Oxen Report Readers,

I hope you got involved in our Overnight Trade of Infosys Technologies Inc. (INFY). The stock beat earnings estimates, reporting an EPS of 0.59 vs. the expected 0.51. The company is looking for more growth in Q4 of 2009, and it is looking like a very solid pick up. We can sell in the morning, as the stock is already up 4% in pre-market trading.

But, let’s get into today’s market…

Buy Pick of the Day: Ultrashort Proshares Real Estate ETF (SRS)

Analysis: Alcoa’s earnings have definitely brought the market down and scared investors in pre-market trading, as the company missed profit estimates and was a shot of reality that things are not as good as some had thought. Futures were down almost 70 points as of 8:30 AM. Yet, I think just as important but overlooked right now is that KB Homes Inc. (KBH), one of America’s leading home producers reported such phenomenal earnings. The company reported an EPS of 1.31 vs. the expected loss of -0.42. Yet, the beat was helped by a tax break, and the company really reported a loss without the tax incentive. That is why the stock is down almost 3% in pre-market trading. Further, the market should get a negative swing from the fact that the trade balance missed and was worse than expected. It is a leading economic indicator..png)

Suprisingly, with this slew of bad news, SRS finds itself up under 2%, with lots of room for growth. Investors had been very excited going into the earnings season, pumping up Alcoa and ETFs. The inverse ETFs have done the reverse. SRS dropped over 10% in the last two weeks. That sort of thought process should snap back on investors, and I think we will see a nice sell off today for most stocks.

Technically, SRS is in a great position to benefit and keep moving higher. The stock is oversold on both slow and fast stochastics, so a lot of buyers are on the sideline. The ETF is also near its lower bollinger band, which should signal a pop at some point in the future. There is no reason to think that SRS cannot move 2-3% higher in intraday.

Get in early, though, because I think this one is going to move fast.

Entry: We are looking for an entry of 7.50 – 7.60.

Exit: Looking for 2-3% increase.

Stop Loss: 3% on bottom.

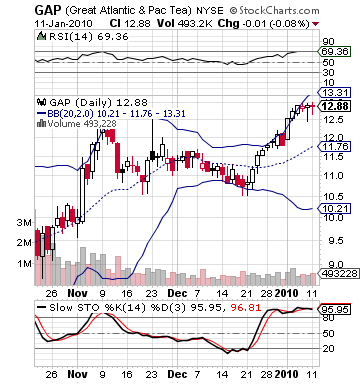

Short Sale of the Day: Great A&P Tea Co. (GAP)

Analysis: When I saw the EPS miss on this one from this morning, I just wrote it down because its one of the biggest misses I have seen in a while. An expected -0.72 vs. the actual -9.42. What?!

The Great A&P Tea Co. reported some pretty awful earnings on Tuesday morning due a huge decline in revenue with nearly 6% loss in sales year over year. I do not know too much about the tea market, but it appears that this past quarter was not the year for tea sales. Either way, we are looking at a solid short sale. Normally, I do not recommend stocks down 14.67% in pre- market, but I think this one is going to continue down a lot further. The market is looking awful, and that miss is such awful. It is a sore that every investor will look and say SELL SELL SELL. A growing short interest will inquire, and we are looking at a stock that has a long recovery ahead of it.

market, but I think this one is going to continue down a lot further. The market is looking awful, and that miss is such awful. It is a sore that every investor will look and say SELL SELL SELL. A growing short interest will inquire, and we are looking at a stock that has a long recovery ahead of it.

The technicals are what makes this trade even sexier. The stock over the past two weeks got pumped for a nearly 20% increase, moving into earnings. Investors were excited. The stock is selling around 11.00 per share in pre-market, and its lower bollinger band goes all the way to 10. We have some definite room to the downside for continued selling.

I expect more declines. Try and get some shorts or put options on this one.

Entry: We are looking for an entry of 10.90 – 11.00

Exit: We are looking for a 2-3% decrease.

Stop Buy: 2-3% increase.

Good Investing,

David Ristau