Wheee – that was fun!

Wheee – that was fun!

Last week, I asked the question were we "Too Bearish or Just Too Early?" I said in that wrap-up: "This Friday the market topped out about 150 points higher than last Friday, closer to the top of our range so we went much more bearish on Friday, perhaps too bearish considering this was the best Friday finish since Nov 6th and we haven’t had a down Monday since October 26th." We did get the move up we feared on Monday but we stuck to our guns and had a fabulous week.

Even as the market was going against us Monday morning, my first Alert of the week to members at 9:44 said: "I’m still more inclined to look downward at: Dow 10,250, S&P 1,100, Nasdaq 2,187, NYSE 7,200 and Russell 600… I’m still bearish because oil is weak, gold is weak, the financials (XLF at 14.30) are weak and most of the good news we are hearing is nothing but fluff." That was a pretty good call as we hit our target levels yesterday and held them, so we flipped more bullish right at 11:30 on Friday, in what was some very good timing for our intra-day play.

We are still on a stock market roller coaster that's going to have plenty of ups and down in the thin, holiday trading that will likely characterize the end of the year. The market will be closed 2 Fridays in a row and good luck finding people around this Thursday or the next one so 6 proper trading days left to 2009 at best. We got out – that drop was very satisfying and we've moved mainly to cash (our $100K Virtual Portfolio has $88,000 in cash at $107,249 at the end of it's first month). Last week we were able to cash out the bull side, this week we got satisfaction from our bear plays and that leaves us footloose and fancy free to have fun the next two weeks. If our day trading goes as well as it did on Friday, we can end this year with quite a bang.

Manic Monday – Dubai, CitiGroup and GS Move Markets

Manic Monday – Dubai, CitiGroup and GS Move Markets

This picture says it all. When you want to blow smoke up investors' asses, the dream team of economic BS is Greenspan and Cramer, who appeared on Meet the Press last Sunday to tell us that the market is smarter than reality and Greenspan actually had the nerve to say that we are underestimating the positive effect of rising stock market wealth this year. What a tool! In case the ex-Chairman's math is rusty, losing 50% of your retirement account and then having a 60% rally back only gives you back 60% of 50%, which is 30%. That totals 80% of what you had which is LESS, not MORE.

Greenspan doesn't feel poor because his new job at PimpCo pays a hell of a lot more than being Fed Chairman ever did and Cramer is practicing wrinkling up his face in hopes that he will one day be Fed Chairmen so he can screw millions more people over than he is able to with his current platform. Monday night, Cramer was still on fire, herding the sheeple into CitiGroup (a pick I agree with but not the timing) on the same day I was concerned about the overall weakness in the XLF. Jim should know better as he's clearly fixated on trying to negate my plays lately but after shearing the sheeple by herding them into the very top of AMZN and RTH, he had to made it a hat-trick by jamming them into C ahead of the dillutive secondary. It is only fitting to see Cramer taking tips from the master, Greenspan, who's advice bankrupted an entire nation:

Now, where was I? Oh yes, Monday… So it wasn't just the comedy duo of Greenspan and Cramer boosting the markets Monday morning, the MSM was touting C's exit from TARP (at all costs) as some sort of triumph of American capitalism while, at the same time, yet another economic fiasco was being bailed out as Abu Dhabi gave $10Bn to Dubai. In the usual sick and predictable way, the global markets once again celebrated a bailout as if it fixes everything and the US futures were up 100 points in early trading, causing me to comment:

I don’t know why they even bother to pretend anymore – they should just put 10 market-boosting statements on a chip that randomly plays one of them whenever the MSM needs a quote for the morning. People don’t seem to notice it’s the same thing over and over and over again so why even bother with the pretense?

Right in the morning post, FOR FREE, I suggested a bullish hedge to the week that I felt would hold up in wild market conditions which was buying the RUT Dec $590 calls for $14 and selling the Dec $600 calls for $7.50 and funding it by selling the Jan $560 puts for $7.50. The Russell finished the week at 610.57 so the spread netted a $10 return and the Jan $560 puts finished at $4.07 for a total profit of $6.93 on a trade that gave you a $1 credit out of the box. That's like infinity percent and those are 100 options per contract! Monday's trade ideas for members went pretty well too:

- LYG at $3.64, now $3.36 – down 8%

- SRS at $7.90, now $7.82 – down 1%

- IYT Dec $75 calls sold at .65, expired worthless – up 100%

- DIA March $106 puts at $5, stopped at $6.10 – up 22%

- IWM Dec $60/61 bull call spread at .63, expired at $1 – up 59%

- IWM Dec $60 puts sold for .36, expired worthless – up 100% (pair trade)

- VNO Dec $70 puts sold for .75, stopped at $1.40 – up 87%

We went into Monday's close extremely bearish, with both our DIA March $106 & $108 puts naked (double our usual position) as the market flatline was not fooling us at all. We also took the money and ran on last Friday's very aggressive FDX play and boy were we glad we did that on Thursday!

TARPless Tuesday – WFC Joins the Exodus

TARPless Tuesday – WFC Joins the Exodus

More happy, happy news for bankers looking to get bonuses as WFC announced they were going to repay their TARP money too. You would think the market would be bored with all these announcements but, no, we rallied again on that news. My comment in the morning post was: "It’s good that we can label this bailout a success because that way Congress won’t waste time approving the next one in March when CRE fails (oops, that’s supposed to be a secret)."

Thomas Jefferson warned us the whole thing was a scam over 200 years ago and no one listened to him and poor Ron Paul is trying to wise people up today and he's treated like a radical as well so I know better than to beat a dead horse so we moved on to look at some more global concerns like the Hong Kong property bubble that had spread to China, prompting the state-owned Xinhau News Agency to say the Chinese government will target “excessive” property price increases in some cities. Maybe I neglect to point this out often enough but there's a BIG difference between what happens when the Chinese government says something and when our government says something. When our government says they will do something – it's 50/50 at best. When China's government says they are going to do something – it's probably already being done and already looking like a success. Their country still has 5-year plans, our country doesn't even know who's going to be in charge next year.

German confidence was down, Japanese confidence was down, Mexico's debt was downgraded, British consumer prices were rising out of control and our producer prices were skyrocketing but the manufacturers were eating the cost as they couldn't pass a penny onto consumers. The Empire Manufacturing Index was a big disappointment and OPEC was trying to tell us demand was picking up so I said: "Needless to say, we’re still pretty bearish but mostly watching with cash on the sidelines, looking for good spots to deploy some capital but happy to wait out the end of the year if this market continues to act like it has been the past two weeks."

- EWJ Dec $10 calls for .05, out at .10 – up 100%

- MA Jan $240/Dec $250 put spread at $2, now $2.50 – up 25%

- IYT Jan $72/Dec $75 put spread at .40, now .64 – up 60%

- FCX Jan $75 puts at $2.20, now $2.60 – up 18%

- RIMM March $70/Dec $65 at $1.75, now $1 – down 43%

- RIMM March $55 puts/Jan $60 puts at .25, now .67 – up 168% (pair trade)

Although we expected a run-up in the morning, we stayed bearish into the close as the NAHB Housing Market Index fell to it's lowest point since June and a NY Times/CBS poll of the unemployed (16-28M of them, depending on who's counting) found that almost half have suffered depression or anxiety, 40% of the parents said it's affecting their children and 25% say they've lost their homes or been threatened with foreclosure or eviction. Merry Christmas indeed!

Which Way Wednesday – Fed Edition

Man, we are used to nonsense in the futures but this 100-point pump-up was just too ridiculous for words. The dollar was being taken down on rumors of what the Fed was going to say and I pointed out how there was NOTHING the Fed could say that they haven't already done to destroy all confidence in our currency so, ipso reductio, whatever the Fed said would have to boost the dollar.

Our Fed has not cornered the market on printing money. One of the things that was boosting the futures was news that the ECB was handing out cheap loans. As I noted in an early morning comment to members:

Yet another super-pump in the futures back to yesterday’s highs so we’ll see if this one holds. This isn’t so much about the PMI in Europe as it is about the ECB lending $141Bn to banks at record low rates. FREE MONEY!!! Also there have been a ton of positive statements about the economy and outlook etc from the usual suspects in the Gang of 12. I look at something like this and I see all this effort being made to pump up the markets yet they can’t even hold Monday’s futures high and it makes me think they are in deep trouble on the whole.

In the morning post I said: "Don’t be fooled by the pre-market smack-down of the Dollar. The Euro hit $1.45 in yesterday’s trading, the lowest level since last October, when the dollar was 10% higher, and the Dollar briefly punched through that critical 77 line we’ve been expecting all month… Boy would we feel silly if we were just 55% bearish when this house of cards comes tumbling down. We’ll see what the man of the year has to say for himself this afternoon. Usually we play both sides of a Fed meeting and we thank the pumpers for giving us a cheap entry on the DIA puts to get started." Of course the DIA $105 puts were the first play of the day in our 9:47 Alert to Members.

- DIA Dec $105 puts at .65, finished at $1.86 – up 186%

- QID Dec $19 calls at $1.15, stopped at $1.50 – up 30%

- QID Jan $19 calls at $1.55, stopped at $1.85 – up 19%

- SRS at $7.80, now $7.82 – up 1%

- SRS Apr $7 puts sold for .85, now .80 – up 6%

- SRS Apr $5/7 bull call at $1.30, still $1.30 – even (pair trade)

- VIX March $20 puts at .35, still .35 – even

- TOL Jan $17.50 calls at $1.40, now $1.15 – down 18%

- XTO Jan $47 puts at $1, now 1.45 – up 45%

- UUP Jan $23 calls at .25, now .35 – up 40%.

- UUP June $22/24 bull call at .85, now .90 – up 6%

- UUP June $22 puts sold for .55, now .40 – up 27% (pair trade)

- RIMM March $75/Jan $70 net .68, now .75 – up 12%

- V Jan $85 puts at $1.93, now $1.40 – down 28%

- DIA Dec $104 puts at .42, finished at .86 – up 105%

I did my usual parsing of the Fed statement and sent it out in a 2:23 Alert to our Members which concluded: "So not a supportive report by any rational stretch. Nice head fake but down we go – should be great for the DIA puts!" At the close we decided to stick with our convictions and stay naked, probably the best decision of the week as we finally did get a down day that followed through. I was far from certain but my 4:01 comment to members captured my logic:

I’m sure they’ll say something to pump us back to 10,500 overnight but yes, I think the dollar will be hard to keep down in Europe and Asia and I think commodiities will sell back off and take down the markets a bit but it’s expiration week so not at all sure. My naked March (and March is a long time) DIA puts are very risky and it’s a conviction stand that there is no justification for topping 10,500 but the markets are far from logical so not much to hang my hat on. Well, that was a fun day. It would be nice if just ONCE they don’t pump up the futures but good luck with that…

Thrill Ride Thursday

I said in the morning post: "It has been volume, volume, volume that kep me questioning the rallies this year – the fact that all the up moves come on very thin volume (ie. manipulated) while all day long the insiders sell to the suckers who are draw in by the futures action and stick saves (it’s a team effort)" and we had a nice chart to illustrate my point.

I reminded people that we had covered this contingency in our "Hedging for Disaster" post of Dec 10th. A 2.5% pullback in the market is hardly a disaster but those hedges holding their own so far, which is just right for insurance plays:

- DXD Apr $26/33 bull call spread at $2.40, now $3.07 – up 27%

- FAZ July $20/35 bull call spread at $2.90, still $2.90 – even

- SDS March $38/50 bull call spread at $2.10, now $1.80 – down 14%

- SMN Apr $11 calls at $1, now $1.05 – up 5%

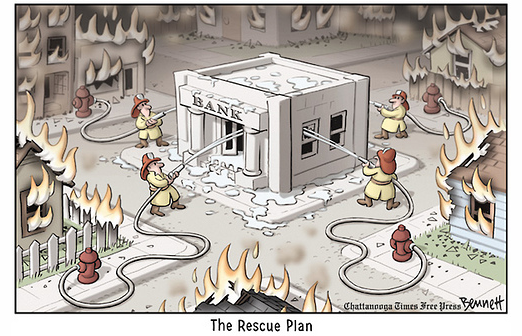

My issue of the day was why does the government and the media feel they have to lie to us (we already know Wall Street lies to us constantly)? Perhaps we can't handle the truth but, as I said in the post – sometimes the sky IS falling and it is helpful if you let the people know it. Pretending everything is fine when it isn't leads to a lot of very poor monetary decisions and our country has made some doozys this past year but why drag the people down with it? Tell the people the truth about the economy and our prospects and let them decide what to do about it. Yeah, right – like that's going to happen…

- C 2011 $4 calls at .50, now .55 – up 10%

- TWM $26 calls at $1.05, out at $1.30 – up 24%

- RIMM March $75/Jan $70 net .43, now .75 – up 74%

- FXP June $6/9 bull call at $1.40, now $1.50 – up 7%

- MA Jan $230 puts at $2.05, now $1.30 – down 37% (rolled up to $240 puts at $3.20)

There wasn't much to do because everything was going our way. Once again we went naked into the close on our March DIA puts but I did mention to Members that the prudent cover was 1/2 the DIA 12/31 $103 puts at $1.30, now $1.15 so, as I often say, there's rarely harm in choosing a well-placed 1/2 cover.

Fa La La Friday – Scroogy Swap Prices Blacken Christmas

Credit Default Swap rates are heading higher all over the world yet there's a parade of analysts (I argued with one on my BNN spot last night) who will tell you how great things are and how much better off we are than last year. This is like telling a double amputee how much better off they are than last year when they were on the operating table and we thought they were going to lose 3 limbs – sure it's better, but forgive them if they don't feel MUCH better about the loss of 2 limbs.

As our own economy limps into the last few days of this century's first decade, do we really feel that things are "better" than they were last year? Things are better than the doom and gloom outlook that was being peddled last year but we never bought into that in the first place. Things are not better with 5M more job losses than they were a year ago except for corporations that trimmed the fat so of course there will be success stories as some businesses are easy to scale and some are not.

It's not the success stories that worry us, it's the failures, and we'll find out soon enough how many retailers are making it through the holidays intact and then we'll find out how many REITs will survive the failure of the retailers and how many builders survive a third year of effectively not building things. If we can get past all that and if Q4 earnings look good, then there will be plenty of things to buy in 2010 but for now, cash and short positions still dominate our end of year strategy:

- Short oil futures at $75.50, stopped at $74 – up $150 per contract (from the main post)

- BAC 2012 $15/22.50 bull call at $1.25, still $1.25 – even

- BAC 2011 $12.50/17.50 bull call at $2.35, still $2.35 – even

- USO Dec $37 puts at .20, out at .60 – up 200%

- EWJ Jan $10 calls at .15, still .15 – even

- DIA 12/31 $101 calls at $2.35, now $2.70 – up 15%

- EDZ July $4/8 bull call at $1.10, still $1.10 – even

- DIA 12/31 $103 puts sold at $1.40, now $1.17 – up 16%

- XLF artificial buy/write (too complicated to to summarize) – on target

- XLF Jan $14 puts sold for .42, now .38 – up 10%

- V Jan $85 puts at $1.15, now $1.40 – up 22%

- MAT artificial buy/write (too complicated to to summarize) – on target

- XOM Apr $75 puts sold for $2.40, now $2.30 – up 4%

- SRS Jan $8 puts sold for .55, still .55 – even

Not bad for a Friday overall. It's always nice to have a few day-trade winners into the weekend. Notice we did take some upside plays – just in case and we went into the weekend "just" 55% bearish, a very big turn-around from earlier the week as we seek to protect our very nice bearish profits, which are mainly off the table anyway.

We have a big data week coming up and just 4 days to get everything done. Nothing on Monday so the bulls can jam us up if they have anything left but Tuesday morning we get hit with Revised Q3 GDP and GDP Prices, followed by Existing Home Sales, which are likely to be off in November as rates ticked higher and government assistance fell off slightly. Wednesday we get Personal Income and Spending for November (which may disappoint slightly), PCE Pirces, Michigan Sentiment and a very sad New Home Sales Report of under 450,000 annulized sales (exactly what I was saying to the guy on BNN!). On Christmas Eve we'll wave goodbye to another 500,000 lost jobs (Ho, ho, ho!) and wish our 5.2M "officially" unemployed people a merry Christmas while we get a read on how many Durable Goods they bought in November.

Lots of fun in store so tune in next week for all the excitement!