Yesterday, we had a nice play with a short sale of MGIC Investment Corp. (MTG). I had originally set my entry range at 6.45 – 6.55. The stock, however, within minutes of opening went from around 6.00 to 6.75, missing our entry. Therefore, we entered the stock at this higher price sine we were short selling and getting MTG at such a premium. We got into the stock at 6.73 and turned a 3% profit when MTG went back to 6.53. Later in the day, I recommended an Overnight Trade of the Day in Callaway Golf Inc. (ELY) in an Oxen Group Alert. Callaway, in after hours, beat its EPS estimates and made bold claims that 2010 would be the year that golf would get its groove back. The stock does not trade pre-market, but we are in at 7.99. I think we should be happy with 2-3% here, but we will see where it opens.

Yesterday, we had a nice play with a short sale of MGIC Investment Corp. (MTG). I had originally set my entry range at 6.45 – 6.55. The stock, however, within minutes of opening went from around 6.00 to 6.75, missing our entry. Therefore, we entered the stock at this higher price sine we were short selling and getting MTG at such a premium. We got into the stock at 6.73 and turned a 3% profit when MTG went back to 6.53. Later in the day, I recommended an Overnight Trade of the Day in Callaway Golf Inc. (ELY) in an Oxen Group Alert. Callaway, in after hours, beat its EPS estimates and made bold claims that 2010 would be the year that golf would get its groove back. The stock does not trade pre-market, but we are in at 7.99. I think we should be happy with 2-3% here, but we will see where it opens.

Now, we move onto today’s pick…

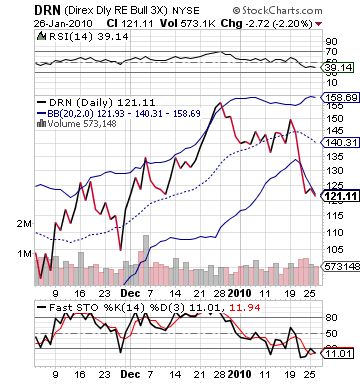

Buy Pick of the Day: Direxion Daily Real Estate ETF (DRN or DRV)

Analysis: The market is pretty much nuetral today. Futures are up only slightly before the market opens. There was no big economic data to push or pull the market in any way prior to the open. Earnings were mostly mixed. For the most part, things are looking pretty neutral. What that does is it allows big moving and volatile ETFs, such as the Direxion and ProShares ones to become more attractive trades. Since, the New Home Sales data is being released at 10 AM, it is going to have a significant impact on the direction of these two ETFs. If the data is good, DRN is going to be in for some major gains. If it is bad, DRV should get somewhat of a boost, yet is not as attractive as DRN.

Analysis: The market is pretty much nuetral today. Futures are up only slightly before the market opens. There was no big economic data to push or pull the market in any way prior to the open. Earnings were mostly mixed. For the most part, things are looking pretty neutral. What that does is it allows big moving and volatile ETFs, such as the Direxion and ProShares ones to become more attractive trades. Since, the New Home Sales data is being released at 10 AM, it is going to have a significant impact on the direction of these two ETFs. If the data is good, DRN is going to be in for some major gains. If it is bad, DRV should get somewhat of a boost, yet is not as attractive as DRN.

The new home sales data is estimated at 370,000 homes sold in December of 2009. That number is increase over November’s 355,000. In my best estimations, this number seems a bit high. The pending home sales plummeted over 16% and existing home sales missed expectations significantly. It would seem the pattern of overestimation is in full swing. Yet, we do not want to be quick to jump the gun, nor do we have to be. DRV is up only 0.25% currently, and it should not move quite significantly until that data is released. The expectation is probably of a miss, so a beat will be huge for the market, and DRN becomes a very attractive trade.

Over the past couple weeks, DRV has jumped almost 25%. That movement, typically, I would highly warn against. In the case of Direxion ETFs, however, many times we can throw technicals out the window. We are looking at ETFs that are completely momentum driven. It takes a great deal to unwind the upward momentum DRV has. Yet, a beat over new home sales could derail the ETF, making DRN look extremely attractive.

.png) What we want to do is set up both trades at market price before 10 AM. Watch CNBC or Marketwatch.com for the data. Pull the trigger once the data is released. We need to be quick on action. This is a nice trade because both ETFs are basically unmoved as of now, but it becomes a very weak and ill advised trade if either is up 2-4% before we can even get involved.

What we want to do is set up both trades at market price before 10 AM. Watch CNBC or Marketwatch.com for the data. Pull the trigger once the data is released. We need to be quick on action. This is a nice trade because both ETFs are basically unmoved as of now, but it becomes a very weak and ill advised trade if either is up 2-4% before we can even get involved.

Get in quick and good luck!

Entry: We are entering at 10 AM based on New Home Sales data. If sales are at or above 370,000 then we want to buy DRN. If they are below 360,000, we want to buy DRV. In between is a no play.

Exit: 2-3% from entry price.

Stop Loss: 3% on bottom.

Good Investing,

David Ristau