Fannie’s Christmas Present – A Delayed Repo

Courtesy of Bruce Krasting

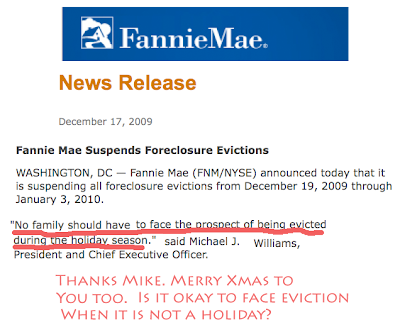

Being the nice guys that they are, Fannie is giving homeowners a few more days before they get tossed on the street. I have not seen that the other D.C mortgage lenders have followed Fannie’s lead, but I am sure they will. Freddie Mac, FHA, FDIC and the Federal Home Loan banks are also “nice” guys who are also in the foreclosure business.

I agree with this decision. What’s the sense of chucking people out in the cold over the holidays? We are supposed to be a compassionate people with a compassionate government. I am not sure that those who get this two-week reprieve will really be enjoying the Christmas spirit. Waiting for the axe to fall does not fit in with the plum pudding and presents thing.

Assume that all of the lenders followed Fannie’s lead and suspended foreclosures from the 19th to the 3rd. That would be a pretty big deal. The number of foreclosure has now reached a level of 11,000 per day. So this break in the action by the lenders would defer as many as 160,000 homes from foreclosure. But that is only for two weeks. It just means the January/February numbers will have a bulge.

The 2009 foreclosure will come in around 4mm. Up from 2.2mm in 2008. In the period 1950-2000 the foreclosure rate averaged less than 1% of all mortgages. In 2010 foreclosures could be 7%. There is nothing normal about our current conditions.

It is certain that there is more bad news in front of us on this issue. Washington has introduced the HAMP and HARP programs in the last year to combat the tide of foreclosures. There has also been pressure by regulators and even the White House on the private sector lenders to avoid foreclosures. These efforts have reduced the numbers, but the real impact is to pass the trash to a future period. We know that 60% of restructured mortgages re-default in less than one year. There is no second chance at this. That 60% is going to hit a wall sometime in 2010.

By any account the US is the wealthiest country in the world. We are also the most indebted. Two years ago I would have thought it impossible that we could come to this. A two-week moratorium on foreclosures is the best we can do. Possibly we are not as wealthy as we think we are.