"If you wanted (as Paul Krugman and some of the questioners at the FCIC hearings did) to know just why things went awry, you’re wasting your time, says the Epicurean Dealmaker: Top bankers are "smart, scary smart," but they have little interest in why things are – and rather plenty of interest in how they can take advantage of the way things are." Phil

See also Trust No Bankers.

A study of recent—and not so recent—financial reform and regulation yields two rules. Rule No. 1: The banks have no idea what kind of regulation is good for them. Rule No. 2: If you ever think the banks have a point, remember Rule No. 1…

Tom Lindmark summarizes:

So there you have it from one of their own. They just didn’t have time to think about how paying exorbitant amounts of money to themselves that they earned from a game the government rigged for them, after the government bailed them out would play out. They weren’t stupid or foolish, just preoccupied with making money. As TED says, that is what they’re all about.

And here is TED’s full inside story:

I’m Dancing as Fast as I Can

Courtesy of The Epicurean Dealmaker

"Aesthetics is for artists what ornithology is for birds."

— Barnett Newman

Good morning, class.

Our quote for the day comes from Barnett Newman, painter, artist, and member of the loosely affiliated post-war group of US artists known as the Abstract Expressionists. Mr. Newman was widely regarded by many—none more so than himself—to be one of the smartest and most intellectual of this group, which contained other, less articulate1 but arguably more talented artists such as Willem de Kooning, Jackson Pollock, and Mark Rothko. Mr. Newman is credited with unleashing this bon mot upon an unexpecting world in the course of discussing art critics, art criticism, and aesthetics—the philosophy of art and beauty.

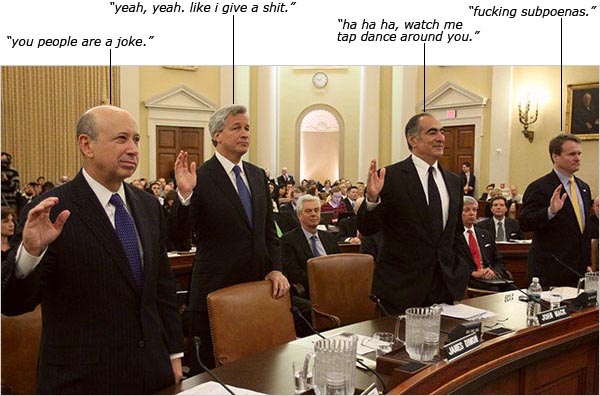

I recalled this quote to mind today when I read Paul Krugman’s latest broadside against all things—and people—financial in The New York Times. In his jeremiad, "Bankers Without a Clue," Mr. Krugman picks apart the recent testimony by four Wall Street CEOs at the Financial Crisis Inquiry Commission and asks the rhetorical question

Do the bankers really not understand what happened, or are they just talking their self-interest?

He concludes that it does not matter, and answers his own question thusly:

Wall Street executives will tell you that the financial-reform bill the House passed last month would cripple the economy with overregulation (it’s actually quite mild). They’ll insist that the tax on bank debt just proposed by the Obama administration is a crude concession to foolish populism. They’ll warn that action to tax or otherwise rein in financial-industry compensation is destructive and unjustified.

But what do they know? The answer, as far as I can tell, is: not much.

By happy coincidence, I enjoyed a quiet morning in the office this past Wednesday free of client obligations. I took advantage of my liberty to view a good chunk of the televised testimony of Messrs. Blankfein, Dimon, Mack, and What’s-his-name on C-SPAN. I have to admit that I too was underwhelmed by the bankers’ grasp of and ability to explain the recent crisis. At one point, for example, Commissioner Johnson asked Jamie Dimon why the financial industry had attracted so many bright and talented individuals away from other, presumably more productive pursuits. The lackadaisical and uninformative reply Mr. Dimon returned revealed in stark detail a critical fact: he neither knew nor cared to know the answer.

And this example cuts to the heart of the matter: it’s not his job to know such things.

Let there be no mistake: Mr. Dimon, Mr. Mack, and Mr. Blankfein are not stupid or uninformed. (The jury is still out on What’s-his-name.) They are damn smart; scary smart, in fact. You don’t get to the top of the greasy ladder of a major global investment bank’s executive suite by being dull, incurious, or lethargic. People like that get sliced to ribbons and thrown into the chum bucket in my industry before they reach Managing Director, if they ever get inside in the first place. These guys got game, people. Serious game. You would be foolish to doubt it.

But they also have absolutely no interest whatsoever in the whys and wherefores of the financial crisis, the proper size and role of banks and investment banks in the domestic economy, or the moral imperatives inherent in stewarding the financial plumbing undergirding the daily lives and livelihoods of six billion people. For one thing, they don’t have time to worry about such things. Most of a senior bank executive’s time is consumed competing against other scary-smart investment bankers and executives at other firms, who are hell-bent on grinding his bones into dust beneath their bloody heels, while trying to prevent his own firm from flying apart under the internal stresses generated by thousands of egotistical prima donnas all scrapping for more than their fair share of the pie. There is too much going on, and unrelenting change comes too fast and furious to allow quiet contemplation of the order of things.

Most thoughtful people would agree: it’s not wise to try to classify boreal flora and fauna when you have a tiger by the tail, much less think about how you would like to turn the forest into a time share resort.

For another thing—and because the volatile, high velocity nature of the business attracts such people—the people who go into the industry are not really interested in thinking deeply about why things are the way they are. You will almost never find an investment banker "sicklied o’er with the pale cast of thought." It’s just not in their genetic makeup to be reflective, introspective, or speculative in an intellectual sense. Investment bankers have almost no interest in why things are the way they are. Rather, they spend all their considerable intellectual and psychological resources on understanding how they can take advantage of the way things are.

It is useful in this context to dust off the hoary distinction between "men of thought" and "men of action." Men of thought like Mr. Krugman analyze, dissect, and theorize about such conundra as the causes of the financial crisis and the proper size of banks in the economy. Investment bankers take such things as given, and then try to make the most of them. Investment bankers are men of action.

This explains not only their obvious lack of intellectual curiosity about the sources of the crisis—nothing remotely unconventional or even interesting on that topic left the mouths of any of the CEOs present at the hearing—but also their resistance to any major change in the way the industry or the markets are regulated. Why should they support change? It’s hard enough just trying to keep ahead of the buzz saw of unbridled competition and unrelenting demands for profitability from lenders, shareholders, and employees without having to cope with changes in the rules as well. Of course they want to preserve their current profitability and size. Who wouldn’t? But they do not assume—and neither, Dear Reader, should we—that changing regulations will necessarily make the industry less profitable. Investment bankers have well-justified confidence in their ability to turn new regulations to their advantage. It’s just that, being in an industry that is constantly creating, reinventing, and destroying itself, investment bankers have a very healthy respect for change. You might even say we fear it.

So yes, Mr. Krugman, you are basically right. Don’t look to investment bankers for answers on how we got here. We don’t know and we don’t care. We take the world as we find it and try to make money.

People still make fun of Chuck Prince’s 2007 pre-crisis assertion that “As long as the music is playing, you’ve got to get up and dance.” Chuck Prince was a boob, and in way over his head, but he was not wrong. Had he even contemplated bowing out of the dance, shareholders, employees, and yes, probably even regulators would have strung him up with piano wire so fast even Mr. Krugman’s head would have spun. Investment bankers’ job is to surf the wave of financial and economic activity and make money from it, not convene a committee to discuss the design of dikes and levees.

That is the job of regulators, politicians, and public intellectuals like you, Mr. Krugman. So get crackin’.

We’ll be over here in the corner, making money, until you get back to us.

1 Or, perhaps, less loquacious or less solicitous of public attention. Surely you are not under the impression that brain power can be measured solely—or even primarily—by public output, are you? If you are, I have a bridge and a few dozen blog pundits I would like to sell you.

© 2009 The Epicurean Dealmaker. All rights reserved.

*****

Photo art: via Barry Ritholtz.