Hey Report readers,

Monday’s Oxen Gamble of the Day was a definite winner, and I thought I would try my hand at it again today. It is exciting for me too. Monday’s pick of Commercial Metals Company worked out very well for us. The way I have tracked these is that I buy them ten minutes before close, and I sell them within the first fifteen to thirty minutes of the market opening. With that said, I bought CMC at 17.25 to start our overnight short sale. The next morning, we were already doing well, and I sold on the stock’s decline thirty minutes into the session at 15.90. It was a great quick gain that was worth 7.80%. I would say that is pretty successful. We also entered Ultra Proshares Oil and Gas for a long play on Monday. I bought ten minutes before close for our entry. This is a long play that we are looking for 5-6% for before selling. We bought in at 33.67. The ETF is now trading at 35.00. We are looking for an exit of 35.33 – 35.67. We still need some more gains, but in just two days we are up 4%. I like!

Now, let us get into the new Overnight Trade of the Day, formerly known as the Oxen Gamble of the Day…

Overnight Trade (Short Sale): Ford Motors Company (F)

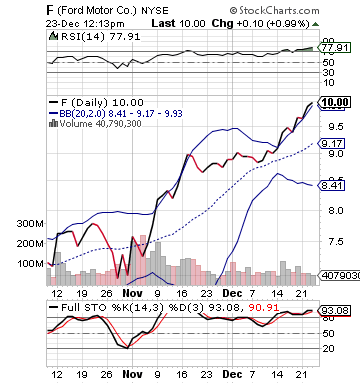

Well, this stock has been on a tear as of late. Ford seems pretty unstoppable. A part of me thinks the momentum is so hot for this stock that the world could be coming to an end and it would still rise. Yet, another, more rational part of me believes that Ford is ready for a major pullback. The stock has risen over 45% since the beginning of November. It is trading at the 10 point mark as of today, which is a pretty big monument for the stock. It has not been at 10 since July of 2005 (wow!). Yet, tomorrow, I think the stock is ready for a pullback. The issue is that the market has been on a major rise with consistent rises, but I think analysts are overestimating the durable goods orders for tomorrow, which includes auto sales.

this stock that the world could be coming to an end and it would still rise. Yet, another, more rational part of me believes that Ford is ready for a major pullback. The stock has risen over 45% since the beginning of November. It is trading at the 10 point mark as of today, which is a pretty big monument for the stock. It has not been at 10 since July of 2005 (wow!). Yet, tomorrow, I think the stock is ready for a pullback. The issue is that the market has been on a major rise with consistent rises, but I think analysts are overestimating the durable goods orders for tomorrow, which includes auto sales.

The durable goods orders are expected to come in at 0.50%, while they were down 0.60% last month. The rise is going to come from what? Auto sales? Total auto sales for this past month came in at 10.9 million, which was above the previous month’s 10.5 million. A change of 400,000 sales is not going to bring a 2% rise. Now, obviously, auto sales is not all that matters, but this rise is just way too great of expectations. Across the board, I just do not see where the rise is going to come from. Analysts are banking on the holiday season, but it won’t be reflected in the November numbers too greatly.

Further, we have unemployment numbers coming out tomorrow. I am continually worried about these numbers. If we have another round of bad data, tomorrow, the market is going to be moving down because it has not price in all the bad data from today yet. Even if there are beats tomorrow, can it really bring that much of a rise? How much higher can we go? How much  higher can Ford go? The stock is currently pricing in the sale of the Volvo sale to Geely. If the market descends tomorrow, Ford could be a large downward mover.

higher can Ford go? The stock is currently pricing in the sale of the Volvo sale to Geely. If the market descends tomorrow, Ford could be a large downward mover.

The stock has been riding its upper bollinger band for two weeks. It is completely oversold on stochastics (fast and slow), and its RSI is actually getting close to 100. The red alarm on shorts should be going off with these technicals. It will only take some spark to send this one spiraling. Tomorrow’s durable goods may be the start. I don’t think we can expect 5-9% like we have had with some of these other gambles. Yet, I do think expecting 3-4% is a safe bet if things go how I hope.

Good luck and get in above 10!

Good Investing,

David Ristau