US Commercial Banks: the Turkeys Are Stuffed

Courtesy of Jesse’s Café Américain

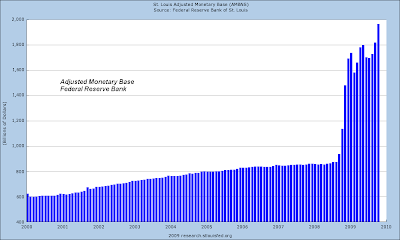

The increase in the monetary base created by the Fed’s monetization of debt is striking, not seen since the early stages of the Great Depression.

[click on charts for larger views]

Banks are not lending despite the massive quantitative easing. They are fat with reserves, paying huge bonuses again, and obviously doing something with their money other than providing funds for the commercial activity of the nation.

Excess Reserves are an accounting function. The banks themselves do not reduce their reserves significantly through lending in the aggregate, but seek to minimize the opportunity cost of reserves. But it is symptomatic in the sense that the lack of reserves is most definitely NOT an issue with lending.

No one can deny with any credibility that if the Federal Reserve reduced their payment on reserves to zero, or even a negative, that lending activity would not increase. And yet they do not. Why?

Because the first priority of the Fed is the health of the banking system itself, and not the national economy and the availability of credit to non-banking institutions. They are seeking to drive commercial entities out of secure savings to risk investment again, but providing a safe harbor for the banks while they are doing it, while attempting to maintain the appearance of financial system solvency.

The critical, unspoken factor is that the US banking system is not yet healthy, is not sound, is not well capitalized despite the record expansion in the monetary base and its specific direction to the banks themselves. They have simply not taken the writedown necessary to make themselves financially sound, because they do not wish to take the hit to earnings, salaries, stock options and bonuses.

Ben Bernanke’s gambit is as much financial fraud as it is a monetarist exerperiment in cynicism with regard to the management of a nation’s money.