Hello Oxen Report readers,

I had a conflict this morning, so we are changing up the game a bit and going with one of the infamous Oxen Gambles of the Day. The last one we had, Big Lots, was worth 9.5% in one day of trading. I am not sure the pick today has that sort of potential, but I am confident that we can have a solid winner.

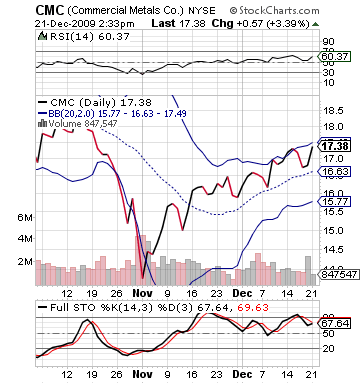

Oxen Gamble (Short): Commerical Metals Company (CMC)

Typically, when I do these gambles, I am looking for an undervalued buy that can rise the next day with some type of company specific news – earnings. Today, however, I like the chances for Commercial Metals Company to decline going into

tomorrow’s session due to a possible earnings let down. The stock may hit a decline tomorrow morning because of Tuesday’s earnings. The stock has an EPS estimate of -0.04 for tomorrow. The negative earnings would be a huge decline from one year ago when it had an EPS over 0.30. Are they underestimating the earnings?

I don’t think so. The iron and steel industry has not been doing well in earnings in the past couple months. Since the beginning of the November only 50% of steel companies have reported positive earnings. In the past two weeks, there have been a number of downgrades. The industry is in a tough position this quarter due to the price of steel and a lack of production and building going on throughout the country.

Further, CMC is highly overvalued right now. The stock is pricing in a beat after last quarters 600% surprise beat has made investors price in a large beat. The stock has increased 22% since the beginning of November and is overvalued and overbought. Further, the stochastics on the stock have been converging over the past month, which signals we are about to be breaking out to either the high or low side. It should be the low side.

The great thing about being overvalued going into tomorrow is that even a beat will not have a huge momentum to the upside. Further, the beat is going to have to be exceptional to please investors. The 600% beat has to be close to met for this to be impressive to investors. Otherwise, it is going to be a disappointment.

Watch out for the miss or disappointment from investors on CMC tomorrow. Plus, with today’s growth, the stock creates an even further greater value investment today.

Buy in before the end of the day and sell tomorrow.

Long Play: Ultra Proshares Oil & Gas (DIG)

The oil market has been hit pretty hard lately. The NYMEX crude oil market is close to a bottom for sure. We are in a range of about 72 – 78, and the bottom is almost reached at $72 per barrel. It has not been completely reached, but even on a rising day oil is still declining. Therefore, we are near a bottom for this market, which should be turned around by the Wednesday crude oil inventories.

The oil market has been hit pretty hard lately. The NYMEX crude oil market is close to a bottom for sure. We are in a range of about 72 – 78, and the bottom is almost reached at $72 per barrel. It has not been completely reached, but even on a rising day oil is still declining. Therefore, we are near a bottom for this market, which should be turned around by the Wednesday crude oil inventories.

We want to buy DIG on a small decline. I think we should buy it tomorrow on any sign of decline or rise. It is going to be flat throughout the day, and it will be increasing as the price of oil changes suit. We should position ourselves in it tomorrow, and this one could be a one to two week rise.

I am pretty confident in the range that oil is bound by, and it should probably move up from this lower range. It may take a bit of time, but it is going to reverse its trend.

Get in tomorrow on a decline and let’s hold for a bit.

Good Investing,

David Ristau