Two articles on collections of second mortgage debt being attempted, prior to resolution of the first mortgage.  Normally, first mortgages have priority, but it appears owners of second mortgage obligations – debt collection agencies – are cutting ahead and demanding payback early and then using questionable tactics to accomplish their goals (e.g., filing suit without giving notice). – Ilene

Normally, first mortgages have priority, but it appears owners of second mortgage obligations – debt collection agencies – are cutting ahead and demanding payback early and then using questionable tactics to accomplish their goals (e.g., filing suit without giving notice). – Ilene

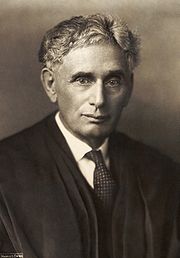

Decency, security, and liberty alike demand that government officials shall be subjected to the same rules of conduct that are commands to the citizen. In a government of laws, existence of the government will be imperiled if it fails to observe the law scrupulously. Our government is the potent, the omnipresent teacher. For good or for ill, it teaches the whole people by its example. Crime is contagious. If the government becomes a lawbreaker, it breeds contempt for law; it invites every man to become a law unto himself; it invites anarchy. Justice Louis Brandeis

Debt Collectors Raiding Coffers Of Homeowners With Second Mortgages

By Vince Veneziani, courtesy of Clusterstock

Housing Doom: Josh Zinner of the Neighborhood Economic Development Advocacy Project in Manhattan said some lenders or trusts for banks that went out of business are selling off second mortgages today to debt collectors for pennies on the dollars. Those debt collectors are then going after the homeowners’ bank accounts or pay checks to recoup whatever money they can.

And if a bank or debt collection agency goes after you, for god’s sake, respond to the complaint in a timely manner:

Perhaps in part because they are not notified, people sued in New York City often fail to appear in court to protect their interests, according to a study released last year by MFY Legal Services, a nonprofit law firm in New York.

MFY found that just seven law firms filed nearly one-third of all the cases seeking to collect $25,000 or less in New York City’s civil courts. Fewer than 10 percent of the defendants in those cases appeared to defend themselves.

“Then there are these high number of default judgments rates,” said Carolyn E. Coffey, a staff lawyer at MFY and an author of the study. She said she was mystified that problems with getting notice could go unaddressed.

Priority? What’s That?

Courtesy of Karl Denninger at The Market Ticker