Dubai World & Bear Stearns: Coal Mine Canaries?

Courtesy of Joshua M Brown, The Reformed Broker

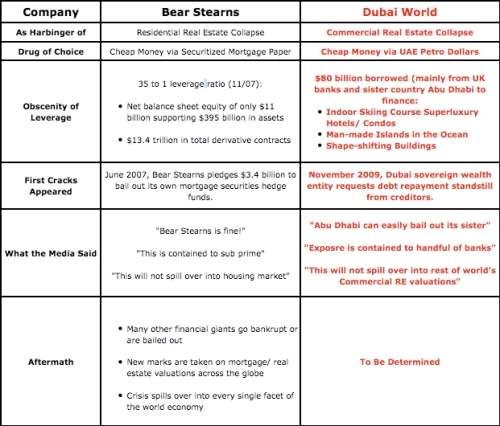

The meme going around now is that the Dubai debt thing is only the start of a wave of sovereign defaults, including Latvia and Greece, coming soon. While this could be the case, I actually see a lot more similarities between what the Bear Stearns blow up ultimately meant to the residential real estate market versus what the default of Dubai World could mean for the commercial real estate market.

While I make no predictions or forecasts on this site whatsoever, I would be remiss if I did not point out some of these similarities (see above chart).

Commercial real estate has long been thought of as 2010’s big meltdown and the proverbial “next shoe to drop”. Nowhere has the worship and commensurate overbuilding of commercial real estate been better exemplified than in the United Arab Emirates. At one point in 2005, it was estimated that 25% of all the cranes in the world were operating within the UAE.

Commercial real estate has long been thought of as 2010’s big meltdown and the proverbial “next shoe to drop”. Nowhere has the worship and commensurate overbuilding of commercial real estate been better exemplified than in the United Arab Emirates. At one point in 2005, it was estimated that 25% of all the cranes in the world were operating within the UAE.

Like California and South Florida came to represent the worst of the residential RE bubbles, the explosion in spending and financing for commercial RE has its international Ground Zero in Dubai. Everyone from the major banks to the private equity cabal to Donald Trump has a stake in this story.

We’ll see whether this story is “contained” or if it is just the harbinger of a re-marking of commercial RE portfolios around the world.

Full Disclosure: Nothing on this site should ever be construed as research, advice or an invitation to buy or sell any securities, please see my Terms & Conditions page for a full disclaimer.