Forecast 2010

Courtesy of James Howard Kunstler

The Center does Not Hold…

But Neither Does the Floor

Introduction

There are always disagreements in a society, differences of opinion, and contested ideas, but I don’t remember any period in my own longish life, even the Vietnam uproar, when the collective sense of purpose, intent, and self-confidence was so muddled in this country, so detached from reality. Obviously, in saying this I’m assuming that I have some reliable notion of what’s real. I admit the possibility that I’m as mistaken as anyone else. But for the purpose of this exercise I’ll ask you to regard me as a reliable narrator. Forecasting is a nasty job, usually thankless, often disappointing – but somebody’s got to do it. There are so many variables in motion, and so much of that motion is driven by randomness, and the best one can do in forecasting amounts to offering up some guesses for whatever they are worth.

I begin by restating my central theme of recent months: that we’re doing a poor job of constructing a coherent consensus about what is happening to us and what we are going to do about it.

There is a great clamor for "solutions" out there. I’ve noticed that what’s being clamored for is a set of rescue remedies – miracles even – that will allow us to keep living exactly the way we’re accustomed to in the USA, with all the trappings of comfort and convenience now taken as entitlements. I don’t believe that this will be remotely possible, so I avoid the term "solutions" entirely and suggest that we speak instead of "intelligent responses" to our changing circumstances. This implies that our well-being depends on our own behavior and the choices that we make, not on the lucky arrival of just-in-time miracles. It is an active stance, not a passive one. What will we do?

There is a great clamor for "solutions" out there. I’ve noticed that what’s being clamored for is a set of rescue remedies – miracles even – that will allow us to keep living exactly the way we’re accustomed to in the USA, with all the trappings of comfort and convenience now taken as entitlements. I don’t believe that this will be remotely possible, so I avoid the term "solutions" entirely and suggest that we speak instead of "intelligent responses" to our changing circumstances. This implies that our well-being depends on our own behavior and the choices that we make, not on the lucky arrival of just-in-time miracles. It is an active stance, not a passive one. What will we do?

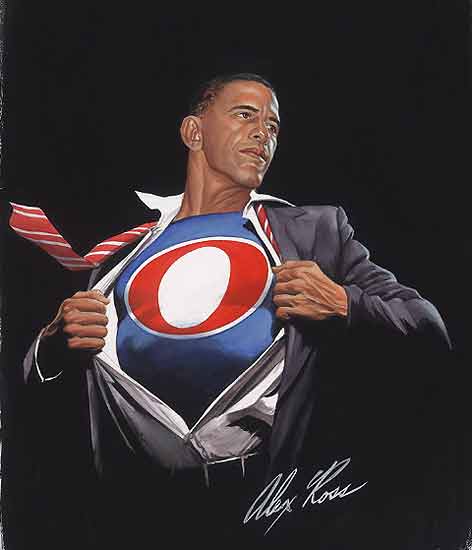

The great muddlement out there, this inability to form a coherent consensus about what’s happening, is especially frightening when, as is the case today, even the intelligent elites appear clueless or patently dishonest, in any case unreliable, in their relations with reality. President Obama, for instance – a charming, articulate man, with a winning smile, pectorals like Kansas City strip steaks, and a mandate for "change" – who speaks incessantly and implausibly of "the recovery" when all the economic vital signs tell a different story except for some obviously manipulated stock market indexes.  You hear this enough times and you can’t help but regard it as lying, and even if it is lying ostensibly for the good of the nation, it is still lying about what is actually going on and does much harm to the project of building a coherent consensus. I submit that we would benefit more if we acknowledged what is really happening to us because only that will allow us to respond intelligently. What prior state does Mr. Obama suppose we’re recovering to? A Potemkin housing boom and an endless credit card spending orgy? The lying spreads downward from the White House and broadly across the fruited plain and the corporate office landscape and through the campuses and the editorial floors and the suites of absolutely everyone in charge of everything until all leadership in every field of endeavor has been given permission to speak untruth and to reinforce each others lies and illusions.

You hear this enough times and you can’t help but regard it as lying, and even if it is lying ostensibly for the good of the nation, it is still lying about what is actually going on and does much harm to the project of building a coherent consensus. I submit that we would benefit more if we acknowledged what is really happening to us because only that will allow us to respond intelligently. What prior state does Mr. Obama suppose we’re recovering to? A Potemkin housing boom and an endless credit card spending orgy? The lying spreads downward from the White House and broadly across the fruited plain and the corporate office landscape and through the campuses and the editorial floors and the suites of absolutely everyone in charge of everything until all leadership in every field of endeavor has been given permission to speak untruth and to reinforce each others lies and illusions.

How dysfunctional is our nation? These days, we lie to ourselves perhaps as badly the Soviets did, and in a worse way, because where information is concerned we really are a freer people than they were, so our failure is far less excusable, far more disgraceful. That you are reading this blog is proof that we still enjoy free speech in this country, whatever state of captivity or foolishness the so-called "mainstream media" may be in. By submitting to lies and illusions, therefore, we are discrediting the idea that freedom of speech and action has any value. How dangerous is that?

Where We Are Now

2009 was the Year of the Zombie. The system for capital formation and allocation basically died but there was no funeral. A great national voodoo spell has kept the banks and related entities like Fannie Mae and the dead insurance giant AIG lurching around the graveyard with arms outstretched and yellowed eyes bugged out, howling for fresh infusions of blood… er, bailout cash, which is delivered in truckloads by the Federal Reserve, which is itself a zombie in the sense that it is probably insolvent. The government and the banks (including the Fed) have been playing very complicated games with each other, and the public, trying to pretend that they can all still function, shifting and shuffling losses, cooking their books, hiding losses, and doing everything possible to detach the relation of "money" to the reality of productive activity.

But nothing has been fixed, not even a little. Nothing has been enforced. No one has been held responsible for massive fraud. The underlying reality is that we are a much less affluent society than we pretend to be, or, to put it bluntly, that we are functionally bankrupt at every level: household, corporate enterprise, and government (all levels of that, too).

The difference between appearance and reality can be easily seen in the everyday facts of American economic life: soaring federal deficits, real unemployment above 15 percent, steeply falling tax revenues, massive state budget crises, continuing high rates of mortgage defaults and foreclosures, business and personal bankruptcies galore, cratering commercial real estate, dying retail, crumbling infrastructure, dwindling trade, runaway medical expense, soaring food stamp applications. Meanwhile, the major stock indices rallied. What’s not clear is whether money is actually going somewhere or only the idea of "money" is appearing to go somewhere. After all, if a company like Goldman Sachs can borrow gigantic sums of "money" from the Federal Reserve at zero interest, why would it not shovel that money into the burning furnace of a fake stock market rally? Of course, none of this behavior has anything to do with productive activity.

The theme for 2009 – well put by Chris Martenson – was "extend and pretend," to use all the complex trickery that can be marshaled in the finance tool bag to keep up the appearance of a revolving debt economy that produces profits, interest, and dividends, in spite of the fact that debt is not being "serviced," i.e. repaid. There is an awful lot in the machinations of Wall Street and Washington that is designed deliberately to be as incomprehensible as possible to even educated people, but this part is really simple: if money is created out of lending, then the failure to pay back loaned money with interest kills the system. That is the situation we are in.

The inertia displayed by our system – especially its manifest ability to keep stock markets levitating in the absence of value creation – is strictly a function of its size and complexity. It is running on fumes. I thought it would finally crash and burn in 2009. The Dow Jones industrial average certainly fell on its ass last March, bottoming in the mid-6000 range. But then it picked its sorry ass off the ground and rallied back up again thanks to bail-outs and ZIRPs and really no other place to look for returns on the accumulated wealth of the past two hundred years, especially for large institutions like pension funds that need income to function. I’d called for a Dow at 4000. A lot of readers ridiculed that call. Was it really that far off?

A feature of 2009 easily overlooked is what a generally placid year it was around the world. Apart from the election uproar in Iran, there were few events of any size or potency to shove all the various wobbly things – central banks, markets, governments, etc – into failure mode. So things just kept wobbling. I don’t think that state of affairs is likely to continue. With that, on to the particulars.

The Year Ahead

Just about everything which evaded fate via gamed numbers, budgets, and balance sheets in 2009 seems destined to hit a wall in 2010. To pick an arbitrary starting point, it is hard to see how states like California and New York can keep staving off monumental changes in their scale of operations with further budget trickery. Those cans they’ve been kicking down the street have fallen through the sewer grate. What will they do? They can massively raise taxes or massively lay off employees and default on obligations – or they can do all these things. The net result will be populations with less income, arguably impoverished, suffering, and perhaps very angry about it. Welcome to reality. Will Washington bail the states out, too? I wouldn’t be surprised to see them pretend to do so, but not without immense collateral damage in everybody’s legitimacy and surely an increase in US treasury interest rates.

But backing up a moment, I’m writing between Christmas and New Year’s Eve. The frenzied distractions of the holidays ongoing for much of Q4-2009 are still in force. In a week or so, when the Christmas trees are hauled out to the curbs (and it turns out that municipal garbage pickup has been curtailed for lack of funds) a picture will start to emerge of exactly how retail sales went leading up to the big climax. My guess is that sales were dismal. Reports of such will start a train of events that sends many retail companies careening into bankruptcy, including some national chains, leading to lost leases in malls and strip malls, leading to a final push off the cliff for commercial real estate, leading to the failure of many local and regional banks, leading to the bankrupt FDIC having to go to congress directly to get more money to bail out the depositors, leading again to rising interest rates for US treasuries, leading to higher mortgage interest rates for whoever out there is crazy enough to venture to buy a house with borrowed money, leading to the probability that there are few of the foregoing, leading to another hard leg down in house values because so few are now crazy enough to buy a house in the face of falling prices – all of this leading to the recognition that we have entered a serious depression, which is only a facet of the greater period of hardship we have also entered, which I call The Long Emergency.

This depression will be a classic deleveraging, or resolution of debt. Debt will either be paid back or defaulted on. Since a lot can’t be paid back, a lot of it will have to be defaulted on, which will make a lot of money disappear, which will make many people a lot poorer. President Obama will be faced with a basic choice. He can either make the situation worse by offering more bailouts and similar moves aimed at stopping the deleveraging process – that is, continue what he has been doing, only perhaps twice as much, which may crash the system more rapidly – or he can recognize the larger trends in The Long Emergency and begin marshalling our remaining collective resources to restructure the economy along less complex and more local lines. Don’t count on that.

Of course, this downscaling will happen whether we want it or not. It’s really a matter of whether we go along with it consciously and intelligently – or just let things slide. Paradoxically and unfortunately in this situation, the federal government is apt to become ever more ineffectual in its ability to manage anything, no matter how many times Mr. Obama comes on television. Does this leave him as a kind of national camp counselor trying to offer consolation to the suffering American people, without being able to really affect the way the "workout" works out? Was Franklin Roosevelt really much more than an affable presence on the radio in a dark time that had to take its course and was only resolved by a global convulsion that left the USA standing in a smoldering field of prostrate losers?

One wild card is how angry the American people might get. Unlike the 1930s, we are no longer a nation who call each other "Mister" and "Ma’am," where even the down-and-out wear neckties and speak a discernible variant of regular English, where hoboes say "thank you," and where, in short, there is something like a common culture of shared values. We’re a nation of thugs and louts with flames tattooed on our necks, who call each other "motherfucker" and are skilled only in playing video games based on mass murder. The masses of Roosevelt’s time were coming off decades of programmed, regimented work, where people showed up in well-run factories and schools and pretty much behaved themselves. In my view, that’s one of the reasons that the US didn’t explode in political violence during the Great Depression of the 1930s – the discipline and fortitude of the citizenry. The sheer weight of demoralization now is so titanic that it is very hard to imagine the people of the USA pulling together for anything beyond the most superficial ceremonies – placing teddy bears on a crash site. And forget about discipline and fortitude in a nation of ADD victims and self-esteem seekers.

I believe we will see the outbreak of civil disturbance at many levels in 2010. One will be plain old crime against property and persons, especially where the sense of community is flimsy-to-nonexistent, and that includes most of suburban America. The automobile is a fabulous aid to crime. People can commit crimes in Skokie and be back home in Racine before supper (if supper is anything besides a pepperoni stick and some Hostess Ho-Hos in the car). Fewer police will be on guard due to budget shortfalls.

I think we’ll see a variety-pack of political disturbance led first by people who are just plain pissed off at government and corporations and seek to damage property belonging to these entities. The ideologically-driven will offer up "revolutionary" action to redefine some lost national sense of purpose. Some of the most dangerous players such as the political racialists, the posse comitatus types, the totalitarian populists, have been out-of-sight for years. They’ll come out of the woodwork and join the contest over dwindling resources. Both the Left and the Right are capable of violence. But since the Left is ostensibly already in power, the Right is in a better position to mount a real challenge to office-holders. Their ideas may be savage and ridiculous, but they could easily sweep the 2010 elections – unless we see the rise of a third party (or perhaps several parties). No sign of that yet. Personally, I’d like to see figures like Christopher Dodd and Barney Frank sent packing, though I’m a registered Democrat. In the year ahead, the sense of contraction will be palpable and huge. Losses will be obvious. No amount of jive-talking will convince the public that they are experiencing "recovery." Everything familiar and comforting will begin receding toward the horizon.

Markets and Money

I’ll take another leap of faith and say that 6600 was not the bottom for the Dow. I’ve said Dow 4000 for three years in a row. Okay, my timing has been off. But I still believe this is its destination. Given the currency situation, and the dilemma of no-growth Ponzi economies, I’ll call it again for this year: Dow 4000. There, I said it. Laugh if you will….

I’m with those who see the dollar strengthening for at least the first half of 2010, and other assets falling in value, especially the stock markets. The dollar could wither later on in the year and maybe take a turn into high inflation as US treasury interest rates shoot up in an environment of a global bond glut. That doesn’t mean the stock markets will bounce back because the US economy will only sink into greater disorder when interest rates rise.

Right now there are ample signs of trouble with the Euro. It made a stunning downward move the past two weeks. European banks took the biggest hit in the Dubai default. Now they face the prospect of sovereign default in Greece, the Baltic nations (Estonia, Latvia, Lithuania), the Balkan nations (Serbia, et al), Spain, Portugal, Italy, Ireland, Iceland and the former soviet bloc of Eastern Europe. England is a train wreck of its own (though not tied into the Euro), and even France may be in trouble. That leaves very few European nations standing. Namely Germany and Scandanavia (and I just plain don’t know about Austria). What will Europe do? Really, what will Germany do? Probably reconstruct something like the German Deutschmark only call it something else… the Alt.Euro? As one wag said on the Net: sovereign debt is the new sub-prime! The Euro is in a deeper slog right now than the US dollar (even with our fantastic problems), so I see the dollar rising in relation to the Euro, at least for a while. I’d park cash in three month treasury bills – don’t expect any return – for safety in the first half of 2010. I wouldn’t touch long-term US debt paper with a carbon-fiber sixty foot pole.

I’m still not among those who see China rising into a position of supremacy. In fact, they have many reasons of their own to tank, including the loss of the major market for their manufactured goods, vast ecological problems, de-stabilizing demographic shifts within the nation, and probably a food crisis in 2010 (more about this later).

Though a seemingly more stable nation than the US, with a disciplined population and a strong common culture with shared values, Japan’s financial disarray runs so deep that it could crash its government even before ours. It has no fossil fuels of its own whatsoever. And in a de-industrializing world, how can an industrial economy sustain itself? Japan might become a showcase for The Long Emergency. On the other hand, if it gets there first and makes the necessary adjustments, which is possible given their discipline and common culture, they may become THE society to emulate!

I’m also not convinced that so-called "emerging markets" are places where money will dependably earn interest, profits, or dividends. Contraction will be everywhere. I even think the price of gold will retrace somewhere between $750 and $1000 for a while, though precious metals will hold substantial value under any conditions short of Hobbesian chaos. People flock to gold out of uncertainty, not just a bet on inflation. My guess is that gold and silver will eventually head back up in value to heights previously never imagined, and it would be wise to own some. I do not believe that the federal government could confiscate personal gold again the way it did in 1933. There are too many pissed off people with too many guns out there – and I’m sure there is a correlation between owners of guns with owners of gold and levels of pissed-offness. A botched attempt to take gold away from citizens would only emphasize the impotence of the federal government, leading to further erosion of legitimacy.

Bottom line for markets and money in 2010: so many things will be out of whack that making money work via the traditional routes of compound interest or dividends will be nearly impossible. There’s money to be made in shorting and arbitrage and speculation, but that requires nerves of steel and lots and lots of luck. Those dependent on income from regular investment will be hurt badly. For most of us, capital preservation will be as good as it gets – and there’s always the chance the dollar will enter the hyper-inflationary twilight zone and wipe out everything and everyone connected with it.

Peak Oil

It’s still out there, very much out there, a huge unseen presence in the story, the true ghost-in-the-machine, eating away at economies every day. It slipped offstage in 2009 after the oil spike of 2008 ($147/barrel) over-corrected in early 2009 to the low $30s/barrel. Now it’s retraced about halfway back to the mid-$70s. One way of looking at the situation is as follows. Oil priced above $75 begins to squeeze the US economy; oil priced over $85 tends to crush the US economy. You can see where we are now with oil prices closing on Christmas Eve at $78/barrel.

Among the many wishful delusions operating currently is the idea that the Bakken oil play in Dakota / Montana will save Happy Motoring for America, and that the Appalachian shale gas plays will kick in to make us energy independent for a century to come. Americans are likely to be disappointed by these things.

Both Bakken and the shale gas are based on techniques for using horizontal drilling through "tight" rock strata that is fractured with pressurized water. It works, but it’s not at all cheap, creates plenty of environmental mischief, and may end up being only marginally productive. At best, Bakken is predicted to produce around 400,000 barrels of oil a day. That’s not much in a nation that uses close to 20 million barrels a day. Shale gas works too, though the wells deplete shockingly fast and will require the massive deployment of new drilling rigs (do we even have the steel for this?). I doubt it can be produced for under $10 a unit (mm/BTUs) and currently the price of gas is in the $5 range. In any case, we’re not going to run the US motor vehicle fleet on natural gas, despite wishful thinking.

Several other story elements in the oil drama have remained on track to make our lives more difficult. Oil export rates continue to decline more steeply than oil field depletion rates. Exporters like Iran, Mexico, Saudi Arabia, Venezuela, are using evermore of the oil they produce (often as state-subsidized cheap gasoline), even as their production rates go down. So, they have less oil to sell to importers like the USA – and we import more than 60 percent of the oil we use. Mexico’s Pemex is in such a sorry state, with its principal Cantarell field production falling off a cliff, that the USA’s number three source of imported oil may be able to sell us nothing whatsoever in just 24 months. Is there any public discussion about this in the USA? No. Do we have a plan? No.

A new wrinkle in the story developing especially since the financial crisis happened, is the shortage of capital for new oil exploration and production – meaning that we have even poorer prospects of offsetting world-wide oil depletion. The capital shortage will also affect development in the Bakken play and the Marcellus shale gas range.

Industrial economies are still at the mercy of peak oil. This basic fact of life means that we can’t expect the regular cyclical growth in productive activity that formed the baseline parameters for modern capital finance – meaning that we can’t run on revolving credit anymore because growth simply isn’t there to create real surplus wealth to pay down debt. The past 20 years we’ve seen the institutions of capital finance pretend to create growth where there is no growth by expanding financial casino games of chance and extracting profits, commissions, and bonuses from the management of these games – mortgage backed securities, collateralized debt obligations, credit default swaps, and all the rest of the tricks dreamed up as America’s industrial economy was shipped off to the Third World. But that set of rackets had a limited life span and they ran into a wall in October 2008. Since then it’s all come down to a shell game: hide the giant pea of defaulted debt under a giant walnut shell.

Yet another part of the story is the wish that the failing fossil fuel industrial economy would segue seamlessly into an alt-energy industrial economy. This just isn’t happening, despite the warm, fuzzy TV commercials about electric cars and "green" technology. The sad truth of the matter is that we face the need to fundamentally restructure the way we live and what we do in North America, and probably along the lines of much more modest expectations, and with very different practical arrangements in everything from the very nature of work to household configurations, transportation, farming, capital formation, and the shape-and-scale of our settlements. This is not just a matter of re-tuning what we have now. It means letting go of much of it, especially our investments in suburbia and motoring – something that the American public still isn’t ready to face. They may never be ready to face this and that is why we may never make a successful transition to whatever the next economy is. Rather, we will undertake a campaign to sustain the unsustainable and sink into poverty and disorder as we fight over the table scraps of the old economy… and when the smoke clears nothing new will have been built.

President Obama has spent his first year in office, and billions of dollars, trying to prop up the floundering car-makers and more generally the motoring system with "stimulus" for "shovel-ready" highway projects. This is exactly the kind of campaign to sustain the unsustainable that I mean. Motoring is in the process of failing and now for reasons that even we peak oilers didn’t anticipate a year ago. It’s no longer just about the price of gasoline. The crisis of capital is making car loans much harder to get, and if Americans can’t buy cars on installment loans, they are not going to buy cars, and eventually they will not be driving cars they can’t buy. The same crisis of capital is now depriving the states, counties, and municipalities of the means to maintain the massive paved highway and street system in this country. Just a few years of not attending to that will leave the system unworkable.

Meanwhile President Obama has given next-to-zero money or attention to public transit, to repairing the passenger railroad system in particular. I maintain that if we don’t repair this system, Americans will not be traveling very far from home in a decade or so. Therefore, Mr. Obama’s actions vis-à-vis transportation are not an intelligent response to our situation. And for very similar reasons, the proposal for a totally electric motor vehicle fleet, as a so-called "solution" to the liquid fuels problem, is equally unintelligent and tragic. Of course something else that Mr. Obama has barely paid lip-service to is the desperate need to retool our living places as walkable communities. The government now, at all levels, virtually mandates suburban arrangements of the most extremely car-dependent kind. Changing this has to move near the top of a national emergency priority list, if we have one.

Even with somewhat lower oil prices in 2009, the airlines still hemorrhaged losses in the billions, and if the oil price remains in the current zone some of them will fall back into bankruptcy in 2010. Oil prices may go down again in response to crippled economies, but then so will passengers looking to fly anywhere, especially the business fliers that the airlines have depended on to fill the higher-priced seats. I believe United will be the first one to go down in 2010, a hateful moron of a company that deserves to die.

My forecast for oil prices this year is extreme volatility. A strengthening dollar might send oil prices down (though that relationship has temporarily broken down this December as both oil prices and the dollar went up in tandem for the first time in memory). So could the cratering of the stock markets, or a general apprehension of a floundering economy. But the oil export situation also means there is less and less wiggle room every month for supply to keep pace with demand, even in struggling economies if they are dependent on foreign imports. Another part of the story that we don’t pay attention to is the potential for oil scarcities, shortages, and hoarding. We may see the reemergence of those trends in 2010 for the first times since 1979.

Geopolitics

The retracement of oil prices in 2009 took place against a background of relative quiet on the geopolitical scene. With economies around the world sinking into even deeper extremis in 2010, friction and instability are more likely. The more likely locales for this are the places where most of the world’s remaining oil is: the Middle East and Central Asia. The American army is already there, in Iraq and Afghanistan, with an overt pledge to up-the-ante in Afghanistan. It’s hard to imagine a happy ending in all this. It’s increasingly hard to even imagine a strategic justification for it. My current (weakly-held) notion is that America wants to make a baloney sandwich out of Iran, with American armies in Iraq and Afghanistan as the Wonder Bread, to "keep the pressure on" Iran. Well, after quite a few years, it doesn’t seem to be moderating or influencing Iran’s behavior in any way. Meanwhile, Pakistan becomes more chaotic every week and our presence in the Islamic world stimulates more Islamic extremist hatred against the USA. Speaking of Pakistan, there is the matter of its neighbor and adversary, India. If there is another terror attack by Pakistan on the order of last year’s against various targets in Mumbai, I believe the response by India is liable to be severe next time, leading to God-knows-what, considering both countries have plenty of atom bombs.

Otherwise, the idea that we can control indigenous tribal populations in some of Asia’s most forbidding terrain seems laughable. I don’t have to rehearse the whole "graveyard of empires" routine here. But what possible geo-strategic advantage is in this for us? What would it matter if we pacified all the Taliban or al Qaeda in Afghanistan? Most of the hardest core maniacs are next door in Pakistan. Even if we turned Afghanistan into Idaho-East, with Kabul as the next Sun Valley, complete with Ralph Lauren shops and Mario Batali bistros, Pakistan would remain every bit as chaotic and dangerous in terms of supplying the world with terrorists. And how long would we expect to remain in Afghanistan pacifying the population? Five years? Ten Years? Forever? It’s a ridiculous project. Loose talk on the web suggests our hidden agenda there was to protect a Conoco pipeline out of Tajikistan, but that seems equally absurd on several grounds. I can’t see Afghanistan as anything but a sucking chest wound for dollars, soldiers’ lives, and American prestige.

What’s more, our presence there seems likely to stimulate more terror incidents here in the USA. We’ve been supernaturally lucky since 2001 that there hasn’t been another incident of mass murder, even something as easy and straightforward as a shopping mall massacre or a bomb in a subway. Our luck is bound to run out. There are too many "soft" targets and our borders are too squishy. Small arms and explosives are easy to get in the USA. I predict that 2010 may be the year our luck does run out. Even before the start of the year we’ve seen the attempted Christmas bombing of Northwest-KLM flight 253 (Amsterdam to Detroit). One consequence of this is that it will only make air travel more unpleasant for everybody in the USA as new rules are instated limiting bathroom trips and blankets in the final hour of flight.

As far as the USA is concerned, I think we have more to worry about from Mexico than Afghanistan. In 2009, the Mexican government slipped ever deeper into impotence against the giant criminal cartels there. As the Cantarell oil field waters out, revenue from Pemex to the national government will wither away and so will the government’s ability to control anything there. The next president of Mexico may be an ambitious gangster straight out of the drug cartels, Pancho Villa on steroids.

Another potential world locale for conflict may be Europe as the European Union begins to implode under the strains of the monetary system. The weaker nations default on their obligations and Germany, especially, looks to insulate itself from the damage. Except for the fiasco in Yugoslavia’s breakup years ago, Europe has been strikingly peaceful for half a century. For most of us now living who have visited there, it is almost impossible to imagine how violent and crazy the continent was in the early twentieth century. I wonder what might happen there now, with more than a few nations failing economically and the dogs of extreme politics perhaps loosed again. History is ironical. Perhaps this time the Germans will be the good guys, while England goes apeshit with its BNP. Wouldn’t that be something?

One big new subplot in world politics this year may be the global food shortage that is shaping up as a result of spectacular crop failures in most of the major farming regions of the world. The American grain belt was hit by cold and wet weather and the harvest was a disaster, especially for soybeans, of which the USA produces at least three-quarters of the world’s supply. Crops have also failed in Northern China’s wheat-growing region, in Australia, Argentina, and India. The result may range from extremely high food prices in the developed world to starvation in other places, leading to grave political instability and desperate fights over resources. We’ll have an idea where this is leading by springtime. It maybe the most potent sub-plot in the story for 2010.

Conclusions

The Long Emergency is officially underway. Reality is telling us very clearly to prepare for a new way of life in the USA. We’re in desperate need of decomplexifying, re-localizing, downscaling, and re-humanizing American life. It doesn’t mean that we will be a lesser people or that we will not recognize our own culture. In some respects, I think it means we must return to some traditional American life-ways that we abandoned for the cheap oil life of convenience, comfort, obesity, and social atomization.

The successful people in America moving forward will be those who attach themselves to cohesive local communities, places with integral local economies and sturdy social networks, especially places that can produce a significant amount of their own food. I don’t think that we’ll be living in a world without money, some medium of exchange above barter, but it may not come in the form of dollars. My guess is that for a while it may be gold and silver, or possibly certificates issued by bank-like institutions representing gold-on-hand. In any case, I doubt we’ll arrive there this year. This is more likely to be the year of grand monetary disorders and continued shocking economic contraction.

Political upheaval can get underway pretty quickly, without a whole lot of warning. I’m still waiting to hear the announced 2009 bonuses for the employees of the TBTF banks. All they said before Christmas was that thirty top Goldman Sachs employees would be paid in stock instead of money this year, but no other big banks have made a peep yet. I suppose they’ll have to in the four days before New Years. I still think that could be the moment that shoves some disgruntled Americans into the arena of protest and revolt. Beyond that, though, there is plenty room for emotions to run wild and for behavior to get weird.

President Obama will have to make some pretty drastic moves to salvage his credibility. I see no sign of any intention to seriously investigate or prosecute financial crimes. Yet the evidence of misdeeds piles higher and higher – just this week new comprehensive reports of Goldman Sachs’s irregularities in shorting their own issues of mortgage-backed securities, and a report on the Treasury Department’s issuance of treasuries to "back-door" dumpers of toxic mortgage backed securities. And on Christmas Eve, when nobody was looking, the Treasury lifted the ceiling on Fannie Mae and Freddie Mac’s backstop money to infinity. Even people like me who try to pay close attention to what’s going on have lost track of all the various TARPs, TALFs, bailouts, stimuli, ZIRP loans, and handovers to every bank and its uncle in the land.

Good luck to readers in 2010. To paraphrase Tiny Tim: God help us, every one….