Hey Oxen Report Readers,

Yesterday turned out to be a fantastic day for us in the markets. We had three solid exits. We started with our Overnight Trade from Monday, which was Infosys Technologies (INFY). We got in before the close on Monday at 54.75 and exited at 57.75. It was a nice 5.50% increase for us. Our trades of the day for yesterday was a buy of Ultrashort Proshares Real Estate ETF (SRS). We got into this one at 7.50 and exited at 7.72 for a nice 3% gain. For our Short Sale of the Day, we bought shares of Great A&P Tea Co. (GAP). The company reported devestating earnings and dropped over 15% in one day. We got in in the morning at 10.75 and exited at 10.43 for a 3% gain. Good day. 3 out of 3!

I hope we can continue that trend today. Let’s take a look at the market.

Buy Pick of the Day: Direxion Daily Energy Bull/Bear ETF (ERX/ERY)

Analysis: Today is a tough day to read in the markets. The market has not really moved significantly in either direction right now since the start of the year as investors wait for signals from the earnings reports. On days like these, when we still want to make a trade, we can look towards more "sure things" (even though there is no such thing). Today, we can look towards the only big news of the morning, which is the crude oil inventories that will be released at 10:30 AM. This report will give us a good reading on the direction of the oil market for the next few days.

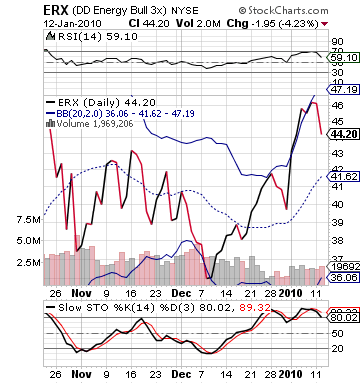

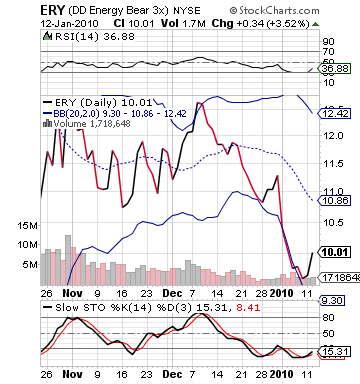

Right now, oil is probably a bit high and the oil ETFs reflect that, but we have seen the price come down this week, which has created this investment opportunity. We are going with the Direxion ETFs because they are very volatile and will have a lot of movement after the report is released. We saw a rise in crude inventories last week of 1.3 million barrels, which has helped bring the price back down. Another rise could send oil prices spiraling back towards $70 per barrel.

If we see a rise above 1.3 million barrels than we are definitely going to want to set up our investment in ERY because oil prices should decline and ERY should rise. If we are under 1 million barrels than we want ERX. This trade also is solid because the day has not had much movement or direction as of yet. Both ETFs are up and down 0.5%, respectively, which is very little movement for these trades. When the report comes out, it could have a strong affect on the rest of the market if significant enough in a rise or fall.

The technicals are also important to allowing this trade to be successful. Since the oil prices have dropped slightly, ERX has moved down in between its bollinger bands and ERY has moved up. Both are in a position for large swings still and are neither overbought or oversold so greatly that they cannot have significant movements.

You want to have your investment ready to go right at 10:30 AM, so set it up prior to the trade for both and buy right at the release. The breaking news will be on CNBC, cnbc.com, or marketwatch.com.

Entry: ERX/ERY at 10:30 AM – the key is the 1.3 million barrels.

Entry: ERX/ERY at 10:30 AM – the key is the 1.3 million barrels.

Exit: 2-3% increase.

Stop Loss: 3% on bottom.

Short Sale of the Day: Symantec Corporation (SYMC)

Analysis: I do not think the market has a lot to run with for today. We still have the bad taste of Alcoa lingering in our mouths as the big Q4 earnings so far. Asia was hit hard and dropped like a rock overseas, and Europe is coming down from gains it had made. There are no economic reports to steer the market, and no big names have done too much. It is a Beige Book day, but i always think those are overrated anyways. It is just sort of a bland marketplace. Futures are reflecting that with a very neutral reading as of 9:00 AM. If anything, I think we are probably going to come down some more because there is just little buying interest.

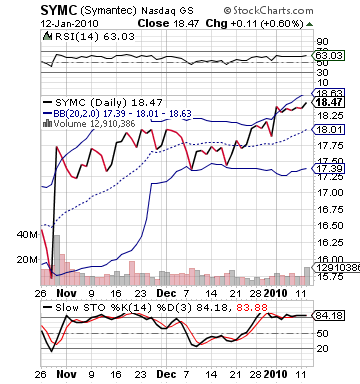

With that said, I look at Symantec as a great short sale due to its large gains in pre-market for a low beta stock. Symantec got an upgrade from Wells Fargo this morning. This upgrade comes after news that SYMC will be buying up GIdeon Technologies. SYMC is an IT service company, and the stock has had a long hot streak. Over the past month, the stock has risen close to 7% for a stock with an under 1 beta. The stock this morning is up over 2.5%, which is a ton for this company. I think it might be too much.

With the kind of run this company has had and the larger gain this morning, a perfect short selling opportunity has definitely presented itself for SYMC. The stock was right on its upper bollinger band going into the day at 18.50. The stock has jumped to almost 19 this morning, which is well outside of its upper band. This is a red alarm for shorters as a chance to overpower the stock with short interest and put on a squeeze of the sellers. I don’t expect SYMC to make great movements in either direction, but I think we can hope for a 2% gain for this overbought, overvalued techie.

presented itself for SYMC. The stock was right on its upper bollinger band going into the day at 18.50. The stock has jumped to almost 19 this morning, which is well outside of its upper band. This is a red alarm for shorters as a chance to overpower the stock with short interest and put on a squeeze of the sellers. I don’t expect SYMC to make great movements in either direction, but I think we can hope for a 2% gain for this overbought, overvalued techie.

Get in early. If the market starts to move down, this one will come with it.

Entry: We are looking for 18.90 – 19.00.

Exit: 2-3% decrease for cover.

Stop Buy: 2-3% increase.

Good Investing,

David Ristau