People have gotten so used to immediate rescues off any drop that holding a floor for two days brings out the doomsayers.

I remember a time, many years ago, where we could go a whole week without the Dow moving 100 points – TOTAL! I know that sounds like it must have been back before the Internet or even electricity but really, even between 2005 and 2007, the VIX averaged 12 – less than half of where it is today and, pre-1997, that was about the norm for the market. Back in those days, we used to buy stocks because we thought the company would grow and we wouldn't hide in ETF "baskets" where we buy every single stock in a sector, as if quality was meaningless and the entire market would trade as a block.

Sadly, ETF funds (according to Blackrock) have now hit $1.032 TRILLION at the end of 2009 and that figure is up 45% for the year! That's right, since their inception, we put about $700Bn into ETFs but, last year, another $300Bn was plowed in – mostly into new commodity ETFs (which creates a very false demand but is self-fulfilling at first). US ETFs account for $706Bn while Europe has $224Bn so imagine how far we can pump up Asia and other emerging markets if we can convince the sheeple to "diversify" over there! And ETFs have plenty of room to grow as BlackRock has done an excellent job of promoting them as a way to "take control of your Investments" as they look to capture more of the $19Tn mutual fund market.

Hedge funds make up just $1.5Tn of the investment money and, as a Hedge Fund manager, I can tell you we could not be more thrilled to see more and more money going into index and commodity funds that BUYBUYBUY and SELLSELLSELL based on rules I can read about in the prospectus. You, the ETF investor are playing a game where your money will be put to work at a certain time and under certain conditions every day and I, the Hedge fund manager, can read your entire playbook and can make my bets ahead of you any time I choose and, even if you see me betting, you still can't change because you (your ETF) still have to follow your rules.

Now we have launches of CRBA, CRBQ and CRBI ETFs, even MORE ways to pile money into commodities – this following closely on the heels of PLAT (platinum) and WCAT (wildcatters) – it's MADNESS I tell you! Apparently, whenever the big boys have positions to dump now, they just start an ETF. You can throw any crap stock in an ETF and people will buy it. This is much the same way that investors would buy toxic loans because the IBanks (the same guys who now put together the ETFs) would bundle them up with a couple of good loans to make the bundle look much better than it really was.

Now we have launches of CRBA, CRBQ and CRBI ETFs, even MORE ways to pile money into commodities – this following closely on the heels of PLAT (platinum) and WCAT (wildcatters) – it's MADNESS I tell you! Apparently, whenever the big boys have positions to dump now, they just start an ETF. You can throw any crap stock in an ETF and people will buy it. This is much the same way that investors would buy toxic loans because the IBanks (the same guys who now put together the ETFs) would bundle them up with a couple of good loans to make the bundle look much better than it really was.

Here's a fun exercise for you ETF holders. Outside of the "top 10 holdings," I challenge you to find out what stocks your ETF actually holds. When you buy XLF are you buying AIG? When you buy IYT, how much YRCW are you buying and are you still buying BNI at $99 even though there's no possible way it can appreciate? What if I have those answers and you don't – do you think that would be unfair? That's what ETF investing is, we (the top 10%) herd the suckers into a rigged game – it's like playing "go fish" where we can see your cards but you can't see our cards OR your cards!

Don't get me wrong, we play ETF's all the time, even leveraged ETFs, which are an exercise in stupidity to invest in – but we play them for what they are and they are NOT generally a good investment. We like XLF but only because we can get suckers to buy overpriced options from us and we loved IHI at $40 earlier this year but we took 25% and ran. ETFs make good momentum plays, especially the ultras with the leverage they provide over the short-term, but don't build your virtual portfolio with them and we love to use a sell-off like this to identify the stocks that get taken down with their ETFs for no good reason other than being stuck in the herd. Unfortunately, the same way ETFs exaggerate the moves up in the market – they exaggerate the moves down and, as we fail to hold our 5% levels, we can trigger selling in the ETF market that can take this market down to the 10% levels we identified on Monday.

Don't get me wrong, we play ETF's all the time, even leveraged ETFs, which are an exercise in stupidity to invest in – but we play them for what they are and they are NOT generally a good investment. We like XLF but only because we can get suckers to buy overpriced options from us and we loved IHI at $40 earlier this year but we took 25% and ran. ETFs make good momentum plays, especially the ultras with the leverage they provide over the short-term, but don't build your virtual portfolio with them and we love to use a sell-off like this to identify the stocks that get taken down with their ETFs for no good reason other than being stuck in the herd. Unfortunately, the same way ETFs exaggerate the moves up in the market – they exaggerate the moves down and, as we fail to hold our 5% levels, we can trigger selling in the ETF market that can take this market down to the 10% levels we identified on Monday.

Anyway, on to the markets! Asia was down AGAIN today with the Shanghai off 1% and the Hang Seng off just 0.4% but they fell 400 points off a morning run and hit my 20,000 target, up with a very small save into the close. India dropped 3% so still a huge drag on that side of the globe overall. We did take our EDZ/FXP money and ran yesterday as we expected to see a bit more of a bounce but things are still weak over there and we sure aren't providing much leasership as our US indexes lounge around the 5% lines.

In a story we've been following of grave concern, Credit Default Swaps are still rising in value and now also increasing in volume as well. The net amount of credit-default swaps outstanding on 54 governments from Japan to Italy jumped 14.2 percent since Oct. 9, compared with 2.6 percent for all other contracts, according to Depository Trust & Clearing Corp. data. European countries led the jump, with the amount of protection on Portugal climbing 23 percent, Spain 16 percent and Greece 5 percent. So the record levels of debt being purchased at Treasury auctions are being hedged with record levels of bets that those debts will default by big money investors. Hmm, can we think of another time that big money investors bought something with one hand while betting against it with the other? I wonder how well that turned out?

The same mistakes that were made lending money to less than qualified mortgage borrowers are now being made lending money to less than qualified nation borrowers and both Nouriel Roubini and I are very concerned this will all end badly. If you thought you were angry about GS getting rich on swaps as MER and LEH wen under, imagine how we'll be feeling when GS makes Billions as the United States goes under! Actually, thanks to the Supreme Court and Madison Avenue PR firrms, we're going to feel however Goldman tells us to feel, right?

The same mistakes that were made lending money to less than qualified mortgage borrowers are now being made lending money to less than qualified nation borrowers and both Nouriel Roubini and I are very concerned this will all end badly. If you thought you were angry about GS getting rich on swaps as MER and LEH wen under, imagine how we'll be feeling when GS makes Billions as the United States goes under! Actually, thanks to the Supreme Court and Madison Avenue PR firrms, we're going to feel however Goldman tells us to feel, right?

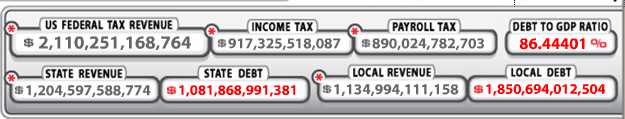

I was somewhat encouraged that Obama was talking about freezing some spending and we were going to form a debt commission to get on top of this problem but the MSM has gone on the attack already on Obama's plan within 24 hours of the announcement and the Senate just struck down the idea of having a commission that would look to balance the budget by a 53 (in favor) to 46 vote as we now seem to need 60% of the Senate in order to get anything done these days. Looking at our national debt clock, you can see why it's more fun to stick our heads in the sand than contemplate these numbers. The part I find disturbing is the state and local debt of almost $3Tn – there's a number no one talks about and our government is taking in $2.1Tn in tax revenues on $3.5Tn in spending this year – that does NOT sound like an improvement.

Like Lot in Sodom and Gomorrah, we can't find 60 righteous senators who want to get an honest assessment of this situation – perhaps because we all know what the answer is (cut spending, raise taxes) and now one has the guts to actually say it out loud. We'll see what, if anything, Obama has to say on this subject in tonight's State of the Union Address but Fox has already declared his spending freeze a disaster and a Public Policy Polling nationwide survey of 1,151 registered voters Jan. 18-19 found that 49 percent of Americans trusted Fox News, 10 percentage points more than any other network. Wow – that is sad!

Europe is down over 1% ahead of the US open as rumors fly that other governments aren't as willing as we are to plow headlong into the debt wall and may be withdrawing stimulus measures this year. Greece is denying reports that, in addition to the $11Bn worth of bonds they sold on Monday, that they are trying to sell $35Bn worth of bonds to China and that news send Greek bond yeilds flying this morning.

We went a little short into yesterday's close and we are now looking at the strong possibility of another 5% drop. We'll still be doing some bottom fishing but we're just slowly scaling into good companies with strong hedges – fully prepared to buy a second round at a significantly lower price – just in case!

Don't forget we have the Fed at 2:15 – that can move the markets either way but any indication of tightening will send us lower.