Happy Thanksgiving to everyone! Hope you all had a nice feast and day of relaxation. My beloved Green Bay Packers took home a nice victory, so it was a good day. I am feeling much better, and I think today should be a good day for us in the market. The markets are looking very, very poor today, but I still think we can find some good places to throw our money. Let’s get into today’s picks and enjoy your leftovers!

Happy Thanksgiving to everyone! Hope you all had a nice feast and day of relaxation. My beloved Green Bay Packers took home a nice victory, so it was a good day. I am feeling much better, and I think today should be a good day for us in the market. The markets are looking very, very poor today, but I still think we can find some good places to throw our money. Let’s get into today’s picks and enjoy your leftovers!

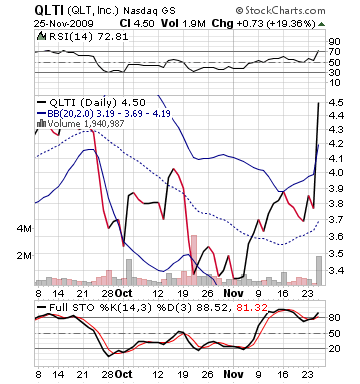

Short Sale Pick of the Day #1: QLTI Inc. (QLTI)

Analysis: Today, I do not think that there is much of a great buy. I am sure stocks will move an upwards direction at some point, but everything is looking pretty bleak. It may be safer to go with a couple of short sales that we think can work. The market is looking down on news coming out of a Dubai investment company may default on over $60 billion in loans, which would affect a multitude of financial institutions and is a sign of the still never ending state of the current economy. Futures are down over 200 points for the Dow as of 8:30 AM, and I don’t see an end in sight. Crude dropped $4.00 this morning. Stocks across the board are in the red. It looks pretty bad out there…

One stock, however, that is in the green is QLT Inc. (QLTI), which is a pharmaceutical company that produces products for use in photodynamic therapy (PDT), using light-activated drugs to treat disease. The company has rose over 20% on Wednesday on news of a settlement that went in QLTI’s favor with a hospital. The stock is still in the green this morning despite the news and the quick fire sale I am expecting. Further, the stock got a small upgrade from RBC Capital Markets. This is also helping to spark some interest but do not be fooled.

With the stocks technicals going hay wire, QLTI hit a two-month high on Wednesday. Typically, when we see a 20% gain on one day, we can expect a solid retrenchment the next day. There are just way too many quick buyers and sellers on days like that. QLTI should be no different, and with the market ready to tank, we should expect this to move into the red pretty quickly. The stock’s technicals tell the story, further. The stock was already oversold going into Wednesday having risen over 10% in the past month. The stock’s RSI is almost at 100, which is a level that is very rarely seen. The stock’s highest bollinger band suggests the stock should move backwards to 4.20, which would be an over 6% drop from its current prices. Yet, the stock is up in pre-market?

We know better. Get into this one and enjoy a nice ride.

Entry: We are looking to enter this one at 4.50 – 4.60.

Exit: Looking to cover with a 2-3% gain.

Stop Buy: 3% on top.

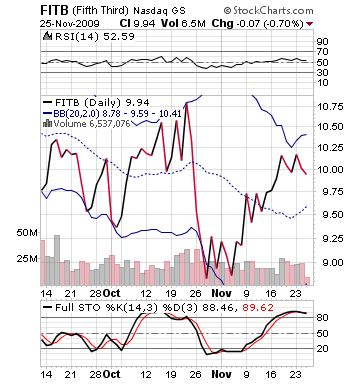

Short Sale Pick of the Day #2: Fifth Third Bancorp (FITB)

Analysis: With the financial markets in a deep threat today, I thought we should find some way to short the financials. What I found was FITB was the stock with the least downward movement in pre-market of all the majors. The stock is down about 2.5% in pre-market trading. SKF is up 6% and the likes of C, BAC, and WFC are all down more than 4%. This is to help give you an idea of where the financials stand this morning. It is not good.

Lately, FITB has been on a terror. The stock has jumped well over 10% since the beginning of November. The stock has seen its technicals look pretty overvalued. Stochastics show the stock is well overbought, and it should have some trouble holding  that momentum. The stock is near its upper band, and it is well overvalued on RSI. Everything is setting up for what appears a longer term play for a short sale. On the other hand, this also means that we should expect the stock to show a lot more of a decrease than it is today because there should be relatively less buyers. The stock is getting a lower volume, however, in pre-market. When the market gets really moving, this one should quickly adjust.

that momentum. The stock is near its upper band, and it is well overvalued on RSI. Everything is setting up for what appears a longer term play for a short sale. On the other hand, this also means that we should expect the stock to show a lot more of a decrease than it is today because there should be relatively less buyers. The stock is getting a lower volume, however, in pre-market. When the market gets really moving, this one should quickly adjust.

It is doubtful FITB has any real connection to the Dubai crisis, but it is a financial institution. As they all go, they all go. I have set the entry higher because I just cannot imagine there won’t be any quick buyer action at these discounted prices, but it should be quickly counteracted by short sellers.

Entry: We are looking to enter this one at 9.70 – 9.80.

Exit: Looking to cover with a 2-3% gain.

Stop Buy: 3% on top of entry point.

Good Luck and Good Investing,

David Ristau