GMAC at the Forefront of Ginnie Mae’s Troubled Issuers

Courtesy of Mish

In response to Taxpayers On The Hook For Ginnie Mae’s Rampant Growth I received a nice Email from the Center for Public Integrity inviting me to take a look at Ginnie Mae’s Troubled Issuers. The data is interesting to say the least.

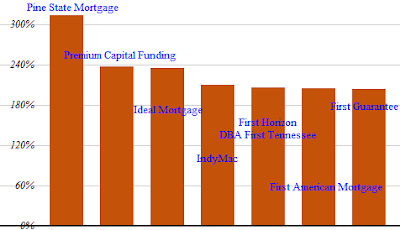

Problem Issuers by Compare Ratio

Compare ratio is the comparison of a lender’s default rates with other lenders in a geographic region as defined by HUD. For example, if a lender has a compare ratio of 200 percent, the Federal Housing Administration loans made by that lender are defaulting at twice the rate of its competitors in its geographic region. A compare ratio of 200 percent or more is grounds for suspension and a compare ratio of 150 percent or more indicates "a problem" lender, according to FHA Commissioner David Stevens.

Compare Ratios Over 150%

- Pine State Mortgage Corporation – 314% – Default Rate 18.86%

- Premium Capital Funding, LLC dba Topdot Mortgage – 238% – Default Rate 14.31%

- Ideal Mortgage Bankers, Ltd, dba Lend America^ – 235% – Default Rate 14.14%

- IndyMac FSB, dba OneWest Bank – 211% – Default Rate 12.67%

- First Horizon Home Loans dba First Tennessee – 207% – Default Rate 12.45%

- First American Mortgage Trust – 205% – Default Rate 12.31%

- First Guaranty Mortgage Corp. – 204% – Default Rate 12.26%

- American Financial Resources, Inc. – 202% – Default Rate 12.16%

- Weststar Mortgage Corporation – 198% – Default Rate 11.88%

- Gateway Mortgage Group – 198% – Default Rate 11.9%

- Colonial Bank – 189% – Default Rate 11.38%

- MVB Mortgage Corporation – 183% – Default Rate 11.01%

- GMAC Mortgage – 171% – Default Rate 10.29%

- Allied Home Mortgage Corporation – 168% – Default Rate 10.09%

- Taylor Bean & Whitaker Mortgage^ – 163% – Default Rate 9.77%

- Shore Financial Services, Inc. dba Shore Mortgage – 159% – Default Rate 9.54%

Problem Issuers by Loan Volume

The charts in the article are interactive so please give it a look.

GMAC – The Gift That Keeps On Giving

None of the above banks should be doing business with Ginnie Mae. Indeed, most of them should not be doing business at all, especially GMAC.

To help bailout GM , the Obama administration screwed the bondholders to appease the unions, and taxpayers channeled additional money to GMAC so that it could continue making loans. GMAC went to the well three times as the following articles show.

Flashback October 28: GMAC May Receive Third Government Bailout in November

GMAC Inc., the lender that received two government bailouts totaling $13.5 billion, is negotiating with the Treasury Department for a possible third lifeline next month, people familiar with the matter said.

The U.S. is studying a capital injection of $2.8 billion to $5.6 billion, according to the people, who declined to be identified because the transaction hasn’t been agreed upon.

GMAC may get more government money because the Obama administration regards the lender as crucial to the survival of the U.S. auto industry. General Motors Co., its former parent, and Chrysler Group LLC rely on the firm to finance their vehicle buyers. GMAC will report third-period results on Nov. 4, after losses in seven of the past eight quarters.

“It’s outrageous that the taxpayers are being asked yet again to support a troubled enterprise,” said Sean Egan, president of Egan-Jones Ratings Co. in Haverford, Pennsylvania. “When will it end?”

Flashback October 29, 2009: Geithner Says GMAC to Need Less Government Aid Than Expected

“We’re likely to have to put in less capital than we expected,” Geithner told the House Financial Services Committee today. He said any additional aid to GMAC would “follow through” on previous commitments, rather than kicking off a new round of bank aid.

“We committed in the event that they were not able to raise capital from the market, that the government would put that capital in,” Geithner said. “There was no prospect, quite frankly, that they were going to be able to raise that capital from the market.”

Flashback November 4 2009: GMAC Reports Third-Quarter Loss Tied to Loan Defaults

GMAC Inc., the auto and mortgage lender negotiating a third round of government aid, reported a third-quarter loss tied to mortgage defaults.

The net loss from continuing operations was $671 million, compared with $2.5 billion a year earlier, Detroit-based GMAC said in a statement. GMAC’s net loss was $767 million; the auto finance unit swung to a profit, while mortgage operations posted a smaller deficit.

Note that GMAC was originally not even a bank, but was made into one for the express purpose of getting $billions in taxpayer handouts.

By keeping GMAC alive, a ridiculous notion in the first place, problems continue to mount elsewhere. GMAC has received over $13 billion in taxpayer handouts and continues to saddle Ginnie Mae with poor quality loans. No price is too high to win union votes.

Addendum:

Aaron Krowne pinged me with an email regarding Inside the FHA Audit: the Disaster of Seller Financing

The homebuyer assistance program allowed sellers to fund the downpayment and then turn around and inflate the home price to recoup the expense. The seller also paid a fee to the non-profit for qualifying buyers and arranging the transactions. HUD saw it as a scam, though the downpayment assistance providers denied it.

It was well documented that buyers generally paid too much for the properties and ended up in high loan-to-value loans that were generally three times more likely to default than other FHA single-family loans.

And default they did. The latest FHA actuarial report calculates the damage SFDP inflicted on the FHA Mutual Mortgage Insurance Fund in startling detail. If the government had never endorsed SFDP loans, the economic value of the MMIF would be $13.2 billion as of September 30 — instead of $3.6 billion — a difference of almost $10 billion. In other words, FHA would be in stronger financial shape today.

Aaron Krowne Writes:

"Of course the government never really endorsed SFDP(A) loans. Rather, it more grudgingly tolerated them. Unfortunately even post-SFDPA FHA issuance with 3.5% down combined with the $8k tax credit likely won’t leave a much improved actuarial profile. Thus, I continue to expect taxpayers to bleed out heavily through Ginnie Mae."

Click here for more from Aaron Krowne on the Seller-Funded Downpayment Assistance (SFDPA) Scam.