Massive Deflation Sighting in the US As Noted in the Asia Times

Courtesy of Jesse’s Café Américain

Courtesy of Jesse’s Café Américain

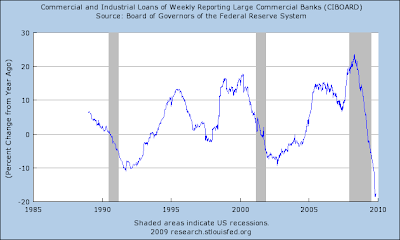

David Goldman says in the Asia Times that "It’s Still the Worst Deflation in US History." He shows a chart (below) of US commercial lending to prove his point.

Asia Times

It’s Still the Worst Deflation in US History

November 18th, 2009

By David GoldmanThis morning’s news that housing starts “unexpectedly” dropped by 11 percent month on month is consistent with my grim view of the American economy. The crystal-meth monetary policy at the Fed makes everyone feel better, until they don’t.

The nonstop rise in the price of dollar hedges tells us that it can’t last forever. Large balance sheets attached to the Fed’s money pump can show profits, and the price of spread assets (as PIMCO’s Bill Gross keeps emphasizing) is stupid rich. But at the capillary level, through, the economy is dying and gangrene is setting in.

Here’s year on year growth in commercial and industrial loans from weekly reporting banks in the US:

A 20% decline year on year does not look like a recovery. In fact, it looks like nothing we have seen since the Great Depression. C&I loan growth lags the end of recessions, to be sure, but this extreme level of credit reduction suggests profound trouble….

Yes commercial lending is slack and gone negative. And yes, it does signal severe economic distress in the productive economy. But is that deflation?

No, it is a sign of a very slow GDP growth and deleveraging in the aftermath of a credit bubble, with a GDP that I think is still negative in real terms. The US economy is still very bad, and David is probably less gloomy about that than Le Proprietaire.

One could assume that by ‘deflation’ David means ‘a recession/depression’ or ‘a lousy economy.’ But that is not deflation, as the economists learned in the economic stagflation of the 1970’s. Words count, and this is an important distinction, because one reacts to situations as diverse as inflation or deflation, hyperinflation or stagflation, differently.

Is this a deflation which we see now in the US, even if it is not the ‘worst in history?’ Is there a steadily strengthening US dollar ,and low money supply growth relative to demand, or GDP relative to money suppy as indicated by an abnormally high velocity of money?

Only in the mind and imagination of someone who already believes in a deflationary outcome with all their mind and heart.

Can deflation happen? Yes. That is inherent in a fiat currency.

If the Fed raised the overnight interest rates to 20% tomorrow, we would have a deflation ‘lickity split’ because that would be an extreme policy action which relative to the underlying demand for money and economic conditions, is purposeful and dramatic towards a specific end. And this is the Fed’s ‘hole card,’ the means by which they think they can control inflation in the future once the US economy has recovered (if it does sustainably I would add, and not just another asset bubble).

Inherent in David’s conclusion is that money supply can only grow through bank lending. This is economic illiteracy. The Weimar inflation, for example, was not caused by excessive lending by German commercial banks in a vibrant economy. It was caused by the monetization of existing debts, the war reparations debt, without a corresponding growth in productive GDP.

So, absent a conscious policy decision by the Fed to strangle the US economy premature to recovery, deflation becomes a likely outcome if the Federal Reserve runs out of debt obligations, both public and private, which it is willing and able to monetize. That is the only ‘hard stop’ in the game on that side of the equation, and good luck with that.

Deflation would hurt those who owe debts in dollars, and be a boon to those who are the creditors. The American people are the debtors, and they control the growth of their money supply, at least for now.

The obvious pivot point, one key vector, in all this is one simple question: "Can the US economy become self-sustaining again, productive in its own right without having to export inflation by printing currency and living on credit?"

A second, but important question is can China and the rest of the mercantilist world adjust gracefully to a rebalancing in the distribution of demand, while maintaining sustainable growth of their own, despite their fears of a rising middle class?

We say yes, but only with a serious effort at fiscal and economic rebalancing. Cutting spending alone is not enough. That is the route to self-destruction, economic anorexia, if nothing else changes. Liquidationism alone is inherent in the neo-Calvinist roots in the US that emphasize the justice of non-redemptive suffering. They have sinned, so they must suffer, and the more the better.

There are three things the US must do: reform, reform, reform. Everything else is a palliative, to buy time at best while you seek to make the necessary systemic changes.

What does it matter, the details of the outcome, as long as the economy is in a slump?

If you want to suffer, go into a serious and protracted stagflation in the US holding dollars as the bulk of your wealth, and that will give you a taste of hell.

What is the most likely outcome? Would you care to buy a vowel? I would suggest that you buy an "I" and then see if there is an "S."

Deflation and straight inflation are relatively easy to hedge. Stagflation is the most difficult outcome to manage from an investment perspective. We’ll talk more about this later if that appears to be the case.

Stagflation will be the unintended consequence that will catch the most people unprepared. This is the outcome most feared by the Fed, because it renders their monetary policies ineffective. The Fed can create money until the dollar goes to zero, but it cannot manage fiscal and industrial policy, and confer productive vitality which is essential to a sustainable recovery.

You cannot say that Bernanke did not warn you about what he will do. Deflation: Making Sure "It" Doesn’t Happen Here

But we cannot stress enough that the outcomes are not predetermined, except in the minds of true believers. Therefore flexibility and clear-headed watchfulness are important now, more than ever.