Hello Oxen Report Readers,

Hello Oxen Report Readers,

Hope you all have had a nice long weekend. The only open position I have to mention is Citigroup (C). We got into this one Thursday in the low 3.50s and saw it rise to 3.56 yesterday. You may have been able to pull a small 2% gain. If you are still holding, we are looking at most likely a down day for C due to weak bank earnings, but we will have to wait and see.

Buy Pick of the Day: Proshares Ultrashort Financials (SKF)

Analysis: Oil is down. Futures are down. Bad earnings came in from Bank of America and Morgan Stanley. Is there any way the market can rally. I was awaiting the economic reports on housing starts and building permits before saying ABSOLUTELY NOT. The reports have come in better than expected. Building permits were 650,000 for the month of December, while expectations were only at 590,000. PPI was higher than expected, which shows some healthy inflation. Housing starts did come in a bit weaker than expected, but it was not enough to really make much of a difference. I think any boost, though, that these reports can provide will be short lived.

The reason SKF looks so attractive is that yesterday we saw a financial driven rally on good earnings from Citigroup. Today, however, we saw EPS misses from both Bank of America and Morgan Stanley. That has driven down futures this morning to down 45 point on the DOW as of 8:40 AM. SKF, however, has not followed the type of upward trend we would expect from this financial inverse ETF. It is up only 0.70% as of 9:00 AM. That type of movement in pre-market trading is not nearly as large as one would expect from SKF with major financials missing targets.

Morgan Stanley is down just slightly, as is, Bank of America. I cannot see any reason why investors would be excited in any way about the earnings we saw from these two financial institutions. We are seeing continued losses on credit costs from financials that started with JPMorgan and has continued through each reporting bank. Even US Bancorp’s small earnings beat is being overshadowed by credit losses. Yet, the market does not reflect it. So, what are we to do?

Get in before everyone else does. We can get SKF at what I think is a bargain price right now. The stock has dropped just under 8% since the beginning of the year and around 4% in the past week. The ETF is near its lower bollinger band, is oversold, and undervalued. We have bad earnings from financials, futures down, and a market looking RED.

It is time to buy SKF.

Entry: We are looking for an entry of 22.10 – 22.20.

Exit: We are looking for an exit of 2-3% on top.

Stop Loss: 3% on bottom.

Short Sale of the Day: Covidien PLC (COV)

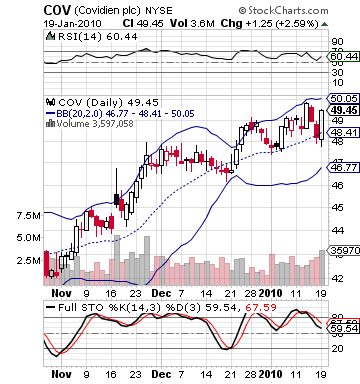

Analysis: On days when I think the market is going to be down, I like to find stocks that are way too high for their own good and should see a snap back to reality during the trading day. Covidien is one of these stocks. COV is healthcare equipment manufacturer. The company reported very good earnings for their latest quarter, beating estimates with an EPS of 0.86 vs. the expected 0.75. The company saw profits rise 7% and saw sales increase 4%. It was an extremely good quarter for the company, and the stock should move up. Yet, it also should not move up more than 5% before  getting some seller interest.

getting some seller interest.

I have entry set on COV for when it gets to that 5-6% range and will be way too overvalued, in the short term, for its own good. COV was up to these levels in early morning trading before falling on its face back down to only about 1% up. The stock is on its way back up to higher levels. I think this will be a perfect range to get involved on a short sale of this stock.

Like any good short sale, the stock has seen some rise, as of late. Over the past month, the stock has risen nearly 8%, which is a lot for a stock with a beta that is low like other healthcare stocks. Yet, any stock that gets ahead of itself is liable to a lot of shorting interest and seller interest. I think this will be the case with COV. On the techinicals, further, COV’s upper band was at just 50. The stock is trading nearly two quarters above that at this point. A definite pullback is in order. We do not want to miss it.

Get in early and enjoy the ride.

Entry: We are looking for an entry of 50.65 – 50.75.

Exit: 2-3% on bottom.

Stop Buy: 3% on top.

Good Investing,

David Ristau