Hey everyone. Well, I hope you all could get involved in my Oxen Gamble of the Day on my Oxen Report for today. We recommended picking up a position in Big Lots Inc. (BIG). It seemed like a solid trade for overnight. We got in at 13.75, and we are already up over 3% in after hours trading. Hopefully, BIG can keep up the movement, and we can sell early for a nice gain.

Hey everyone. Well, I hope you all could get involved in my Oxen Gamble of the Day on my Oxen Report for today. We recommended picking up a position in Big Lots Inc. (BIG). It seemed like a solid trade for overnight. We got in at 13.75, and we are already up over 3% in after hours trading. Hopefully, BIG can keep up the movement, and we can sell early for a nice gain.

For today, I am actually going to be traveling this morning, and I am posting now in order to get in a report, since I have been dragging my feet for all of you. I can’t update my post, and I will be gone by 7:30 AM, so the report will be based on what I can imagine happening and will give you some options.

Tomorrow is a big day because we get a revision in the unemployment numbers. It was released last month at 10.2%. The government will revise that number. If the numbers are bad, I think the market will tank severely. The news of bad unemployment from ADP that was released on Wednesday was never factored into the market, and it should compound on the of unemployment for tomorrow. If the news is good, however, I think we will see a good start that will dwindle to pretty neutral day in the markets.

So, if the numbers are revised up on unemployment or we see the market overwhelming looking down…what to do?

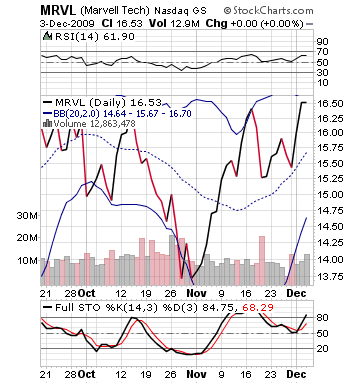

Short Sale: Marvell Technologies (MRVL)

Marvell released some pretty solid earnings in after hours. The company beat earnings estimates, reporting an EPS of 0.35 vs. the expected 0.27. The company, on top of this, is expecting revenue in Q4 around $850 million, well above expectations. The stock jumped 6% in after hours, and it should open with a pretty solid gain.

The issue, though, is if the market is pointing red. There is no way Marvell will be able to hold its gains. The stock was already pricing in a beat, moving up over 8% in the past three days. The stock is right at its upper bollinger, overbought on stochastics, and overvalued on RSI. It is red flagged for a pullback for sure. Great earnings but the market was expecting it.

We will want to get in right away and bask in the glory of this one coming down quickly.

This has nothing to do with the fundamentals of the company, but rather the patterns of the market. If we drop even more than 1% tomorrow, you have to accept that MRVL won’t be able to hold onto its gains.

If the numbers get revised down, what then?

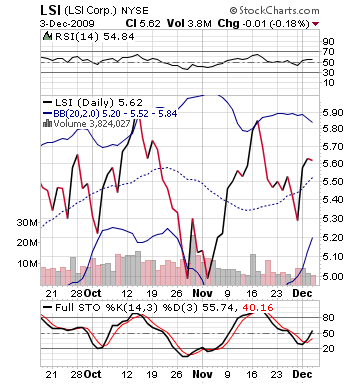

Buy Pick: LSI Technologies Inc. (LSI)

Let’s stick with Marvell because it is the big earnings news that we have in the market. The semiconductor industry should benefit, as a whole, from the market being up and the Marvell news. Therefore, one semiconductor stock that is very similar to Marvell is LSI Technologies. The stock is not overvalued, in fact, it is slightly undervalued. The whole sector should get a big lift from Marvell, and LSI should be getting a larger lift than most. The news will get buyers interested into this one, and if the market looks good, we may be in for a run up.

The stock is down close to 5% over the past couple weeks, and it has seen a couple down days in a row. If the market is bad, this is definitely a no go. If things are looking green, though, we should play this one.

The stock is down close to 5% over the past couple weeks, and it has seen a couple down days in a row. If the market is bad, this is definitely a no go. If things are looking green, though, we should play this one.

Word of caution, however. If LSI is up over 2% when the market opens, I would not play this. You might look towards TXN and STM. If they are not up over 2%, they may be places that could benefit from MRVL. I would look to STM first before TXN (as it is pretty well overvalued).

Look for 2-3%.

Good luck tomorrow. I may be able to check in in the afternoon, so if you have any questions that can wait till then just post them up. I will answer when I can.

Good Investing,

David Ristau