5 REASONS TO EXPECT A NEAR-TERM SELL-OFF

Courtesy of The Pragmatic Capitalist

Strategists at Credit Suisse are currently expecting a near-term equity sell-off, but are not yet concerned about the downturn evolving into a larger bear market decline. Why have they turned a bit more cautious? A series of psychological, fundamental and technical events:

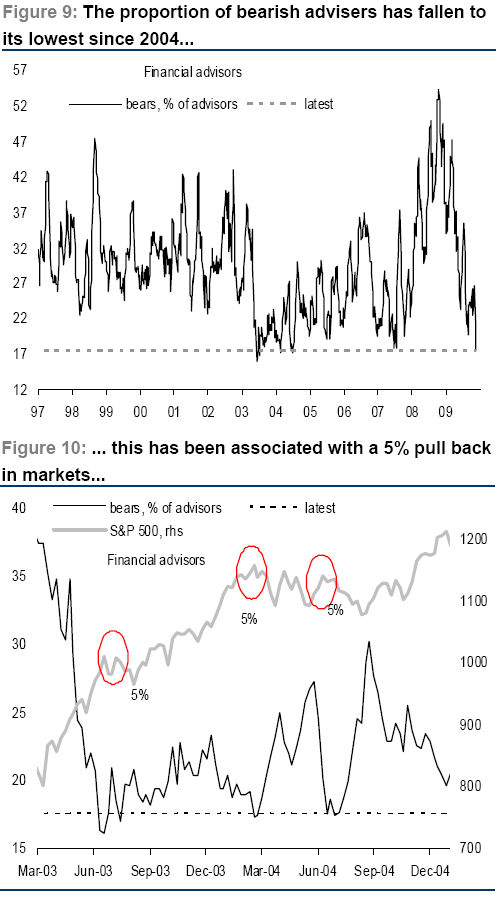

As we’ve previously noted, sentiment is turning extremely bullish:

(a) Bearish sentiment has hit June 2004 low (Figure 9). When it was this low in 2003 and 2004, markets corrected by 5% (Figure 10), but we would stress that bullish sentiment at that point was a lot higher then than it is now.

Credit spreads have begun to widen in the last few months. Not surprisingly, investors are beginning to focus on the long-term debt problems around the globe. In addition, Dubai and the upcoming wave of mortgage resets could prove a reminder that the credit crisis is not quite over yet.

(b) Stress in the credit markets. We have seen the sovereign CDS rise in the past three months especially in Japan (the world’s largest creditor!), whose CDS has doubled (rising from 35bps to 70bps) – a surprise, given that the trigger has been the DPJ tightening fiscal policy by 1.2% of GDP. We have also seen the credit spreads of lower quality European countries deteriorate (Greece spreads have widened by 100bps over the past three months).

As we recently noted in the Expectation Ratio, it’s likely that the gap between real earnings and expectations has peaked. Credit Suisse believes upgrades have likely peaked as well:

(c) The rate of earnings upgrades has just peaked, and on the last three occasions this happened (June 04, Sep 05 and May 06), the S&P 500 has traded sideways for a the next three months.

Credit Suisse is concerned thatthe ECB could begin pulling the liquidity plug:

(d) The ECB will start withdrawing part of the emergency liquidity – with the announced end of the unlimited one-year refinancing operations in December. Greece and Ireland are the main recipients of the funds from ECB refinancing operations, with these funds being equivalent to around 50% and 16% of GDP respectively, according to our European Economics Team.

Although the technicals remain firmly positive in the long-term, we are nearing a critical juncture in the rally. In addition, the alarming volume trends are reason for CS to be concerned:

(e) Chartist point: 1,121 on the S&P 500 would mean a 50% retracement of the bear market. This point has not been breached. In the last month, volumes have been slightly higher on down-days than on up-days.