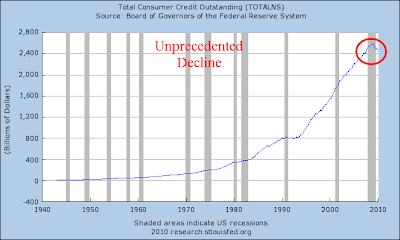

Consumer Credit Drops Record $17.5 Billion; Steepest Declines Since WWII

Courtesy of Mish

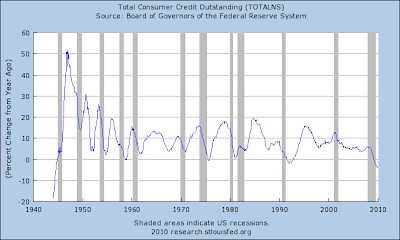

While monetarist clowns focus on so-called excess reserves and the huge surge in inflation that is supposed to bring (See Fictional Reserve Lending And The Myth Of Excess Reserves) I am watching the biggest plunge in consumer credit since WWII.

Please consider Consumer Credit in U.S. Drops Record $17.5 Billion.

Consumer credit in the U.S. dropped a record $17.5 billion in November as unemployment close to a 26- year high discouraged borrowing and banks limited access to loans.

The slump in credit to $2.46 trillion was more than anticipated and followed a revised $4.2 billion drop in October, Federal Reserve figures showed today in Washington. The median estimate of economists surveyed by Bloomberg News projected a decrease of $5 billion. The series of 10 straight declines was the longest since record-keeping began in 1943.

“Double-digit unemployment is eroding consumer confidence and the uncertainty is prompting consumers to pay down their credit card debts,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. “We have not seen such a wholesale reduction in consumer credit since the last time we had double-digit unemployment rate following the early ‘80s recessions.”

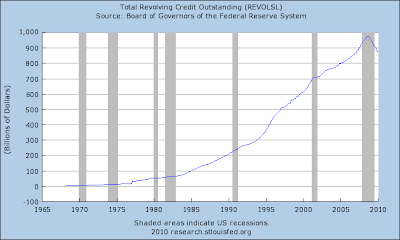

Revolving debt, such as credit cards, plunged by a record $13.7 billion in November, the Fed’s statistics showed. Non-revolving debt, including loans for autos and mobile homes, declined by $3.8 billion. The Fed’s report doesn’t cover borrowing secured by real estate.

Bank of America Corp. Chief Executive Officer Brian T. Moynihan has said the largest U.S. lender needs to reduce the loss rate on credit cards, which ranked highest among the nation’s six biggest card companies in November. Bank of America’s card defaults are “still very high,” Moynihan, 50, said.

‘Significant Bubble’

“As an industry, we over-lent and customers over-borrowed, and that led to a fairly significant bubble,” Moynihan said Jan. 4 in an interview on Bloomberg Television in Raleigh, North Carolina. “We have to help lead the economic recovery. At the same time, we have to be responsible lenders.”

Total Consumer Credit

click on chart for sharper image

Total Consumer Credit Percent Change From Year Ago

click on chart for sharper image

Total Revolving Credit Outstanding

click on chart for sharper image

click on chart for sharper image

Consumers Attitudes Are Key To Deflation

The Fed has pumped (attempted to is a more apt description) $trillions into the economy.

Consumers (and lenders) responded by cutting credit. Here is the telling comment of the week from the CEO of Bank of America: "We have to help lead the economic recovery. At the same time, we have to be responsible lenders.”

New Religion

- Banks have a new religion on lending.

- Consumers have a new religion on borrowing.

If you think that is inflationary, you have no idea what inflation is. In case you need a refresher course please consider Fiat World Mathematical Model.