John Rubino is the co-author, with

GoldMoney’s James Turk, of

The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of

Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008),

How to Profit from the Coming Real Estate Bust (Rodale, 2003) and

Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He now writes for CFA Magazine and manages and edits the terrific websites

DollarCollapse.com and

GreenStockInvesting.com.

“This is the end of a long era and the beginning of another that is not going to be nearly as nice.” John Rubino

Our first conversation was on the phone, the day Ben Bernanke was named “Person of the Year” by

Time Magazine.

Ilene: So what do you think of Ben Bernanke winning the Time’s person of the year award?

John: First, this was obviously a lame year – not much competition. Second, it’s a great negative indicator, like Time’s “Home Sweet Home” edition just prior to the housing collapse. Ben Bernanke is part of the old monetary order, in which it was acceptable to create paper money in infinite amounts to finance a growing government. The peak of his popularity coincides with the end of the system he helped design.

Ilene: Do you think Bernanke will get reappointed?

John: Oh yes, he fits the times perfectly. Most of the people in charge think he did a great job. He’ll be reappointed and he and Alan Greenspan will be identified with the future crisis, they’ll be the guys who are in the history books as the Fed Chairmen who ran us off a cliff. And it couldn’t happen to two nicer guys as far as I’m concerned.

Ilene: What are your thoughts regarding our economy in 2010, and the stock market?

John: In the short run, anything can happen. It’s unknowable since there are so many competing forces. The government pumping liquidity into the system can produce some nice corporate earnings reports, which pumps up the stock market in the short run. Or we could have Greece or some other bankrupt country default and send global markets into a tailspin. There’s no real way to know. Both are reasonably likely, so you could see a decent or a horrendous market.

But I do think the trends of the last year– stocks bouncing, gold prices soaring, and long term interest rates stable, despite a massive increase in money supply–I think these trends have had long runs and are due for corrections. Personally, I’m paring back on gold and silver mining stocks and increasing my short positions in stocks and long-term Treasuries. But nothing is guaranteed.

Ilene: So you believe 2009’s trends are going to reverse but the timing is questionable?

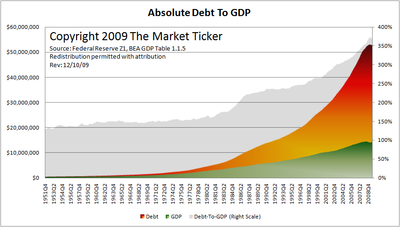

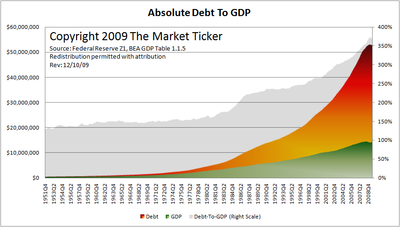

John: It does feel like last year’s trends are ready to peter out, but again, I’m almost never right about short term moves. Longer-term, things are clearer: The surge in debt levels in the U.S., with the public sector now doing most of the borrowing, is a continuation of the trend that began in the 1980s when we as a society started borrowing a lot more money than we had in the past. If you chart it, from the 1950s to the 1970s, debt and the GDP grew in tandem. But in the 1980s, debt started growing faster than GDP. This accelerated in the 1990s and really took off under George Bush. In the 1990s it was the private sector taking on debt. And now that the housing bubble has burst, the government is trying to keep this debt-addicted economy going by borrowing and printing more and more paper currency.

I think in the end it doesn’t matter who is borrowing, because we’re all responsible for it. We’re at the point where we could never pay our current debts off in today’s dollars. So we’re left with a choice of disasters: We’re either going to collapse under all this debt and repudiate it via bankruptcy, as we did in the 1930s, or print so much new currency that we end up paying our creditors in greatly depreciated dollars. Our creditors, the Chinese, Japanese, and Saudis, will get far less value back in return for what they gave us, much less than they expected to get back. And savers will have a lot less than they thought they had saved.

We’ve chosen the second course, to try to inflate away our debt. The end result will be a huge drop in value of the dollar. This will cause interest rates to go up, which will end up crushing the financial system in the future, giving us a 1930s style depression anyhow.

So our choices are limited: a depression now or a hyperinflation followed by depression later. This is the inevitable result of too much debt.

John: Yes, the book went chapter by chapter through this process. Borrowing too much and then repudiating the national debt is pretty common historically, so we were able to cite a lot of examples and explain the way it typically happens. We conclude that we’ve probably passed the point of no return, and the solution for the average person is to put as much capital as possible in real assets because those things can’t be created out of thin air by the government. For example, assets such as gold, silver, commodities and maybe real estate will hold their value. The paper money of the world will be destroyed and the real stuff will be left standing. So get as far away from dollars as possible and put capital in real assets.

Ilene: In that case, let’s say you have a house with a mortgage. Is it worth paying off that mortgage with dollars today?

John: Possibly. That subject has been coming up lately because the logical conclusion of the recognition that we’re destroying the value of the dollar is that you should borrow as much as possible, since the coming hyperinflation will eliminate your debt. If the dollar goes down 90%, the real value of your debt payments goes down 90% as well. So one logical response is to borrow as much as you can and hope to pay off the loan with depreciated dollars.

But that makes sense only if you’re guaranteed to be able to make the payments because if your cash flow is impaired, for example by your losing a job, or declines in the value of your other investments, you then risk losing everything – the worst possible scenario. Most people shouldn’t be playing around this way — borrowing in the hope of benefiting from hyperinflation. Most people should pay off their debts and have their house be theirs, so no matter what they have a roof over their heads.

Ilene: Do you do any financial advising as well as writing?

John: No, it’s a regulated career, you take test, register with government. I’m just a writer, so whatever you see here or on DollarCollapse.com should be read with the proviso that I’m not a financial advisor. I can’t directly advise you on how to manage your money and you can’t sue me if it goes wrong.

Ilene: But you can tell us what you’re doing with your money, which is buying real things – gold, silver, commodities, and real estate – real things. And you’re taking short positions in financial things, like stocks indexes and treasuries bonds.

I’ve been wondering about this myself and maybe others are too – where do you put money now?

John: The average person is really stuck right now, since there are limited things you can do that are within the range of mainstream investing. A bank CD, if it is in dollars, will go down if the dollar goes down; and bonds, which are the thing that most financial advisors will tell you are the safest investments, are actually a disaster in a currency crisis when the value of the currency goes down. It’s tricky and a lot of people are going to get burned because they don’t understand the difference this time. They don’t understand how the last 70 years were one period of history, and that period is ending. This is a new world and you have to adjust accordingly. The next period is going to be different.

But there are things you can do: go to a coin dealer and buy some gold and silver coins and then store them in a safe place. And gold and silver mining stocks will go up if the dollar goes down. The Collapse of the Dollar has a chapter on this.

Ilene: Next, on to clean tech stocks. Will you tell me about clean tech stocks and the particular types of technology you think make the best investments?

John: Clean tech is interesting for several reasons. One is that a lot of these things have been around for a long time but they didn’t really work because they weren’t efficient enough to compete in the marketplace with existing energy sources. But over the years they’ve gotten more efficient and cheaper, and now wind, solar and a few other clean technologies actually work and can compete with coal, oil and natural gas. Other things being completely equal, they would be part of the mix in utilities generating electricity, and homeowners deciding how to build their houses. But other things aren’t equal. World governments have come to two conclusions: First, fossil fuel-based economies are causing various kinds problems that we have to deal with sooner rather than later. So governments are passing laws to encourage the adoption of alternative energy sources and to discourage the adoption of carbon-based energy sources. That skews the playing filed a little in favor of clean tech.

Second, governments of the world believe they need to spend huge sums of money in order to keep their economies from falling into a depression. And one of the things they’re spending money on is clean tech. They’re using this as an opportunity to borrow a lot of money and revamp their energy infrastructure, upgrade electricity grids, build new wind farms and solar panel plants, and further research on geothermal energy and other things like biofuels.

In the short term, the best clean tech stocks will be supported by the inflow of public money. In the intermediate term, they’ll be supported because the products they make actually work, with people buying them on the merits. Clean tech stocks are going to be growth stocks for a really long time.

So then the question becomes which of the twenty different possible clean tech sectors do you want to focus on first? There are several that are here and now, ready for market and with great growth prospects.

The best of them is called smart grid. That’s where we use information technologies to upgrade the power grid, either to make homes more energy efficient or to help utilities better track of who’s doing what and to better manage their energy flows. There are a lot of companies that are producing things like smart meters and energy management systems. Smart grid will make people a lot of money.

Geothermal energy uses the heat differential between underground and above ground to produce electricity very cheaply and very cleanly, and that seems to work and is growing fast. Solar power has progressed to the point where in sunny climates, the newest generation of solar panels produces electricity cheaply enough to compete with head to head with local utilities, and that’s going to spread like crazy. Wind works and the next generation of biofuels looks interesting, as do the batteries that run plug-in hybrids and fully electric cars. That will be a huge growth field. It just goes on and on. And water of course, is crucial: half the world is running out of water so the technologies that allow us to better manage our water supplies or get more water will be huge growth fields going forward. You could make a career out of just studying clean tech for the next 20 years.

The key is to focus on the technologies that are ready and available now, and not spend too much time on the stuff that is five years out because that’s a dangerous gap. People can get excited about the prospects of something but then disappointed if it doesn’t immediately turn into earnings. You want to focus on what has sales and cash flow and leave the story stocks to the speculators.

Ilene: To invest in these companies, should we wait for a pullback?

John: Well, here again, I’m the worst market timer on earth. What I’m doing is lightening up on some clean tech stocks that have gone up–as the overall market has gone up 65% or so from its bottom after the crash–and that implies we have a correction out there and possibly a nasty one. Right now a lot of things that can go wrong, like Greece or Spain defaulting which leads to other countries defaulting, or Israel bombing Iran’s nuclear plant, or U.S. interest rates spiking because the dollar falls. Those are the kinds of things that you worry about after going up 65%.

If the broad market goes down, it will pull down clean tech as well. So I wouldn’t jump with both feet into even the best clean tech stocks. Instead I’d use this time to get to know the stocks that look most interesting and look for entry points. It could be after there’s a decent correction in the overall market or before you think there’s going to be positive announcement. Or you might want to dollar cost average over a period of time. But don’t jump in all at once right now.

Ilene: What are your favorite stocks in this area?

John: Now the stocks that I’m going to mention have had good runs, and are probably due for a correction. But they’re the premier companies in these fields and they’re the ones you want to pay attention to:

- American Superconductor (AMSC) makes technologies that allow wind farms to cheaply transport electricity to the market. As more and more wind farms are sited far from their customers, transmission will become a bigger part of the game.

- Itron (IRTI). They make the smart meters that will someday be installed in every home to allow utilities to communicate back and forth with homeowners. This is a huge potential market, and Itron is the leader in the field.

- Ormat (ORA). The leading geothermal company, with nice steady growth as far as the eye can see.

- ITT (ITT) makes all kinds of boring but high-growth water technologies that will be in demand all around the world. Water shortages are the next environmental front-page stories, so ITT will find itself in a hot field.

- EnerNOC (ENOC). One of the leaders in “demand response” technologies which allow utilities to communicate with customers and manage the flow of electricity. It’s had a huge year, with big orders and a surging stock price.

- First Solar (FSLR) is the biggest, most efficient solar panel maker. Its thin film panels are the lowest cost and its balance sheet is solid, a combination that’s allowing it to take market share from weaker solar players during the current glut. It should emerge stronger in a year or two. Hugely volatile stock, great buy on pullbacks, load up next time the stock gets whacked.

Ilene: John, is there anything you’d like to add to our interview before we stop?

John: One thing that frequently happens during a currency crisis is that governments become coercive. That is, they’ll confiscate wealth or impose currency controls or price controls. The U.S. government, for instance, is already considering converting IRAs and 401Ks to government accounts, in effect confiscating that money. In other countries in other times, during crises like this, governments have done all kinds of crazy things, imposing the death penalty on citizens who raise prices or refuse to accept paper money in payment. In the U.S. in the 1930s they confiscated gold and made it illegal for Americans to own gold.

So assuming we’re headed for one of the all-time nastiest currency crises, it’s reasonable to expect a lot of coercion from the U.S. government, so one of the things you might want to consider is geographic diversification. Move some of your money oversees; no guarantee that anywhere else will be safer, but at least you’ll be hedging your bets. So store some gold in a vault in Switzerland or use a service to do it for you, or buy some land in another country that might not be directly affected by the U.S. crisis. Many people are looking at countries in Asia or Latin America. They’re trying to find relatively stable countries and they’re buying assets there to be beyond the reach of whatever kinds of capital controls come. So if you’ve got the money, it’s worth trying to diversify geographically.

Ilene: Would you say that the currency crash is pretty much inevitable, 100%?

John: I think that a financial crisis is inevitable and I think we basically have a choice between different types of crises. We could stop borrowing money and collapse into a 1930s style depression right now, or we could keep running the printing presses and have a hyperinflation and currency collapse sometime in the future. We’re trying for the second but there’s no guarantee that we can succeed. We’ve never been here before. It is unchartered territory to have the whole world be over-indebted and running fiat currency printing presses. This is a new chapter in history and we don’t know how it will play out but we know from previous periods that we’re at the point where something bad almost has to happen because of all the debt we’ve taken on.

Ilene: And even if we go the second route with hyperinflation, a collapse comes anyway.

John: Eventually, yeah, it does. Because when we destroy the currency, the financial system will stop functioning for a while. So we will have a depression; it’s almost unavoidable.

Ilene: Why is the government choosing this course which is going to end just as bad, just take a little longer to get there?

John: That’s the least painful course in the short run. If they choose the other course, in other words just collapse under all this debt, then whoever’s in charge is this generation’s Herbert Hoover. Nobody wants to be the guy who gets blamed for this. So they try to get through the next day. Bail out the next company that needs to be bailed out. And do whatever it takes to get through the next election and keep things going. It could be that they don’t even know that what’s out there is Weimar Germany style hyperinflation. It could be that they assume normality will return if they just pump enough money into the system. Who knows what they’re thinking?

Ilene: Just one more question. Do you think there is some sort of conspiracy between the Federal Reserve and government to have these drastic collapses because certain people are profiting by it?

John: In the short run, Wall Street traders love volatility as long as they can manipulate it, because they make a fortune trading paper back and forth. There’s also a theory that beginning in 1913 with the formation of the Fed there’s been a conspiracy of powerful international bankers that has purposely brought us to this point. Personally, it’s hard to imagine them wanting this to happen. It’s only in their interest in the short run because in the long run things are going to get very unstable and very dangerous. I would not want to be the Chairman of Goldman Sachs when everything falls apart. It’s a really dangerous time to be identified with the mess that’s coming. Who knows what the people in charge are really thinking but I suspect a big part of it is just cluelessness and incompetence, rather than brilliance and evil.

Ilene: Well okay, I think I asked you EVERYTHING that I can think of for now.

John: Well, thanks a lot Ilene, it was good talking to you.

Ilene: You too, and thank you so much.

Debt to GDP Chart by Karl Denninger at The Market Ticker.

John Rubino is the co-author, with GoldMoney’s James Turk, of The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He now writes for CFA Magazine and manages and edits the terrific websites DollarCollapse.com and GreenStockInvesting.com.

John Rubino is the co-author, with GoldMoney’s James Turk, of The Collapse of the Dollar and How to Profit From It (Doubleday, 2007), and author of Clean Money: Picking Winners in the Green-Tech Boom (Wiley, 2008), How to Profit from the Coming Real Estate Bust (Rodale, 2003) and Main Street, Not Wall Street (Morrow, 1998). After earning a Finance MBA from New York University, he spent the 1980s on Wall Street, as a Eurodollar trader, equity analyst and junk bond analyst. During the 1990s he was a featured columnist with TheStreet.com and a frequent contributor to Individual Investor, Online Investor, and Consumers Digest, among many other publications. He now writes for CFA Magazine and manages and edits the terrific websites DollarCollapse.com and GreenStockInvesting.com. John: First, this was obviously a lame year – not much competition. Second, it’s a great negative indicator, like Time’s “Home Sweet Home” edition just prior to the housing collapse. Ben Bernanke is part of the old monetary order, in which it was acceptable to create paper money in infinite amounts to finance a growing government. The peak of his popularity coincides with the end of the system he helped design.

John: First, this was obviously a lame year – not much competition. Second, it’s a great negative indicator, like Time’s “Home Sweet Home” edition just prior to the housing collapse. Ben Bernanke is part of the old monetary order, in which it was acceptable to create paper money in infinite amounts to finance a growing government. The peak of his popularity coincides with the end of the system he helped design.

Ilene: Given that your book is called “The Collapse of the Dollar and How to Profit From It,” are these events pretty well spelled out in your book?

Ilene: Given that your book is called “The Collapse of the Dollar and How to Profit From It,” are these events pretty well spelled out in your book?