Nearly 1 in 4 Borrowers Is Underwater; Case Shiller Prices Rise 4th Consecutive Month; Treasury Yields Sink

Courtesy of Mish

Case Shiller housing data for September came out today and Home Prices Rose For 4th Consecutive Month.

Home prices in 20 U.S. cities rose for a fourth straight month in September, pointing to improvement in real estate that’s helping the economy emerge from recession.

The S&P/Case-Shiller home-price index increased 0.27 percent from the prior month on a seasonally adjusted basis, after a 1.13 percent rise in August, the group said today in New York. The gauge fell 9.36 percent from September 2008, more than forecast, yet the smallest year-over-year decline since the end of 2007.

Rising home sales, aided by government programs and a decline in mortgage rates this year, have helped stem the slump in property values that precipitated the worst recession since the 1930s. Home buying and consumer spending may still be hampered by higher unemployment, which may prompt more foreclosures.

That’s the good news.

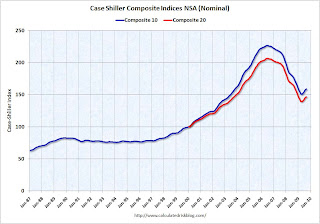

A look at some Case Shiller Home Price Graphs from Calculated Risk put the recovery in bit of a different light.

Click on graph for larger image in new window.The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 29.9% from the peak, and up about 0.4% in September.

The Composite 20 index is off 29.1% from the peak, and up 0.3% in September.

Maybe we get a couple more months of price increases as pent-up demand exhausts itself. Then, tax credits or not, prices are likely to resume their natural state of affairs which at this point is still down.

Housing starts are declining, unemployment has not yet peaked, inventory is high, shadow inventory is waiting in the wings, and there is no driver for jobs or a solid sustained recovery.

23% Of Mortgage Holders Is Underwater

The Wall Street Journal is reporting One in Four Borrowers Is Underwater

The proportion of U.S. homeowners who owe more on their mortgages than the properties are worth has swelled to about 23%, threatening prospects for a sustained housing recovery.

Nearly 10.7 million households had negative equity in their homes in the third quarter, according to First American CoreLogic, a real-estate information company based in Santa Ana, Calif.

These so-called underwater mortgages pose a roadblock to a housing recovery because the properties are more likely to fall into bank foreclosure and get dumped into an already saturated market. Economists from J.P. Morgan Chase & Co. said Monday they didn’t expect U.S. home prices to hit bottom until early 2011, citing the prospect of oversupply.

Home prices have fallen so far that 5.3 million U.S. households are tied to mortgages that are at least 20% higher than their home’s value, the First American report said. More than 520,000 of these borrowers have received a notice of default, according to First American.

Negative equity "is an outstanding risk hanging over the mortgage market," said Mark Fleming, chief economist of First American Core Logic. "It lowers homeowners’ mobility because they can’t sell, even if they want to move to get a new job." Borrowers who owe more than 120% of their home’s value, he said, were more likely to default.

Mortgage troubles are not limited to the unemployed. About 588,000 borrowers defaulted on mortgages last year even though they could afford to pay — more than double the number in 2007, according to a study by Experian and consulting firm Oliver Wyman. "The American consumer has had a long-held taboo against walking away from the home, and this crisis seems to be eroding that," the study said.

Even recent bargain hunters have been hit: 11% of borrowers who took out mortgages in 2009 already owe more than their home’s value.

Many borrowers are so deeply under water that they can’t take advantage of lower rates and refinance their mortgage. "We’re declining hundreds of loans each month," said Steve Walsh, a mortgage broker in Scottsdale, Ariz. "The only way we will make headway is if we allow for a streamlined refinance where the appraisal is irrelevant."

Treasury Reaction

Inquiring minds are asking "How did the treasury market react to the good news?" That’s a good question and here is the answer.

click on chart for sharper image

Two year treasuries are sporting a yield of .74% while five year treasuries are yielding an astonishingly low 2.12%. Those yields are smack in the face of today’s record $42 billion auction of notes maturing in five years.

While the stock market is saying one thing, the treasury market says another. I know who I believe, and it’s not the stock market.

Addendum:

Tim Ellis at the Seattle Bubble comments

Hi Mish,

The Bloomberg article you linked to today has an outright false headline. "Home prices in 20 U.S. cities rose for a fourth straight month" is totally incorrect. Home prices rose in only 9 of 20 cities tracked by Case-Shiller. The 20-city index rose, but the headline clearly states that home prices "in 20 cities" rose, which is false.

Tim is correct. My link had it correct Home Prices Rose For 4th Consecutive Month. However, the actual landing headline is Home Prices in 20 U.S. Cities Rise for Fourth Month.

Note that the 20 city index composite rose but only 9 of 20 cities actually rose, 10 declined and 1 was flat. Here is the pertinent statement from the article.

Nineteen of the 20 cities in the S&P/Case-Shiller index showed a smaller year-over-year decline in home prices than in August.

Compared with the prior month, nine of the 20 areas covered showed an increase while 10 had a decline. The biggest month-to- month gains were in Detroit and Minneapolis, where prices increased 1.8 percent.