US foreclosure filings will hit 3.9M in 2009, bringing the 3-year total to 10% of all US homes.

US foreclosure filings will hit 3.9M in 2009, bringing the 3-year total to 10% of all US homes.

How is this "good" for the economy? "It’s a stealth stimulus," says Christopher Thornberg of Beacon Economics, a consulting firm specializing in real estate and the California economy. "The quicker these people shed their debts, the faster the economy is going to heal and move forward again." That’s right, bankrupt is the new rich in the USA as the 4.8M homes that are at lest 3 months behind on their mortgages (see map) are "saving" $5Bn a month in mortgage payments.

Analysts at Deutsche Bank Securities expect 21 million U.S. households to end up owing more on their mortgages than their homes are worth by the end of 2010. If one in five of those households defaults, the losses to banks and investors could exceed $400 billion. As a proportion of the economy, that’s roughly equivalent to the losses suffered in the savings-and-loan debacle of the late 1980s and early 1990s. Even the rich are playing the default game now. More and more Americans are realizing there is no sense in paying a $7,000 monthly mortgage on a $1M mortgage with $100,000 in equity when they can walk away and buy a similar home for $500,000. We’re talking about saving $3,500 a month for 30 years or $1.26M.

As more and more people see their friends and neighbors "get rich" by walking away from bad home investments, this trend is likely to accellerate, not abate, unless housing prices rally back fast. A recent study found that four out of five people believe defaulting on a mortgage is morally wrong if one can afford to pay it, but they also found that the people become 82% more likely to say they’ll default if they know someone else who defaulted. Meanwhile, there is a massive game of chicken being played by the 4.8M people who have simply stopped payinig their mortgages and the banks who have no desire to take a huge loss to their books by actually taking over and selling the homes in this terrible market.

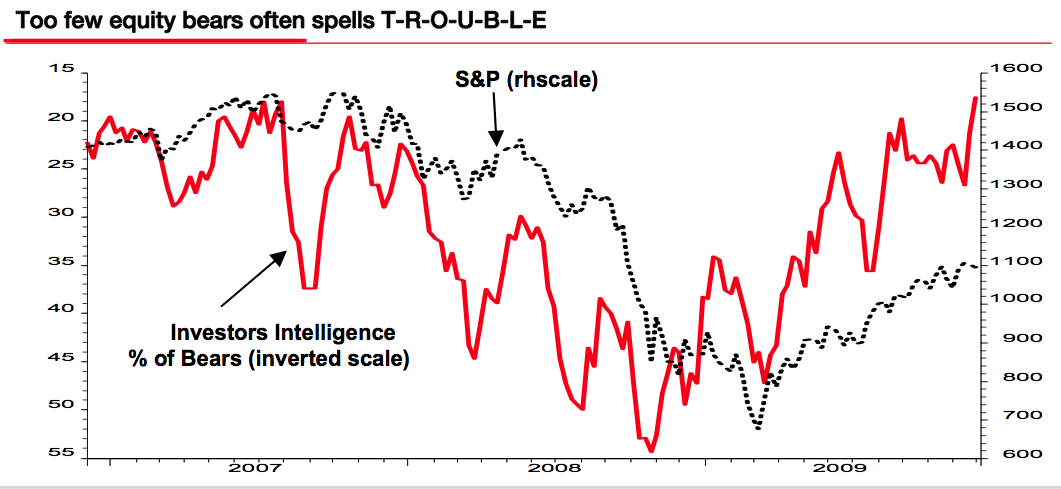

Investors meanwhile, can’t be bothered with abstract market undercurrents and the above chart shows that there haven’t been so few bears in the market since right before we began to crash in 2007 – Excellent! What’s really funny is that, as the market has topped out the past month, the bulls have gone into a frenzy, wiping out all but the last 17% of the bears. As one of the few remaining bears, I do have to tell you it’s lonely out here but we’re not perma-bears, just bearish since the S&P crossed 1,000 as we are long overdue for a correction and we’re likely to flip bullish again at 880.

Speaking of levels – How good are we with our projections? Yesterday morning I said we expected bounces to Dow 10,336, S&P 1,095, Nas 2,158, NYSE 7,095 and Russell 593 and we got Dow 10,337, S&P 1,095, Nas 2,183, NYSE 7,067 and Russell 598 – not bad for a morning prediction! There was no way to predict the massive push on the Nasdaq that took them up 20 points in the last two house of trading. Well, there is some way as we played for the stick save but that was a REALLY big one, very disproportionate to the other indexes.

Speaking of levels – How good are we with our projections? Yesterday morning I said we expected bounces to Dow 10,336, S&P 1,095, Nas 2,158, NYSE 7,095 and Russell 593 and we got Dow 10,337, S&P 1,095, Nas 2,183, NYSE 7,067 and Russell 598 – not bad for a morning prediction! There was no way to predict the massive push on the Nasdaq that took them up 20 points in the last two house of trading. Well, there is some way as we played for the stick save but that was a REALLY big one, very disproportionate to the other indexes.

That means today we’ll be looking to see if the Nasdaq can get back over our breakout level at 2,187 (see Monday’s level chart) and the Dow is already well over 10,250 so the focus will be on S&P 1,100, Russell 600 and NYSE 7,200. We need ALL 5 of our indexes over in order to get more bullish but there is such a massive push on in the futures at the moment (8:20) that I think they are trying to gap us over before the open. Remember also from yesterday’s post, denial is the 2nd phase of a market turndown – if we fail here, we move on to fear, and that can get ugly so we’ll be taking our levels very seriously.

Copper, oil and gold are all still weak in overnight trading and silver looks like it’s going to be testing $17 again, which makes one wonder what the futures traders are getting so excited about. The gang of 12 was on the march this morning with JPM raising their outlook for oil prices by 15% in 2010, Pimco buying Abu Dhabi bonds (signaling they don’t feel the Dubai crisis will spread even as far as their sponsor) and George Soros announcing that he’s sure the Greek government "will not be allowed to default on its debts, despite growing budgetary difficulties. There has to be pressure on Greece to put its house in order but I’m sure that Greece will not be allowed to default. The same applies to the U.K." Well if a guy with Billions of dollars of investments in Greece and the UK tells us not to worry about those countries then why should we worry – he couldn’t possibly have an ulterior motive could he? The same goes for Pimco, as this is not the first round of Abu Dhabi bonds they’ve ever bought but you wouldn’t guess they were just covering their assets from the way the MSM is reporting it.

Someone had to step in and do something this morning as the Hang Seng failed to get back over 22,000 (falling 400 points from the open prior to a stick save in the final minutes) and the Nikkei fell 141 points, back to 9,862 – once again creating a huge and unusual gap between the Nikkei and the Dow. This is great for us as we can reboot our EWJ play if the Dow does break up from here but, more likely, the Dow will follow the Nikkei down. China’s fall is particularly disturbing as they went so far as to extend subsidies for autos and home appliances, which has been the entirety of global demand this year.

Someone had to step in and do something this morning as the Hang Seng failed to get back over 22,000 (falling 400 points from the open prior to a stick save in the final minutes) and the Nikkei fell 141 points, back to 9,862 – once again creating a huge and unusual gap between the Nikkei and the Dow. This is great for us as we can reboot our EWJ play if the Dow does break up from here but, more likely, the Dow will follow the Nikkei down. China’s fall is particularly disturbing as they went so far as to extend subsidies for autos and home appliances, which has been the entirety of global demand this year.

Government support helped fuel a 42 percent jump in nationwide vehicle sales to 12.2 million in the year through November, putting China on course to surpass the U.S. as the world’s largest auto market. China’s full-year auto sales may be about 13 million, according to Booz & Co., which advises carmakers and investors in China. China will extend subsidies for purchases of automobiles, appliances and farming equipment in rural areas, according to the statement, which didn’t give a time frame for the program. China will continue appliance trade-in subsidies beyond May 2010, when they had been set to expire. Subsidies for motorcycle purchases will be extended to the end of January 2013, the State Council said.

Over in Europe, despite assurances from Pimco and Soros and encouragement from JPM, all coincidentally coming at the open of their markets, the DAX has been rejected right at our 5,750 target (up 1.25%) and the FTSE has been rejected right at our 5,250 target (up .75%) so we’ll be watching those closely today. Even the BOE chipped in this morning, announcing they will stick to its plan to buy as much as 200 billion pounds ($326 billion) in bonds. The central bank also held the bank rate at a record low of 0.5 percent, according to a statement in London. Of greater concern in Europe is an ECB document warning that: "The authorities in the Baltic states may not be able to prevent a renewed emergence of macro-economic imbalances and a repetition of the boom-bust cycle." The boom-to-bust fate of the Baltic states has been exacerbated by euro-denominated borrowing since the countries joined the EU more than five years ago. That’s obliged central banks to stick more rigorously to their euro pegs or risk leaving households and businesses unable to service their debt.

Jobless claims were up 17,000 this week to 474,000 but hey, it’s not 500,000 so yay, I guess… Expert economists had been predicting 450,000 job losses but a 5% miss isn’t even worth mentioning compared to their usual screw-ups. Tomorrow is a big data day with Import/Export Prices, November Retail Sales, Michigan Sentiment and Business Inventories so even if we do sustain this pre-market BS rally we’ll still be going short into the close as all 4 of those things could be a bummer.

Be careful out there!