I feel a slight buzz in the air about the holidays lurking right now. The malls were busy to start the holiday shopping season and sales are up from one year ago. On recap, last week was definitely a tough week due to my illness, but I am back with full powers this week. Friday, we had one great pick and one horrible pick. On QLTI, we lost 3%. The stock did pretty much the exact opposite of what I expected and ended up, even with a almost 2% down day. We did, however, have good success with Fifth Third Bancorp’s short sale. We got in at 9.80, and we were able to sell it at 9.61 for a solid 2% gain right before the close of the day.

1/2 not too bad for having the flu. Let’s get into a 2/2 day.

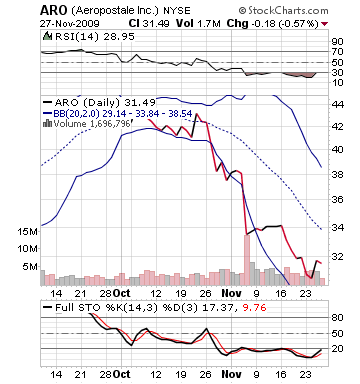

Buy Pick of the Day: Aeropostale Inc. (ARO)

Analysis:

Retailers got some good news this morning on a number of fronts that I believe should help the market challenge the overhand on the Dubai market issues we saw Friday. ShopperTrak, which is a research firm on retail, said that they saw the after Thanksgiving season up 0.5% in sale totals from one year ago, according to initial data. The total was $10.66 billion. Online sales were up 11% from one year ago. Even with the encouraging news, the National Retail Federation is still expecting a 1% decline from one year ago in total sales.

Not all analysts were excited, as John Long from Kurt Salmon Associates commented, "Forget Black Friday for bricks and Cyber Monday for clicks — this year it’s all about making it easy for customers to satisfy their shopping fix … we’re still seeing cautious spending. The pie isn’t increasing whether you decide to buy in the stores or online."

Not all analysts were excited, as John Long from Kurt Salmon Associates commented, "Forget Black Friday for bricks and Cyber Monday for clicks — this year it’s all about making it easy for customers to satisfy their shopping fix … we’re still seeing cautious spending. The pie isn’t increasing whether you decide to buy in the stores or online."

Yet, some analysts this morning, including myself, are excited about these stocks. American Eagle received an upgrade from Lazard Capital Markets, and Abercrombie received an upgrade from FBR Capital. These two upgrades have helped to lift these stocks in the morning. Further, in after hours, we are getting an earnings report from Guess?. I think all of this is reason for retail to look towards a positive day, and it could even be the market leader.

Aeropostale is my pick of the day because it has gone under the radar and is undervalued, but it will definitely get some added attention from the upgrades and overall retail sentiment. ARO has lost 25% over the past month, it is extremely undervalued, and way oversold. It has been pretty tough since earnings reports started for Aeropostale and October sales were reported. Today, though, is the perfect day to get involved because the rise will compound with the fact that the company is reporting earnings on Wednesday.

The stock is not up significantly in pre-market, but it should be a big mover. Futures continue to move higher, and we should ARO having a very solid day today.

Entry: We want to get in at 31.70 – 31.80.

Exit: We are looking for a 2-3% gain on the day.

Stop Loss: 3% on the bottom.

Short Sale of the Day: Direxion Daily Energy ETF (ERY)

Analysis:

As the futures continue to get better for the Dow and S&P and the market starts to turn away from the Dubai news, we are looking at what could be a rallying day in the market. If that is true, then we are going to want to avoid short sales on most sectors and stocks because they will be rallying on the dips experienced last week. One ETF, though, that had a mega jump last week was ERY on the drop in oil prices. ERY gained 7% on Friday, setting it up for a nice dip today. Oil is neutral, but as the market continues to trend higher, ERY will be moving downwards.

Brent crude dropped again today, as Europe got hit by the Dubai news. The American market, however, I am believing is more resilient. Oil should be on the rise if the market is on the rise. There is not a lot of news to keep it down, and if the dollar remains weak, it will continue to increase.

"The long-term prospect for commodities including oil looks strong amid expectations that the value of the dollar will remain weak," Victor Shum of Pervin and Gurtz noted.

A lot of people I think are believing that the Dubai problems means somehow oil problems, but this is just not the case. Oil analysts know this, and I see a gain on the day for oil. That will translate into a tough day for ERY. We want to get in early and ride this one down.

Entry: We want to set our short sale entry at 11.75 – 11.85.

Exit: We are looking for a 2-3% gain for the cover.

Stop Buy: 3% on top.

Good Luck and Good Investing,

David Ristau