1,118 | 2,199 | 7,261 | 598 | 1,888 | 23,340 | 9,734 | 5,466 | 5,893 |

| Nov High | 10,471 | 1,113 | 2,205 | 7,266 | 605 | 1,905 | 23,100 | 9,995 | 5,396 | 5,843 |

| 2.5% Down | 9,772 | 1,042 | 2,059 | 6,784 | 565 | 1,764 | 21,283 | 9,259 | 5,199 | 5,606 |

| July Base | 8,200 | 880 | 1,750 | 5,600 | 480 | 1,650 | 17,500 | 9,200 | 4,200 | 4,600 |

| 25% Up | 10,250 | 1,100 | 2,187 | 7,000 | 600 | 2,062 | 21,875 | 11,500 | 5,250 | 5,750 |

| Retrace | 10,125 | 1,056 | 2,100 | 6,950 | 576 | 1,980 | 21,000 | 11,040 | 5,040 | 5,520 |

We see strength in China and Europe built not Japan. The Dow and NYSE are already in good shape and the DAX is, as usual, critical at 5,750. We need to see 3 of 5 of our US indexes hold those 25% lines to get more bullish but let’s not kid ourselves, with 3 days to Thanksgiving we’re not going bullish into the holiday anyway so it’s really a matter of restraining ourselves from making any bearish bets.

We only have Existing Home Sales at 10 this morning. For some reason they expect 5.85M homes in the October report, up a lot from 5.57 in September and that seems a bit doubtful but we’ll see. Tomorrow we have revised Q3 GDP data and it’s now expected that it will be revised down to 2.8%, from the ridiculous 3.5% number that rallied the markets last time. Case-Shiller’s September Index is out at 9am tomorrow along with consumer confidence and then FHFA Home Price Index at 10. Wednesday is a datapalooza with Personal Income & Spending, PCE Prices, Jobless Claims, Durable Goods, Michigan Sentiment, New Home Sales and Oil Inventories so fun, fun, fun this week.

Let’s be careful out there!