Hello Oxen Report Readers,

Hello Oxen Report Readers,

Since I have had some success with the Overnight Trade of the Day and have gotten requests for more of them, I thought today we would try out another one. Yesterday was a so-so day for us. Our Buy Pick of the Day, ERY, did not work out well for us, dropping 3% and getting stopped out. The Short Sale of the Day, however, Symantec, was worth a solid 3%.

Let’s get into the Overnight Trade, though.

Overnight Trade of the Day: Citigroup Inc. (C)

I am excited about Friday’s prospects because we start the financial earnings with JPMorgan Chase (JPM). Over the past four quarters, JPM has been a solid earnings reporter that has nearly always given financials a big boost going into the earnings’ weeks. The company consistently beat estimates, and I expect more of the same from them tomorrow. The consensus estimate for the company is that they will have an EPS of 0.62, which is a large increase from the 0.07 from one year ago. Yet, the Q4 estimate is 0.20 below what was reported in Q3.

Most analysts are expecting a tamer Q4 than Q3, which would explain the decline. It is mostly due to the fact that the market was not as volatile and large gains were not able to made. Some people believe trading was down in Q4, yet it could be replaced with more credit card usage and credit card charges. JPM is the first to go, and its earnings will definitely have a huge shock to the market. If they are good, it will bring up all the financials across the board. If they are bad, though, we are going to see large declines.

I am going to go with that they will be good. JPM has been a market leader throughout the financial crisis. In Q4 2008, they were one of the only big banks to report profits. 12 out of 15 analysts covering JPM have the stock rated as a buy. I am behind this company. They have steered through this crisis, and they just have "it."

If the earnings are good, as I am gambling on they will be, it will give all the financials a super boost. One of those companies that could really get the boost is Citigroup (C). At under $4 per share, it also is a super value investment. The stock, when it gets going, is one of the most volatile financials that we can associate with the big banks. Its beta sits at 2.73. I love that number. An earnings beat by JPM will give C a big boost.

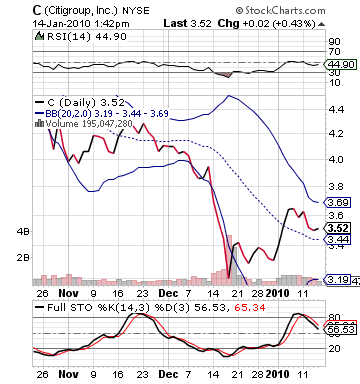

C could use that boost, as well. The stock has been on a slow decline over the past three months, losing over 26% of its value in that time frame. The stock has dropped close to 8% in the past week, as well. The stock has been sold off over this week, and it has buyers on the sidelines. A JPM beat would mean a huge boost for this stock.

C could use that boost, as well. The stock has been on a slow decline over the past three months, losing over 26% of its value in that time frame. The stock has dropped close to 8% in the past week, as well. The stock has been sold off over this week, and it has buyers on the sidelines. A JPM beat would mean a huge boost for this stock.

The stock is pretty neutral today, and we can get it at a great price today.

This one is definitely more risky than some in the past, but throughout December we have only seen money center banks getting tons of upgrades across the board. Additionally, the big banks in Canada – Royal Bank of Canada Toronto Dominion – have seen beats on estimates. While they are definitely apples and oranges, it is better than if they were seeing large losses. Investors are worried and not getting in. Tomorrow, if JPM does beat, there will be a flood of investors coming into these financials.

We want to beat them to it.

Good Investing,

David Ristau