The Impact of Dubai Default Has Much More Widespread Consequences, and Opportunities

Courtesy of The Shocked Investor

Until yesterday, ‘Dubai’ seemed to evoke an economic miracle. The best known of the six monarchies that formed the United Arab Emirates in the early 70s, Dubai appeared to be the best of several worlds. A small country (83 sq. kilometers), with few people (4.7M) and rich in oil, Dubai seemed destined to be another of the Arab dictatorships in which a minority enjoys the petrodollars and mass of the population lives in misery stalls. This script, however, was not true. The Emirates not only reached a high standard of living but also achieved something rare for an Arab country. Its economy reduced dependence on oil. The pharaonic constructions are not royal palaces, but hotels and headquarters of banks. More than bricks and concrete, Dubai managed to establish itself as a regional financial center, while offering a favorable environment for business and an open Islamic society.

Thus the strong impact of the news that circulated this morning, that the holding company Dubai World was trying to postpone the payment of U.S. $ 59 billion in debt. With about $ 80 billion in assets, Dubai World is the investment vehicle of the government of the emirate that allows international investors to participate, for example, in construction of hotels, resorts and marinas on the shores of the Persian Gulf. It was thought that the reserves in hard currency of Dubai made its economy as robust as their hotels. To finance these buildings require much capital, big money even for a country rich in oil. This resulted in the the heavy indebtedness of Dubai World, which funded some of the most sumptuous hotels in the world through the issuance of securities in the international market. The company survided well through the worst of the crisis thanks to its abundant reserves in hard currency and the recent recovery in oil prices. However, the downturn has drained resources and diverted investments from emerging countries, which proved to be cumbersome for the Dubai World.

The effects on the Brazilian Real and on the Euro have been much more significant than on the USDX, which is a basket of currencies. This will present tremendous opportunity today, where markets are open, and perhaps still tomorrow AM. In particular, Brazil is not significantly exposed to Dubai. Unless there is a widespread crash, this may well be another temporary blip on the currency, much like the 2% IOF imposed last month.

Effects on Brazilian Real (charts from INO tools, which works intra-day today):

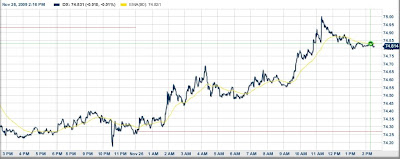

Effects on USDX:

(Impact on USDX today, to 2:30PM, click to enlarge)

Effects on the Euro:

The Euro is part of the USDX basket, thus the smaller influence there.

Risks

The sudden default of a participant in the financial market taken as unshakable shows that the risks of crisis are still far from over. It came late but it happened, the devaluation of the real estate market, and the downturn buckled Dubai World. New cases may occur, and, especially, can be generated under the current conditions.

It has been discussed at length how the packages of government aid pumped trillions of dollars in a global economy without demand. One of the negative side effects of these policies is the ability to raise money cheaply to finance any initiative. In a recent article, Bill Gross, director of the American fund Pimco, the world’s largest, noted that some funds are offering a net yield of 0.01% per annum. In this step, an investor would take 6,932 years to double its capital, says Gross. Few have so much patience or live so long – not even Methuselah who lived to be 1,000 years old – which stimulates the search for risk. With money plentiful and cheap, there is an increase of the possibility of generation of new bubbles. The low interest rates in major economies may exacerbate uncontrollable outbreaks of leverage, with unpredictable consequences. In other words, we must be attentive to the lessons that Dubai can teach us.

Impact on Brazil

The impact on Brazil will be small. In addition to the two economies are not highly connected, Brazilian investors have not discovered the Islamic market. Instead, the incursions of Brazilian banks in the Middle East are much more to get money than to invest. Still, it is essential to talk about Dubai.

With information obtained from Brazil, where markets are open.