"There is no pain you are receding

A distant ship's smoke on the horizon.

You are only coming through in waves.

Your lips move but I can't hear what you're saying.

When I was a child

I caught a fleeting glimpse

Out of the corner of my eye.

I turned to look but it was gone

I cannot put my finger on it now

The child is grown,

The dream is gone.

but I have become comfortably numb." – Pink Floyd

I have a theory that the markets (and the American people in general) aren't irrational, they are simply shell-shocked after suffering a very traumatic group financial experience…

To be shell-shocked is to be "mentally confused, upset, or exhausted as a result of excessive stress" and the most common symptoms are: Fatigue, slower reaction times, indecision, disconnection from one's surroundings, and inability to prioritize – That certainly sounds like our Congress doesn't it? Combat stress disorder was first diagnosed in WWI, when 10% of the troops were killed and 56% wounded – far worse than had been experienced in previous wars. Our current financial crisis has similarly affected more people than any previous crisis with almost everyone knowing someone who is bankrupt or lost their jobs or homes and almost no one escaped the carnage of the downturn without some financial damage.

Combat fatigue may go a long way to explaining the severe drop-off in volume that has plagued the markets since March, with participation now down to 25% of where we were last January and that leaves us open to the blatant sort of market manipulation that Karl Denninger caught last week as well as the usual nonsense we get daily from HFT programs that drive the market with such precision that we are able to tell how the day is going to go by simply checking our hourly volume targets. Here's a clip from CNBC where a floor trader discusses market manipulation as a fact of trading (2 mins in).

Combat fatigue may go a long way to explaining the severe drop-off in volume that has plagued the markets since March, with participation now down to 25% of where we were last January and that leaves us open to the blatant sort of market manipulation that Karl Denninger caught last week as well as the usual nonsense we get daily from HFT programs that drive the market with such precision that we are able to tell how the day is going to go by simply checking our hourly volume targets. Here's a clip from CNBC where a floor trader discusses market manipulation as a fact of trading (2 mins in).

As Nicholas Santiago points out on In The Money Stocks, "January is usually a very high volume month, yet it has started off the New Year even lighter than the last two months of 2009. Light volume markets are very difficult to short. Hence the old saying, 'never short a dull market'." Not only is the market volume light, but over 60% of the trading volume is concentrated on 5 stocks: AIG, C, BAC, FNM and FRE!

We have often noted that high-volume (relatively) days almost always tend to be down days and PSW Members can tell you how the day is going simply by checking the volume against our "norms," which comes in very handy with our day-trading. I had expected more normal volume to return in January and send us into a correction but that hasn't happened yet – even Friday's big drop came on just 20% more than "average" volume for the past 90 days, which is still less than 1/2 of a good day last winter.

As I detailed in the Weekly Wrap-Up, we expected a further sell-off but we weren't brave enough to bet heavily on it over the long weekend as we've now been burned often enough to be conditioned not to go too short into a Monday although my comment to Members at 10:46 on Friday for weekend positioning was:

"A big loss by us today can send Asia into a nice tailspin on Monday AND Tuesday (because we won’t be open to dispute it) and that would lead to a gap down open for us on Tuesday and then the guys who are selling today can buy back the same shares into the retail panic on Tuesday, before resuming business as usual after once again teaching the bears a lesson that they can never win." Because we got such a nice sell-off on Friday, however, we actually flipped bullish on Friday afternoon and then rode a mainly cash position into the weekend uncertainty.

Over in Asia, the Nikkei did indeed spend 2 days selling off, dropping 250 points in two days and falling back to 10,750 on a poor finish this morning. Not so the Hang Seng, that had a phenomenal 300-point rally after lunch today, taking them right back to where they were on Friday's close on no particular news and the Shanghai Composite also finished up 0.3%. but the Bombay Sensex was down 0.8% so mixed to say the least over in Asia.

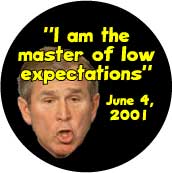

EU markets, like the US futures, have staged a huge comeback off a poor open starting at about 8am EST also on no particular news other than C's earnings not sucking very much. As I said, we have been "comfortably numbed" to weak earnings so a loss of "just" $7.5Bn at C sounds just fine compared to last year's $17.25Bn loss. Even better, if we exclude $6.2Bn in charges relating to repayment of government aid, then we can call ordinary losses at Citi just 6 cents per $3.30 share so yay, I guess… Keeping expectations low is going to be the key to winning this earnings season – we shorted JPM last week because they committed the sin of letting investors get excited about their earnings – this week we hear from 200 reporting companies and it's going to be a wild ride as we gauge investor sentiment by watching the reactions to each announcement.

EU markets, like the US futures, have staged a huge comeback off a poor open starting at about 8am EST also on no particular news other than C's earnings not sucking very much. As I said, we have been "comfortably numbed" to weak earnings so a loss of "just" $7.5Bn at C sounds just fine compared to last year's $17.25Bn loss. Even better, if we exclude $6.2Bn in charges relating to repayment of government aid, then we can call ordinary losses at Citi just 6 cents per $3.30 share so yay, I guess… Keeping expectations low is going to be the key to winning this earnings season – we shorted JPM last week because they committed the sin of letting investors get excited about their earnings – this week we hear from 200 reporting companies and it's going to be a wild ride as we gauge investor sentiment by watching the reactions to each announcement.

Speaking of high expectations – I was discussing in Member Chat this weekend my conversation with a commodities trader that soured me on gold again (working out the fundamental math of the situation) and it looks like Credit Suisse must have taken note of my comments as they issued a report arguing: "against all this peak gold nonsense" with the very dire warning that "Our calculations show a large oversupply of around 420 tonnes in our supply-and-demand equation for 2010. In summary, we believe that the steam has run out of investment demand as the economic environment has and is changing to the positive. Muted investment demand coupled with a change in market sentiment and a projected large oversupply in the supply equation all point to a downward correction in the gold price from the highs reached at the end of 2009."

It's an uninspiring data week so our focus is on earnings. FAST, FHN, IIVI, EDU and AMTD missed this morning with C, FRX, MMR, PH and PETS meeting or beating expectations. Tonight we hear from ADTRN, CREE, CSX, FULT, HBHC, IBM, PNFP, SUPX, WIT and IBM can punch a hole in the Dow if they miss as they have been flying very high in anticipation of more than doubling last year's results as the stock trades near it's all-time highs, even those crazy 1999 levels!

Tuesday's earnings of interest include BAC, EAT, COH, HCBK, MTB, MS, NTRS, PGR, STT, USB and WFC and if the financials don't implode by then, we're in good shape. Tuesday evening we see EBAY, FFIV, KMP, LOGI, OHB, RJF, STX, SLM, SBUX and XLNX. There's plenty of BIG names Thursday and Friday as well but let's see if we survive Tuesday and Wednesday first, before we start worrying about those…

Earnings season is like party time for options traders – even with the low, low VIX, there's still plenty of fun to be had but we'll be taking it easy this week as we try to get a grip on sentiment from reading the early tea leaves. If the volume stays low, it should, as I predicted on Friday, be back to business as usual and business is usually up as long as bad news continues to roll right off the shell-shocked public's back.