CNN Money On Small Business Lending

Courtesy of Mish

Here are a pair of interesting article on CNN Money about Small Business lending.

January 4, 2010: Small business lending begins to rebound

The Small Business Administration’s flagship lending program backed 37% more loans in its latest quarter than it did a year ago, at the height of the financial crisis.

SBA loans represent a tiny portion of the overall small business lending landscape, but they’re an important barometer of banks’ willingness to extend credit to startups and growing companies.

January 18, 2010: Banks pull another $1 billion from small business lending.

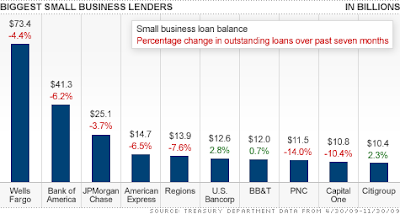

The nation’s biggest banks cut their collective small business lending balance by another $1 billion in November, according to a Treasury report released late Friday. The drop marked the seventh straight month of declines.

The 22 banks that got the most help from the Treasury’s bailout programs have cut their small business loan balances $12.5 billion since April, when the Treasury began requiring them to file monthly reports on the tally.

10 of the 22 banks have cut their small business balances every single month since April. That list includes firms such as JPMorgan (JPM) that are now posting monster profits.

Small Business Lending Spin

Clearly one can take the same data and spin it in all sorts of fashion.

The truth of the matter is poor lending decisions is what got banks into trouble and for the first time in a decade banks are arguably lending responsibly. The last thing taxpayers need is for banks to start lending recklessly, get into trouble, and need another bailout.

Many banks are getting hammered with enormous credit card losses, and more foreclosures and commercial real estate writeoffs are coming down the pike and they have made no allowances to cover the losses.

Assets at Banks whose ALLL exceeds their Nonperforming Loans

The above chart courtesy of the St. Louis Fed.

Because allowances for loan losses are a direct hit to earnings, and because allowances are at ridiculously low levels, bank earnings (and capitalization ratios) are wildly over-stated.

Moreover, with unemployment at 10% and consumers cautious, banks have every reason not to lend and businesses have every reason not to borrow.

Please consider the latest Fed Senior Loan Survey.

Demand for C&I loans from small firms

The chart clearly shows a drop in small business loan demand. Of the demand present, how much is credit worthy?

FDIC Allows Banks To Hide Insufficient Capital

Dateline December 15, 2009: FDIC Approves Giving Banks Reprieve From Capital Requirements

The Federal Deposit Insurance Corp. gave banks including Citigroup Inc., Bank of America Corp. and JPMorgan Chase & Co. a reprieve of at least six months from raising capital to support billions of dollars of securities the firms will be adding to their balance sheets.

Bank regulators including the FDIC and Federal Reserve want to permit a phase-in of capital requirements that rise starting next month under a change approved by the Financial Accounting Standards Board. The rule, passed in May, eliminates some off- balance-sheet trusts, forcing banks to put billions of dollars of assets and liabilities on their books.

Executives from Citigroup, JPMorgan, Bank of America, Wells Fargo & Co., Capital One Financial Corp. and the American Securitization Forum met FDIC officials Dec. 2 to discuss capital requirements related to the FASB measure.

The executives proposed that “the transition period should extend beyond 2010 to a point in the economy where unemployment is lower and issuers are less capital-restrained from growing their balance sheet and providing credit,” according to a paper the ASF presented the FDIC.

Citigroup suggested three years to offset assets and liabilities brought onto balance sheets, Chief Financial Officer John Gerspach said in an Oct. 15 letter to regulators. Requiring banks to “assume the risk-based capital effects immediately, or even over one year, is an undeniably severe penalty,” he wrote.

Banks in general are sitting on assets, not marked-to-market, both on and off their balance sheets, for which they have made no loan loss provisions, while credit risk for new loans is exceptionally high.

Banks did not "pull" money from small businesses as CNN Money suggests. Businesses and consumers alike are deleveraging (paying down debts) and demand for loans from credit worthy borrowers is dropping. There are plenty of reasons to be upset with banks, but "pulling" money from small businesses isn’t one of them.

Those wanting to rail about something ought to rail about FDIC and Fed decisions that allow banks to use mark-to-fantasy pricing for assets on their balance sheet.

The real story is banks are undercapitalized, with inadequate loan loss provisions, demand for small business loans is down, and there are few credit worthy borrowers in the first place. In short, bank earnings are a mirage, banks have reason not to lend, and CNN Money missed the boat.