Well I hate to say I told you so but…

No wait, that's nonsense – what market prognosticator doesn't love to say "I told you so"? Actually, it's kind of my job to tell you so and the reason I'm so popular is because, more often than not, when I tell you so, I tend to be right. I'm not right all the time and my single biggest flaw is I am often right but sometimes way too early and timing is EVERYTHING in the markets. It's not good enough to tell you what is going to happen (give things enough time and everything happens eventually, right Cramer?) – I need to get the period right as well so we can turn it into an actionable trading idea that makes money.

As a fundamentalist, I didn't like the entire last 500 points of the rally. I had predicted the market would finish the year at 10,200 way back when it was down at 8,650 when the idea was we'd have a Santa Clause rally to 20% (10,380) and then a 20% pullback of that run (346) into Jan earnings that would take us back to 10,034 so the entire run from 10,200 to 10,700 REALLY annoyed me. It didn't annoy me just because it made me wrong – I'm wrong a lot and I'm old enough to have learned how to deal with it. What annoyed me was the manipulation as, clearly, the fundamentals in no way, shape or form justified the additional 5% move up.

I've gone on and on about how fake the move was and how manipulated the markets were and how artificial the support was and I think I've pulled out the Seinfeld "fake, Fake, FAKE" clip often enough now that I don't even have to do a link (but I love it, so I do) or explain how it's a metaphor for recent market activity so I'm not going to waste our valuable time here. Let's just do a review of the recent action, which is my best way of preparing for the upcoming Members only post where I'll be charting out new levels and coming up with action plans for the week ahead.

So don't read this if you can't stand to hear "I told you so" because this is the review post and I did tell you so!

When did things go wrong? Clearly they were wrong for ages but when did things go wrong enough that they finally affected the market? I'm cranking up the old Way Back Machine all the way to Dec 22nd, where our famous PSW Holiday Shopping Survey showed a less than rosy outlook of Retail Sales and, the next day, I wrote a post called "Which Way Wednesday – For Retail Sales" where I expressed my concern that Retail Sales and Commercial Real Estate were likely to take down the markets. My timing premise was that Retail would disappoint and then, at earnings time, we'd begin to hear about large-scale store closings which would panic people (rightly so) out of CRE, which seemed shaky at best.

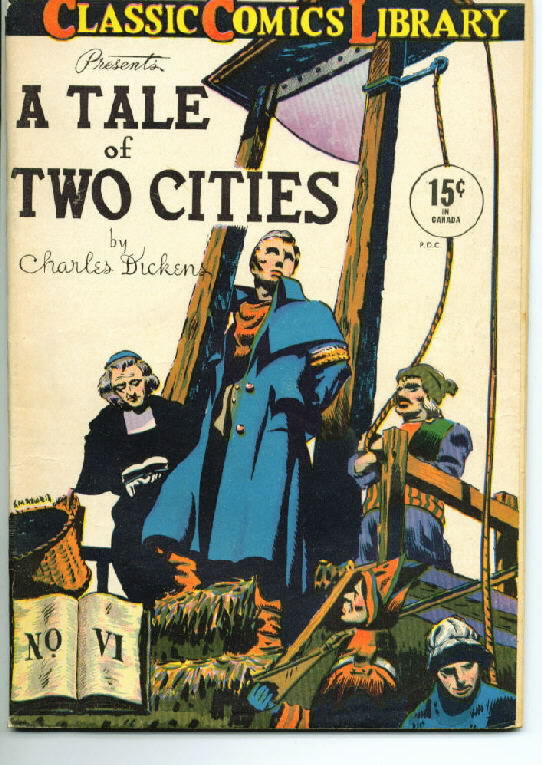

Nonetheless we had our Watch List (now our Buy List) as the markets continued to press higher and my outlook for 2010 was published on Dec 27th in "A Tale of Two Economies" where my premise was that this country was starting to look like pre-revolutionary France where the top 10% (epitomized by Wall Street Bankers and their bonuses) flaunted their wealth in front of a peasant population that pretty much comprised EVERYONE ELSE as the middle class was dying and getting more and more angry about it every day.

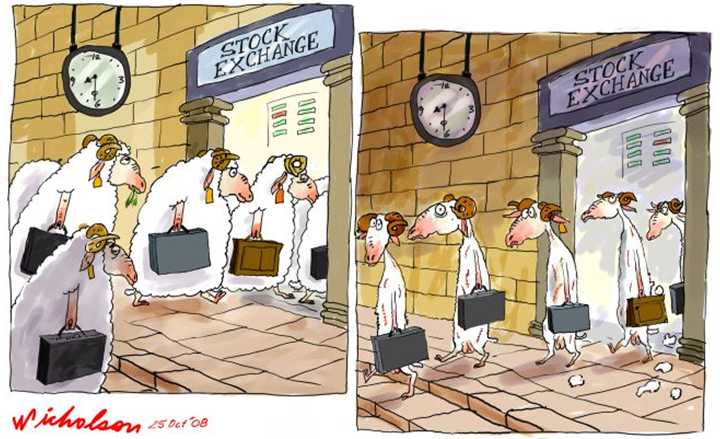

Since we don't know WHEN the revolution will come, my plan was to play the companies that serviced the top 10% of the population, who are flush with cash from the market rally and, most importantly, EMPLOYED and able to buy things like food and fuel – luxuries that are more and more growing out of reach of the average citizen. Of course, there's a reason we call them "the beautiful sheeple" and one of my timing mistakes was underestimating how much crap the American people were willing to take before getting angry.

Since we don't know WHEN the revolution will come, my plan was to play the companies that serviced the top 10% of the population, who are flush with cash from the market rally and, most importantly, EMPLOYED and able to buy things like food and fuel – luxuries that are more and more growing out of reach of the average citizen. Of course, there's a reason we call them "the beautiful sheeple" and one of my timing mistakes was underestimating how much crap the American people were willing to take before getting angry.

Of course, I can be fooled too (you can fool all of the people some of the time) and when MasterCard released a Spending Pulse survey on Dec 28th, my dumbfounded headline was "MasterCard's Monday Madness – Retail Up 3.6%?" As it turned out, that was complete and utter BS and retail was actually up less than 1% from last year's AWFUL numbers but by the time we got the real numbers, the damage had already been done and we broke up all the way to 10,600 by the next morning. I said that Monday:

I’ve been playing for a big, sharp sell-off that just doesn’t look like it’s going to happen now as it was going to be retail that I expected to take us down, with imminent store closings finally deflating the REIT sector. Now what? I have some serious rethinking to do and it looks like we are going to track more in-line with the bullish side of the economy (the success of the top 10%) and ignoring the suffering of the masses for as long as we can get away with it.

We still have our concerns and we’ll wait for a bit more data but we’re not going to fight the tape and we will remain mainly in cash until next week, where we can see how much of this year-end rally we can hang onto but this morning we have upgrades on AAPL and AMZN, which should help the Nasdaq to keep leading us higher and oil is up to $79 thanks to some weekend terrorism (also helping gold stay over $1,100) so it’s business as usual this week and business is usually good in thinly traded markets!

One of my HUGE concerns was the growing tanker glut where reports were that as much as 25% of the fleet was idle and that didn't even include the 168 tankers that were storing over 300M barrels of oil offshore and we were incredulous as oil creeped back over $80 per barrel when 25 days worth of US imports were floating in the ocean in addition to our record inventory levels. This was coupled with a dollar that had risen from 74.23 on Thanksgiving to 78 on Christmas Eve (up at our 5% rule) and, at 10:03 in Member Chat that day, my comment was: "Why is V still falling??? MA too – something is fishy with those retail reports…"

My trade idea off those observations was the SMN July $6/8 bull call spread at $1.10, selling the Jan $6 puts for .70, giving us a net .40 entry on the $2 spread to cover what I considered a strong possibility of Basic Materials selling off during the quarter. On that day, the Jan $6 puts were .40 and our TARGET sell was .70 so we planned on it going down first, then up and that's EXACTLY what happened. These hedged plays are a great way to take advantage of this kind of irrational market movement and going long on the spread leg gives us plenty of time to be (eventually) right. The sold puts expired worthless last week and that July spread is already at $1.30 (up 225%) and $1.89 in the money so right on track for the full 400% gain but we're so far ahead now, we set a stop at 200% (25% trailing stop).

In Dec 29th's "Top Testing Tuesday" I was livid about the pre-market manipulation and maybe it's just me but I get a kick out of reading my old posts and watching my disgust build day by day as the shenanigans went on. My statement as to whether or not the rally had enough fuel to sustain the move was:

I don’t think that matters as GS and the Fed manufactured far more than that this year between discount window borrowing and high-frequency trading – they’ve built this house of straw up in record time – let’s just hope there aren’t any big, bad wolves out there looking to knock it down… I doubt anyone will care – or at least not anyone who has any control of the markets as "THEY" are determined to finish this year off with a bang and we are just lucky to be able to sit back and watch.

We peaked out Tuesday morning and we had fun with some short plays. On Wednesday, the 30th, I wrote a special post called "2010 – Time to Arrest the Oil Extortionists?" as oil went back over $80 on what I considered blatant, flagrant manipulation as I asked about the coverage by Criminal Narrators Boosting Crude:

We peaked out Tuesday morning and we had fun with some short plays. On Wednesday, the 30th, I wrote a special post called "2010 – Time to Arrest the Oil Extortionists?" as oil went back over $80 on what I considered blatant, flagrant manipulation as I asked about the coverage by Criminal Narrators Boosting Crude:

Is it FRAUD or merely CRIMINAL NEGLIGENCE that they failed to mention that petroleum imports for the week were off 11,291,000 barrels from the week of 12/18/08? Not only was there an 11.3Mb decline in imports but there was also a 4.5% drop in refining output – meaning (at 19Mb/day) that the refiners supplied 6Mb LESS product per week than the year before. So we have an 11.3Mb decline in imports that leads to a 4.8Mb drawdown in our crude inventory for the week (net 6.5Mb LESS demand) and we have a 6Mb decline in production that leads to a 3.9Mb drawdown in refined products (net 2.1Mb less) AND THEY CALL THAT AN INCREASE IN DEMAND???

I think I mentioned we were shorting SMN as it wasn't just oil but copper, gold, coal, silver… all were making ridiculous runs with no evidence of demand whatsoever. My logic for these things is a commodity bubble also bubbles up the commodity sector and if XLE and OIH and the Ags make up 20% of the S&P 500 and OIH (for example) goes from $110 in December to $130 in January (up 20%) on what are essentially false pretenses, then can't we simply infer that 4% of the S&Ps gains over that time period are BS and can easily be reversed? That's all it takes to apply my fundamental outlooks to my chart projections – we just try to separate what is from what should never be as we wait for it to show (please excuse the rambling and obscure Zeppelin reference but I do like to amuse myself on weekends).

Wednesday we got bad news about a debt crisis in the EU but our own government stepped in to prop up the markets by promising $4Tn in future bailouts under the 1,279-page “Wall Street Reform and Consumer Protection Act” that clearly protects only one thing – Wall Street… I think if I had to pick the spot that I got well and truly disgusted with Wall Street and our government, this was the day! We also had market boosting news from China with claims that banks there were lending at a new record pace, a pace I said was ridiculous and unsustainable and my closing comment was:

Wednesday we got bad news about a debt crisis in the EU but our own government stepped in to prop up the markets by promising $4Tn in future bailouts under the 1,279-page “Wall Street Reform and Consumer Protection Act” that clearly protects only one thing – Wall Street… I think if I had to pick the spot that I got well and truly disgusted with Wall Street and our government, this was the day! We also had market boosting news from China with claims that banks there were lending at a new record pace, a pace I said was ridiculous and unsustainable and my closing comment was:

Don’t be fooled though, the MSCI World Material Index is now at 234 which, according to Bloomeberg, is 81 times earnings for that sector. This is why we like SMN as a short play as well as EDZ – just in case people aren’t willing to pay 100x for commodities in 2010… Europe has pulled back a bit this morning as have the US futures. We’ll see if we can hold our levels this morning after yesterday’s exciting finish.

We had not been making many plays that week as I had called for cash into New Year's but my first trade of that morning was selling SCO (ultra-short crude) Feb $13 puts for .90 (now .15) and I pointed out to members: "Bearish sentiment is at the lowest levels since April 1987. Please look up April 1987 on the charts."

Notice the nice 10% correction off the 25% run right at the peak of bullish sentiment. On Dec 30th, we were almost 25% off our July lows and continuing higher without a pullback just did not seem likely to continue. That night I posted "The Last Charts of the Decade!" and we used Fibonacci series coupled with our normal 5% rule calculations to determine that our technical tops should be Dow 10,549, S&P 1,135, Nasdaq 2,314, NYSE 7,389, and Russell 638. My conclusion was:

Lack of volume remains my main concern as it’s very possible that every single point gained in the past 2 weeks was total BS but we’ll find out soon enough next week when some real volume should return and, since all volume has been down volume since September – I’m maintaining a bearish stance until then.

Notice I said that every point gained off of 10,200 may have been total BS and look how fast we dropped right back to it this week! As I said, timing is everything, I had the motion right but I was a little early expecting the move back down. We had a half day on the 31st and my post that morning, for those who didn't cash out into the long weekend was "How to Have a Happy and Safe New Year with Hedges." The hedges were, of course, brilliant and all are doing their job but more important is the point I made about ignoring the media hype machine when making investment decisions:

I myself have gone from being the lone market optimist back in March (see our Crisis, Year One Review) to being one of the 11% of the remaining pessimists as the market takes back over 50% of it’s losses (I am arguing that it’s less than 50% in my Last Charts of the Decade). Whether we are, as I think, at the apex of a very normal Fibonacci retracement or whether we are at the mid stage of a full recovery back to our 2007 glory remains to be seen but for now, I can re-use the same statement I made to Members when I argued the media was too bearish in March (click on image for great video):

"Television is a powerful and emotional medium, it is very difficult to go against the will of ALL these "experts" when they get on TV and all tell you to sell (or buy) and then their TV station backs them up with bearish news and bearish guests – it’s a natural bias that develops, they aren’t going to make their own paid personalities look foolish by contradicting them with facts and dissenting opinions."

Substitute bullish for bearish and we have my quote of the day for December 31st, 2009. If you do nothing else today in the markets, at least consider the idea of establishing some hedges – just in case we open the new year on a down note.

I advocated a small initial disaster hedges of 5-10% of the virtual portfolio going into the new year with the intention of doubling down if things kept going higher, giving us good long-term buffers. As I pointed out in that post "that is the cost of insurance" against our bullish positions.

As we are doing today, I began Jan 1st with a "PSW Rewind of 2009" so we could look back before trying to look ahead, followed on Monday, the 4th by "My 2010 Technical Outlook," where we discussed the 10 lessons not learned and, after many chart reviews, I concluded that the low volume manipulation made the movement uncertain but that I strongly felt that the commodity led rally bubble would pop in the near future. My fundamental analysis coming into earnings was not too bright as I said:

As you can see from the chart on the left, our little spike in the Nasdaq this past month has put the capitalization to GDP ratio of the NYSE and Nasdaq back over 100% – well above historical highs. As a fundamental investor, this just rubs me the wrong way and I have very serious concerns that the earnings numbers we see this month will not be able to support what is already becoming bubble-like market behavior as expectations have far outpaced the actual improvements in corporate earnings.

I added TRANQ 2,000 (Nasdaq Transport Index) to our critical watch list and that index saved us from making the mistake of falling for what otherwise was looking like a big breakout in early January. My outlook conclusion for January in that post was pretty accurate as I said: "Strap in – it’s going to be a wild ride – THAT I can predict!" I won't go into too much detail about the next two weeks as Monday we topped out at 10,650 and that was followed by 2 full weeks of even more blatant market manipulation where the sheeple were fleeced daily and sometimes twice daily in what I call a Bugs Bunny market after the time where he throws an intemission switch and stampedes people mindlessly in and out of a theater (5:10 on the video).

If you thought I was disgusted Christmas week, you should read Jan 6th's "Fake Rally Follies!" where I compared the blatant chart painting to pornography, citing Supreme Court Justice (back when we had a real court) Potter Stewart's famous statement that he wasn't going to attempt to define obscenity "but I know it when I see it." David Fry agreed with me as he too "saw it" in the charts but that did not stop the markets from tacking on 2 more weeks of gains – "all" the way to 10,725 on the Dow and 1,150 on the S&P.

In my weekend post of Jan 10th, I re-emphasized the need for disaster hedges with SMN Apr $9s down to .45 (now $1, up 122%) and DXD Apr $26/33 bull call spread at $2.20 (now $3.50, up 60%), FAZ July $20/35 bull call spread at $1.60 (now $2.70, up 68%), FAZ July $15 puts sold naked for $2.45 (now $1.85, up 25%) and SDS March $34/44 bull call spread at $1.40, now $2.60 (up 85%). Of course, for example, $2.60 is NOTHING on the SDS March spread as the potential upside is $8.60 and that's the point of disaster hedges – So far, we have a little 5% correction in the market and if, for example, you had just 10% of your virtual portfolio in these hedges that gained 122%, 60%, 68%, 25% and 85%, you would very likely have offset the entire 5% loss on the other 90% of your virtual portfolio and those gains ACCELERATE as we go down further with the DXDs having 200% more to go to a full payoff (and DXD is just under $31) and FAZ paying a whopping $15 on $1.60 if the financials crash betwen now and July etc.

If you are not using these plays, I urge you to go back to the original posts and at least experiment with this strategy over time, it's worth establishing a paper trading account to get comfortable with these hedges. As I reminded Members that Sunday: "Remember, your hedges are supposed to lose money if the bulk of your virtual portfolio is flying" – this is something I found that some people lost sight of as the markets went higher and higher – giving up on the hedges rather than scaling in along the way or at least rolling the ones they had to follow the market…

On Monday, Jan 11th, the futures were up 100 points (as usual) and my post was titled "Monday Market Momentum – Can We Keep It Up?" I ripped apart the bullish premise for moving the markets higher, especially the skyrocketing commodities (yes, I was 2 weeks early with my original call). I put my foot down at $84 oil as a weekend Rent-A-Rebel attack was the only reason oil was moving up and, to me, that just smacked of being an act of desperation on the part of the oil pushers, who were getting worried about the upcoming February contract expiration and needed a spike to unload into.

On Monday, Jan 11th, the futures were up 100 points (as usual) and my post was titled "Monday Market Momentum – Can We Keep It Up?" I ripped apart the bullish premise for moving the markets higher, especially the skyrocketing commodities (yes, I was 2 weeks early with my original call). I put my foot down at $84 oil as a weekend Rent-A-Rebel attack was the only reason oil was moving up and, to me, that just smacked of being an act of desperation on the part of the oil pushers, who were getting worried about the upcoming February contract expiration and needed a spike to unload into.

There were lots and lots of fundamental things going wrong that day including AIG removing 45 geographic housing areas from it's riskies underwriting category (a big mistake reflected in AIG's drop), banks were boosting their lending to hedge funds to record levels, BCS won the first ever Dubai foreclosure case and China approved both short selling and margin trading (but only for rich people who qualified) on the same day that Fitch warned that "Chinese banks are creating "a growing pool of hidden credit risk" through financial moves that shift loans off balance sheets." I hated to be a stick in the mud but these things did bother me and I urged extreme caution until we got past the post MLK-day earnings week – silly me!

AA disappointed us on Tuesday and I warned that the Beige Book was likely to remind us of a darker brown color on Wednesday. I was thrilled to discover that hedge funds (the ones we had noted were given record funds from the banks on Monday) had made record bets on higher crude and fuel prices with the CTFC telling us that "the total net number of long positions held by so-called large speculators in NY crude, heating oil and gasoline futures is at an all-time high." I, of course, reiterated my short position on USO and OIH (and our short sale of the XOM $70s was also a home run but not, obviously, the Leap at this moment). Monetary policy was tightening in China and I predicted doom for FXI (it's down 10% since that day so far) and I reminded readers that I liked FXP long (it's up 20%) as a way to play it. We had a great time day trading the markets and I detailed that in a very educational post HERE.

Wednesday, the 13th, was "Beige Book Boogie" day but I predicted (after Tuesday's crazy action) that we were once again in a "Meatballs Market" where bad news JUST DOESN'T MATTER and, indeed, despite what I thought was a TERRIBLE Beige Book – the market just kept going up. Thursday we got another boost from one of the Gang of 12 as DB said "Ignore the Unemployed Men Behind the Curtain" and forecast the US economy would grow 6% in 2010. I pointed out how insane that was and ran the numbers but there must be people who don't read my column as the market did fly up to 15-month highs that day, causing me to call for a cash out on our bullish positions (unhedged ones).

Wednesday, the 13th, was "Beige Book Boogie" day but I predicted (after Tuesday's crazy action) that we were once again in a "Meatballs Market" where bad news JUST DOESN'T MATTER and, indeed, despite what I thought was a TERRIBLE Beige Book – the market just kept going up. Thursday we got another boost from one of the Gang of 12 as DB said "Ignore the Unemployed Men Behind the Curtain" and forecast the US economy would grow 6% in 2010. I pointed out how insane that was and ran the numbers but there must be people who don't read my column as the market did fly up to 15-month highs that day, causing me to call for a cash out on our bullish positions (unhedged ones).

My premise that stealing from the poor through commodity inflation to give to the rich through speculative gains was not a firm basis for declaring economic victory, something I had already covered a long time ago when I was popping the last rally bubble in the "Dooh Nibor Economy" I warned that we were partying like it was 1999, adding "or 1929" – complete with this video to hammer the point home. But, like I said, it seems that not everyone pays attention. In addition to my commentary and the video, my 9:44 Alert to Members contained the following warning: "Be very careful today, I still feel like this whole thing can snap on one bad news story." The next morning, I was right already but nowhere near as right as I was the following week!

I predicted a "Freaky Friday" on options expiration day and we were not disappointed as the Dow dove almost 200 points intra-day but we were smart enough (burned enough times) not to go too short into the weekend. In the morning post I was really getting fed up with the public apathy to the ongoing swindle on Wall Street (especially as Karl Denninger pointed out ridiculous manipulation in the S&P futures) and maybe I woke someone up because things finally started changing this week as the Administration struck back with Obama leading a populist revolt against the hand that usually feeds him. I won't rehash it here but it was quite a manifesto I wrote in that post.

We were thrilled with the sell-off as we had cashed out our bullish plays at 10,700 and the nice drop on Friday felt like we were finally making some bearish progress. My 1:35 chat comment to Members set the stage for this week as I said that day: "So funny, a whole week of gains I thought were ridiculous wiped out in 4 hours." It was even "funnier" this week as 4 days of trading wiped out 2 months of gains. In my "Wild Weekly Wrap-Up" I detailed all 68 trade ideas for the week (only 12 losers) and we carried some of our focus index shorts through to this week and it's interesting to see how some did now that we've run 7 more days (not including complex spreads):

We were thrilled with the sell-off as we had cashed out our bullish plays at 10,700 and the nice drop on Friday felt like we were finally making some bearish progress. My 1:35 chat comment to Members set the stage for this week as I said that day: "So funny, a whole week of gains I thought were ridiculous wiped out in 4 hours." It was even "funnier" this week as 4 days of trading wiped out 2 months of gains. In my "Wild Weekly Wrap-Up" I detailed all 68 trade ideas for the week (only 12 losers) and we carried some of our focus index shorts through to this week and it's interesting to see how some did now that we've run 7 more days (not including complex spreads):

- EDZ Apr $4 puts sold for .50, now .30 – up 40%

- VNO Feb $65 puts at $1.25, now $2.85 – up 128%

- FAS Feb $98 calls sold for $2, now .35 – up 82%

- TBT Feb $48 puts sold for $1.10, now $1.55 – down 40%

- RTH Feb $90 puts at .80, now $1.35 – up 68%

- IYR March $46 puts at $2.20, now $3.45 – up 56%

VNO is not an index but we switched to shorting VNO at $70 as SRS was simply way too annoying as a way to short CRE – nothing against VNO, who are a good company, but they have been reliably rejected at $70. Notice that TBT is working against us at the moment. This is why, when interviewed on BNN last night, my pick of the week for next week was – TBT! Those guys can come in fresh on a position we lost 40% on – that's a great deal! Of course, when we sell a put short it's because we are willing to take a long-term ownership of the stock. In this case TBT would be put to us at net $47.90 and TBT is currently trading at $47.35 so we are far from worrying. This is something that takes getting used to with option put selling as the 40% paper loss on the puts is "just" a 1.1% net loss on the stock position and that is still better than if we had bought the stock straight up for $50 last week.

We use short puts to hedge our early entries into a stock that we want to own long-term when we are not sure that they won't be dropping further on us. Another nice thing about selling puts is you can "roll" them to a longer month at a lower strike and the Feb $48 puts at $1.55 can be rolled to the June $44 puts, now $1.50, for 5 cents – giving us another 10% downside buffer in case we decide we want to avoid the assignment this month. Isn't that a nice, relaxing way to test-drive a stock – especially in an uncertain market. You'll see a lot of put selling in this weeks picks as we are not at all sure when the music will stop on this downslide so we are bottom fishing with caution.

We use short puts to hedge our early entries into a stock that we want to own long-term when we are not sure that they won't be dropping further on us. Another nice thing about selling puts is you can "roll" them to a longer month at a lower strike and the Feb $48 puts at $1.55 can be rolled to the June $44 puts, now $1.50, for 5 cents – giving us another 10% downside buffer in case we decide we want to avoid the assignment this month. Isn't that a nice, relaxing way to test-drive a stock – especially in an uncertain market. You'll see a lot of put selling in this weeks picks as we are not at all sure when the music will stop on this downslide so we are bottom fishing with caution.

Last week was a short but exciting one. I my Martin Luther King Day post I had a dream (well, actually a discussion with a commodities trader) and that prompted me to warn Members to get out of gold (not the first time I've said this) and, finally, my timing was spot on this week. I put up just two working plays for the day (obviously to be executed the next day). My 12:12 comment to Members was: "I’m not so bullish on the RUT between now and Feb as I do expect a market correction of about 5% (taking RUT to about 610) between now and then." The Russell finished the week at 617, down from 640, so not a bad call on the whole and we still have a 2 weeks to February! Special feature this week will be trade adjustments to fix our bullish plays that got burned (and there were plenty!):

- UYG Feb buy/write at $5.40/5.70, UYG now $5.47 – off target, no change.

- IWM 2011 $62/68 bull call spread at $3, now $2.60 – down 20%, no change

- IWM Feb $65 calls sold for $1, now .53 (pair trade) – up 47%, stop at .60 (.10 tailing)

This is another very nice strategy we've been using lately, using a long bull call spread as a base to sell calls against rather than just a leap as it gives us much better coverage in case of a major sell-off.

Testy Tuesday – Have the Markets Become Comfortably Numb?

I said on Tuesday: "I have a theory that the markets (and the American people in general) aren’t irrational, they are simply shell-shocked after suffering a very traumatic group financial experience…" That was my expectation for the low-volume complacency we have been seeing in the markets and my outlook for the week was to watch for a return of volume because "high-volume (relatively) days almost always tend to be down days." I went on to conclude:

Earnings season is like party time for options traders – even with the low, low VIX, there’s still plenty of fun to be had but we’ll be taking it easy this week as we try to get a grip on sentiment from reading the early tea leaves. If the volume stays low, it should, as I predicted on Friday, be back to business as usual and business is usually up as long as bad news continues to roll right off the shell-shocked public’s back.

We already had an almost entirely bearish virtual portfolio and we were looking for ways to balance to the upside and, of course, the cornerstone to our strategy is scaling into positions (article here from our strategy section) so please don't look at these trades in a vaccum – until we violate the 5% rule (and we're right there) then we have to look at the 5% pullback I predicted as a buying opportunity – the first one we've really liked in a while. Of course, in additon to my Monday comment to expect a 5% correction and my Tuesday warning to "take it easy" I did post this helpful visual aid:

I know, way too subtle…. Anyway, we did mix in a lot more bullish plays and hopefully they do come in handy down the road and the adjustments posted are based on the assumption that we are following sensible scaling strategies. I had not intended to trade much on Tuesday but we continued up on a low volume rally so, after closing out our bullish V play, I said to members at 12:37:

12:30 Dow volume is 87M, with 90M being "normal" at 1pm so volume is trailing off fast but we’re still going up and up and up. I’m getting very interested in the idea of going short again here on the Dow as they are about 20 points off Thursday’s high (from which we fell 150-points). DIA $106 puts dropped to $1.38 so that’s my put of choice with a DD at $1.12 for a $1.25 avg entry and a stop at $1.

- V Feb $85 calls at $3.35, out at $4.50 – up 34%

- QQQQ March $47/46 bear put spread at .45, now .70 – up 55%, stop at .65 (.10 trailing)

- CAKE 2011 $17.50/25 bull call spread at $4, now $3.70 – down 8%, rolling $17.50 calls to $15 calls for $1.20 or less.

- CAKE March $22.50 calls sold for $1.30, now .80 (pair trade) – up 38%, on target

- WFR Feb $14 puts sold for .85, now $1.30 – down 53%, can be rolled to March $13 puts, now $1 so no worries yet

- WFR March $13 puts sold for .65, now $1 – down 54%, can be rolled to Apr $12 puts, now .75 so no worries yet

- WFR 2011 $10s at $5, now $4.30, – down 14%, would like to roll to $7.50s for $1.35 if possible

- DIA $106 puts at $1.38, now $4.88 – up 253%, should be stopped out or tight stops (.25 trail)

- EDZ March buy/write at $3.50/4.25, EDZ at $5.59 – on target

- TBT complex spread, too complicated to list here – on target

- XLF March buy/write at $13.88/14.44, now $14.18 – off target, no change

- SDS complex spread, too complicated to list here – on target

- TWM Feb $21 calls at $2.65, now $4.70 – up 77%, should be stopped out or tight stops (.25 trail)

So we had intended to relax and not play too much but we ended up taking a large set of very bearish trades. The main reason was that the market was flying up on the ridiculous premise that the loss of the MA Senate seat in Tuesday's elections would be fantastic for health care stocks and great for the market in general as it was going to "stop Obama" and the evil Democrats from doing all those nasty things they do to the market (like having it run up 50% off the March lows). Maybe I'm too liberal and cynical but I considered this asinine and I said to members at 3:43: "I really think this is all about the fundies dumping their health care stocks on a whole new round of suckers as the spin a brand new tale right before they collapse the tent."

My 3:54 call into the close, after making all those bearish picks was: "This will probably be my last bearish judgment call because if they crack up from here, it’s just going to be foolish to be bearish but I’ll give it one more night and see if all those reporting companies can send us higher tomorrow (plus the miracle in Mass)." You may disagree with me and think that GS and their gang of 12 and the MSM don't manipulate the market through a mix of program trading and well-timed rumor mongering but it is funny how often my cynical view of the situation pans out, isn't it?

Whig Party Wednesday – Republicans Take Kennedy's Seat at the Table!

I was very pissed that the Dems blew it but fortunately, John Stewart was even more pissed so I let his clip do the talking. Our consumer confidence was down and German Investor Confidence was down and New Home Construction was down and Mervyn King said we're all doomed and that led me to close the post with: "So happy Wednesday to you! Looks like we’re glad we were short yesterday and we’ll have to see in chat if our levels hold up, giving us yet another chance to flip bullish and have a 2-way day or if we finally have a proper sell-off, maybe with some volume this time.."

- DIA $107 calls at $1, out at $1.20 – up 20%

- DIA $103 puts at $1.13, now $2.94 – up 160%

- NSM March $14 puts sold for .65, now $1.05 – down 62%, March $15 puts are .55 so no worries

- SPWRA March $21 puts sold for $1.50, now $1.95 – down 30%, no change

- AAPL 2011 $185/230 bull call spread at $22, now $19.10 – down 13%, roll down $5 for $2.50 (always)

- AAPL 2011 $185 puts sold for $18, now $21.80 – down 21%, no change

- TWM Feb $25 calls at .90, now $1.80 – up 100%, plan was to cover with $26 calls at .90 for free bull call spread or, at this point, protect the double with .15 trailing stop.

- UNP March $67.50/Feb $65 diagonal at net .20 credit, now .15 credit – up 25%, on target (you have to be patient with these!)

- IMAX June $10s for $3.50, now $3.90 – up 10%

- IMAX March $12.50 puts sold for .90, now .80 – up 11% (pair trade), on target

We got cautious, expecting a stick save in the afternoon and my 1:14 comment to members was:

Dow volume 115M at 1pm and we’re right back down to stickable levels (145M by 3pm). Of course keep in mind we’re playing up for the irrational stick that has no basis in fundamentals – that is very different from being bullish. We got the Mega-Stick on Friday afternoon that followed through to yesterdeayd morning and we got a similar move a week ago Tuesday into last Wednesday but, ONE DAY, the stick will fail us and we’ll sell and sell as people wake up from their stupor and realize the market is up 27% since last earnings and these earnings are NOT 27% better… TWM $25 calls are nice movers to the downside at .90, using the $24.25 line as a stop (right here).

My last trading comment to members at 3:53 was: "DIA $107s hit goal at $1.20 – Don’t be greedy!!!" as we had no lasting faith in our open bullish bets. After hours we made some quick gains trading oil futures to the upside ahead of inventory but wisely took that money and ran as we didn't expect a good report – just the anticipation of one!

Philly Fed Thursday – The Fix is In!

I was livid about the ridiculous lack of funding and time given to the Financial Crisis Inquiry Commission and I correctly anticipated Job Losses would be worse than expected (I have to publish the first half of my post before the 8:30 reports in order to make our morning newsletter mailing) and I also correctly predicted the Philly Fed would be worse than expected (and it was REALLY bad) and China's GDP was just way too hot at 10.7%. Oh yes, and Nouriel Roubini said the global market rally would be coming to an end – now THERE's a guy with good timing!

My opening comment in the 9:50 Alert to Members was: "I am for shorting into this morning spike as it’s nonsense, especially this run in the Nas – most likely it will reverse but I’d like to see a clear move back to resistance first. QQQQ $45 puts give you great leverage at .56 and you can use $46.20 on the Qs as a stop out, looking for .70+ on the day." but, at 11:59 I commented to Members "QQQQ $45 puts are now $1.25 and that is PLENTY!" they are now $1.60, up 185% for those who hung tough but 123% in 2 hours is a nice rate of return…

- QQQQ $45 puts at .56, out at $1.25 – up 123%

- DIA $107 calls at .avg .67, now .42 – down 37%, hope is the only plan!

- DIA $102 puts at $1.11, out at $1.37 – up 24%

- GS March $150 puts sold for $4.50, now $7 – down 55%, no worries yet, Apr $145 puts are $6.80 and GS is at $154 so it's all premium anyway.

- IWM Feb $61/63 bull call spread at $1.18, now $1.07 – down 9%, setting stop on $63 calls (now $1.22) at $1.30 (.10 trail)

- IWM March $59 puts sold at $1.20, now $1.68 – down 40%, May $54 puts are $1.60 so we are good for another 10% drop so no worries yet

- XLF Feb $14 puts sold for .25, now .45 – down 81%, need to keep an eye on these!

- XLF 2011 $15s at $1.39, now $1.19 – down 14%, roll down to $13 calls for $1 would be nice if possible

- ZION $19 calls sold for $1.40, now .75 – up 46%

- APH complex spread, too complicated to list here – on target

- TASR 2011 buy/write at net $3.40/4.20, TASR at $5.84 – on target

- XOM Apr $65 puts sold for $1.90, now $2.45 – down 29%, fine

- HOG Feb $25 puts sold for .90, now $1.80 – down 100%, looking at roll to 2x the March $23 puts, now $1.15 no worse than even.

- GE 2012 $12.50/17.50 bull call spread at $2.60, now $2.55 – down 2%

- GOOG March $530/560 bull call spread at $21, now $15.80 – down 24%, stop on $560 caller at $22 ($2 trail stop)

- GOOG March $540 puts sold for $11.50, now $20.60 – down 81%, no worries at all, June $500 puts are $20.50 but, with an expensive put like this, it's worth considering that you collected $11.50 so only worry about the $9.10 you are down and roll that down to the March $510 puts, now $10.40 but only if the markets keep going lower.

- GOOG 2011 $880 calls at $3, now $2 – down 33%

Notice that, because we were going down so fast, we started trying to protect our bearish profits with some upside plays – a little bit of bottom fishing and a few day trades, but with stops, of course. If you are going to let profits ride, it's a good strategy to poke at protective plays but don't let the protection be more than it is – just a way to ease you through the bounces until you decide to stop out your bearish plays…

At 5:28 am I sent out a special Alert to Members regarding managing our Mattress Plays (our normal protective virtual portfolio puts) and how to add to them in a down market (something that hasn't come up in quite a while). The basics of this strategy can be viewed by non-Members in my original article: "The Stock Market Parachute." It's amazing how fast we went from worrying about being too bearish to worrying about being too bullish, isn't it?

Fall Down Friday – Stop the Week, We Want to Get Off!

Hmm, 3 headlines with exclamation points in 4 days – that can't be a good thing… As I said that morning "Boy, when sentiment shifts – it REALLY shifts!" (another exclamation point!) My outrage of the day was the very bad Supreme Court decision on "corporate personhood" and I was looking at the lack of rail volume coupled with our ongoing concerns following the Baltic Dry Index as well as CNBC's "cover up" (for lack of a nicer word) of the oil inventory data. Nonetheless, we were still loaded down with bearish positions so we kept poking at bull plays, hoping Mr. Stick still had game:

- DIA $105 calls at $1.18, out at $1 – down 18%

- EDZ March buy/write at $3.50/4.25, EDZ now $5.59 – on target.

- BTU March $44 puts sold for $2, now $1.80 – up 10%

- WFR March $13 puts sold for .70, now $1 – down 44%

- BYD March buy/write at $5.57/7.78, BYD now $8.38 – on target

- WFR 2012 $10 calls at $5.50, now $5.30 – down 4%

- DIA $106 calls at .86, out at .60 – down 30%

- HOV 2012 $2.50/5 bull call spread at .95, still .95 – even

- HOV 2012 $2.50 puts solf for .70, still .70 – even (pair trade)

- ISRG March $300 puts at $3.70, now $4.40 – up 19%

- AAPL March $180 puts sold for $5.85, now $6.40 – up 9.45

- EDZ Apr $4 calls at $1.75, still $1.75 – even

As we were near the 5% rule for the week, my 3:48 comment to members was "Back to cash but leaving disaster hedges, which are looking great now as this is shaping up to be some disaster." I noted that there wasn't very much support between here and another 5% drop if we head lower on Monday and we added those EDZ calls near the close just in case Roubini's Global melt-down scenario starts on Monday.

It would have been fun to go gung-ho bearish but we had a fantastic week last week and cashed out our bullish plays on top and now we had a chance to cash out the bear side (or most of it) after a 500-point drop – it just doesn't make sense to push it when given a gift like that. Starting this week off in cash gave us a great opportunity to jump on the bear wagon on Tuesday and we rolled part of those profits into some bottom fishing but we're sure ready to short the next leg down if Mr. Stick can't pull it together over the weekend.

In our next post, we'll be discussing our next set of watch levels and what the week ahead may bring…