Double dip recession and the perverse math of GDP reporting

Posted by Edward Harrison at Credit Writedowns

Posted by Edward Harrison at Credit Writedowns

Remember when I said the following:

GDP as reported

From my view point, the interesting bit about

GDP is NOT inflation (i.e. real vs. nominal GDP), but rather the fact that the number which is reported is a first derivative. It is the change in GDP which is reported, not the actual number. And, this is significant because generally a business cycle troughs when the change in GDP goes from being negative for a significant period to being positive for a significant period. Equally, a business cycle peak (read recession) occurs when the change in GDP goes from being positive for a significant period to being negative for a significant period. So, it is the change in GDP that everyone cares about. But, reporting the change brings in a few statistical anomalies that are important.

This was a point I made in May in “Economic recovery and the perverse math of GDP reporting” when everyone was convinced the bottom was falling out, but I was predicting a fake recovery. It is the change in GDP that matters, not the absolute level. Well, the numbers work the same in both directions. And given the fact I see a double dip now as a baseline by early 2011, this makes Paul Krugman’s recent missive very much on point.

One thing that often becomes clear when we talk about prospects for next year — which worry me — is that there’s a lot of confusion over the timing of stimulus impacts. Even well-informed people will say things like “we’ve only spent a quarter of the money, so let’s wait and see what happens.” Menzie Chinn tried to get at this confusion recently; here’s my take.

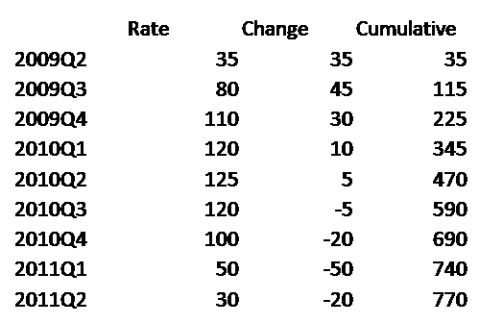

Let me work with a stylized numerical example. It doesn’t quite match the real stimulus — there’s no distinction between spending and tax

cuts , and it tails off much faster than the real thing. But I think it’s close enough to make the point. Here’s the table:

In the table, “Rate” is the total stimulus spending within each quarter. “Change” is the change in stimulus spending from the previous quarter. And “Cumulative is the total spending to date.

Translation: it’s irrelevant what percentage of the stimulus spending has already been spent. That is not how GDP is measured. It’s the quarter-on-quarter change in GDP that is relevant – and government stimulus subtracts from the change in GDP starting in Q3 2010 (see column two above).

This is why President Obama’s explanation for his recent turn toward deficit hawk is misguided. He said he wants to avoid a double dip

If the recent spectacle of government handouts to big Pharma and the banks via GSE mortgage market intervention give you that warm and fuzzy feeling about the efficacy of stimulus, then you’ll want to see some serious additional stimulus to prevent this coming train wreck. Otherwise, brace yourself for serious economic problems in the U.S. starting in the second-half of 2010 – just in time for the mid-term elections. And given already high levels of unemployment and fragile asset markets, expect serious carnage in both the real and financial economies.