Good Monday! Hope everyone had a nice weekend. For a recap of last week’s 4/5 week, check out The Oxen Recap. The big winner of the week was Big Lots with a nearly 10% gain on the stock in Thursday’s Gamble of the Day. This week we are looking at a market that is a bit toppy and has a limited number of earnings and economic data points until the end of the week. That may mean the market is not going to have much to extend its rally on, and we should take an early bear position on the market.

Good Monday! Hope everyone had a nice weekend. For a recap of last week’s 4/5 week, check out The Oxen Recap. The big winner of the week was Big Lots with a nearly 10% gain on the stock in Thursday’s Gamble of the Day. This week we are looking at a market that is a bit toppy and has a limited number of earnings and economic data points until the end of the week. That may mean the market is not going to have much to extend its rally on, and we should take an early bear position on the market.

Let’s get into Monday’s picks…

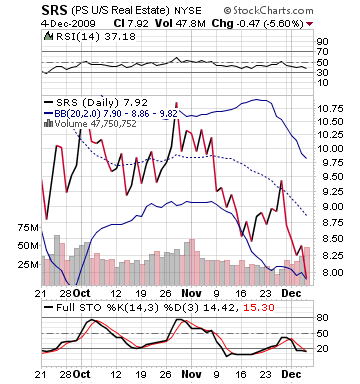

Buy Pick of the Day: Ultrashort Proshares Real Estate ETF (SRS)

Analysis: The market futures are all pointing down on this Monday morning as the dollar is rising and a lack of economic and company based news is causing a complete focus on the big story of the day…the Fed. Ben Bernanke, Chairman of the Federal Reserve, will be speaking with the Economic Club in Washington. There is speculation that he will unveil some insight or mention that the Fed will be raising their interest rates for the first time in almost a year. The speech comes at 12:45 PM, and the market may begin pricing in a stronger dollar up until that point, which is not good news for the market. As the market heads down, any number of your inverse plays, such as inverse ETFs, present viable options.

One that I like in particular is the Ultrashort Proshares Real Estate ETF (SRS). It is one of the most volatile ETFs out there, and it has been completely beaten down among an extended market rally. With things looking toppy, though, I would expect a large decline in the real estate sector, translating into a positive day for SRS. There is no market pertinent news for the real estate sector, so it will most likely be a market follower.

One that I like in particular is the Ultrashort Proshares Real Estate ETF (SRS). It is one of the most volatile ETFs out there, and it has been completely beaten down among an extended market rally. With things looking toppy, though, I would expect a large decline in the real estate sector, translating into a positive day for SRS. There is no market pertinent news for the real estate sector, so it will most likely be a market follower.

The fact that it is a market follower, in fact, may be a pretty good thing for today. The sector has not had significant pre-market movement like a lot of other stocks and sectors have already priced in. SRS is only up a bit over 0.50% on the morning, so we can get into it at a relatively cheap price with the upside being pretty extreme. The stock is right at its lower bollinger band, is undervalued on RSI, and is heavily oversold on slow and fast stochastics. There are just too many buyers on the sideline. With the market being down and the REIT and housing market having a quiet week, SRS should get some great attention.

Buy in early and sell off before the Bernanke speech. If he says something not expected, the whole market could turn around in a heartbeat.

Entry: We are looking for an entry of 7.90 – 8.00.

Exit: On a 2-4% gain.

Stop Loss: 3% on bottom.

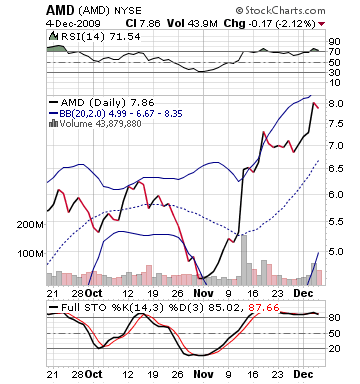

Short Sale of the Day: Advanced Micro Devices Inc. (AMD)

Analysis: As has been discussed, the market is looking to most likely move down today on speculation of talk about rate increases from the Fed. With the market moving down, those highly overvalued stocks that are trying to move higher present a fantastic short sale opportunity. One of these would be Advanced Micro Devices (AMD). The stock is sitting just at its 52-week high this morning in pre-market after receiving an upgrade from Bernstein. The company gave the company a two level upgrade from underperform past market perform to overperform. The reason being is the settlement that AMD was able to recently make with Intel that went in the favor of AMD.

sitting just at its 52-week high this morning in pre-market after receiving an upgrade from Bernstein. The company gave the company a two level upgrade from underperform past market perform to overperform. The reason being is the settlement that AMD was able to recently make with Intel that went in the favor of AMD.

This is all great and well for AMD. Yet, the stock is definitely way, way too toppy. The stock is up 4.5% in pre-market trading to 8.20. The stock’s 3-month chart shows its bollinger band range topping out in the 8.10 – 8.15 area, so the stock is already opening outside its upper band. The stock has been overbought and overvalued for over a month, so with the further increase, the momentum just will not be able to be maintained. This one is setting up for a large pullback today and probably into the future, as well.

Therefore, we want to get into AMD on a short sale early on in the day. As the market starts to quickly dip, we can get out for a solid 2-3% gain.

Go get em!

Entry: We are looking to start our short sale in the 8.25 – 8.35 range.

Exit: Looking for a 2-3% drop to cover.

Stop Buy: 3% on top.

Good Investing and Good Luck,

David Ristau