EWI’s offering a free ebook on deflation — deflation in social mood, deflation in the volume of money and credit, deflation in the stock market. The story of Socionomics is that it all goes together. So Can the Fed Stop Deflation? Robert Prechter’s answer is NO. – Ilene

Bernanke’s Burn Notice — Why Now? Research Reveals Insight Into Fed Chairman’s Popularity

Courtesy of Elliott Wave International

Courtesy of Elliott Wave International

Like a spy who gets a burn notice, Federal Reserve Chairman Ben Bernanke has suddenly lost his support.

Bernanke has gone from being Time magazine’s Man of the Year in 2009 to … what? A Fed chairman embroiled in a controversial reconfirmation process before U.S. Congress. Why the sudden turnaround in his fortunes?

Robert Prechter, president of the research firm Elliott Wave International, has written about the history of the Fed and its chairmen several times over the years, and his research shows that their popularity rises and falls with social mood, which is measured by the stock market. Here is a compilation of excerpts from Prechter’s monthly market letter, The Elliott Wave Theorist, from 2005-2009 about the trouble he sees brewing at the Fed.

*****

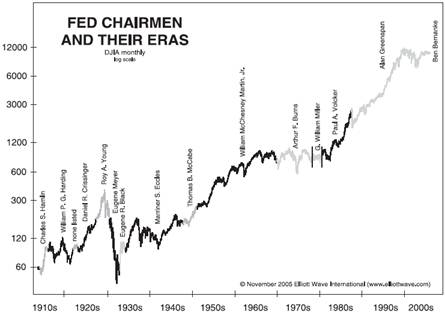

(November 2005) The Coming Change at the Fed | Public figureheads have a way of representing eras. This is certainly true of entertainment icons and politicians. The history of Fed chairmanship implies a similar tendency for changes of the guard to coincide with changes in social mood and therefore stock prices and the economy. [The chart below] depicts our social-mood meter—the DJIA—since the Fed’s creation in 1913, marked with the reigning chairmen according to a list on the Fed’s website.

The first chairman, Hamlin, presided over a straight-up boom. As it ended, Harding took over and presided over an inflationary period that accompanied a bear market, exiting just as a new uptrend was developing. Crissinger took over at the onset of the Roaring Twenties, and Young presided over the boom, the peak and the rebound into 1930. Meyer took over just as confidence was collapsing and left the office in early 1933 at the exact bottom of the Great Depression. The next three chairmen struggled through the choppy years of the 1940s. Then Martin presided over virtually the entire advance from the early 1950s through 1969, exiting just before the recession of 1970. Burns and Miller presided over a bear market and exited as the new uptrend was developing. Volcker, after weathering an inflation crisis, presided over the explosive ’80s. Greenspan has presided over the manic ’90s and the topping process. [Ben Bernanke] will have his own era. Given the eras that have immediately preceded the coming change in leadership, the odds are that this new environment will be a bear market.

(June 2006) Economists are convinced that the Fed can "fight" inflation or deflation by manipulating interest rates. But for the most part, all the Fed does is to follow price trends. When the markets fall and the economy weakens, the price of money falls with them, so interest rates go down. When the markets rise and the economy strengthens, the price of money rises with them, so interest rates go up. The Fed’s rates fell along with markets and the economy from 2001 to 2003. They have risen along with markets and the economy since then. Regardless of the Fed’s promise to keep raising rates, you can bet that the price of money will fall right along with the markets and the economy. Pundits will say that the Fed is "fighting" deflation, but it will simply be lowering its prices in line with the others.

It is highly likely that the next eight years or so will test the nearly universally accepted theory—among bulls and bears alike—that the Fed can control anything at all. The Great Depression made it look like a gang of fools, as will the coming deflationary collapse. We have predicted unequivocally that the new Fed chairman will go down as Hoover did: the butt of all the blame, and if you are reading the newspapers you can see that it’s already started. "When Bernanke Speaks, the Markets Freak" (San Jose Mercury News, June 10, 2006); "Bernanke is being blamed for spooking Wall Street" (USA Today, June 7, 2006); "Bernanke to blame for volatility" (Globe and Mail, Canada, Jun 13, 2006). The new chairman had a brief honeymoon (which we also predicted), but it’s already over.

By the way, I heard his commencement speech at MIT last week, and in it he spoke eloquently of the value of technology and free markets. But he also opined that economists have successfully applied technology to macroeconomics. We believe that the collective unconscious herding impulse cannot be tamed, directed or managed. In our socionomic view, the Fed cannot control the mood behind the markets, but rather, the mood behind the markets controls how people judge the Fed. We’ll ultimately find out who’s right.

(December 2009) Bernanke’s greatest achievement was not the measly $1.25t. of debt that he arranged to have the Fed monetize; it was convincing the government to shift the burden of debt default from the speculators and creditors to taxpayers.

(September 2009) Thanks to the Fed Chairman and two Treasury Secretaries, profligate bankers have been cashing checks off the Fed’s and the Treasury’s accounts, and the poor savers and taxpayers who fund these institutions are unaware that their personal bank accounts are being tapped by counterfeiters and thieves.

That lack of awareness may soon change. Declining social mood is fueling the drive to expose the Fed’s secrets. [Ed. note: Bloomberg News has sued the Fed under the Freedom of Information Act; Congressmen Ron Paul, R-Texas, and Barney Frank, D-Mass., are leading a charge to audit the Fed.] Exposing the Fed’s secret deals could lead to scandal and the collapse of major money-center banks. But most important to our monetary outlook, it will serve to curb the Fed’s reflation efforts. As I have written many times, deflation will win. Social mood is impulsive and cannot be stopped. The downtrend will claim its victims by whatever measures it must take to do so.

(August 2009) On July 26, in a speech in Kansas City, MO, Fed Chairman Ben Bernanke declared, "I was not going to be the Federal Reserve chairman who presided over the second Great Depression." (WSJ, 7/27) We think this implication of a fait accompli is premature. Clearly, the Fed Chairman and the majority of economists are of the opinion that the worst of the financial crisis is past and that the Fed’s unprecedented lending has averted deflation and depression. But wave 3 down in the stock market will dispel these illusions. Years ago, we suggested that Chairman Greenspan quit if he wanted to keep his lofty reputation. He didn’t do it. Now Chairman Bernanke should consider this option.

*****

So will Bernanke serve a second term as Fed chairman? The January 2010 Elliott Wave Financial Forecast says, "Social mood is still too elevated to deny Bernanke reappointment as head of the Fed. … But rising political tension confirms that his next term will be far more stressful than his first."

Can the Fed Stop Deflation? Robert Prechter answers this all-important question in his Free Deflation Survival Guide. The guide gives you a 60-page ebook that will help you understand deflation and its effects on society; you’ll even learn how to survive and prosper in such an environment. Download Your Free 60-Page Deflation eBook Here.

Robert Prechter, Chartered Market Technician, is the founder and CEO of Elliott Wave International, author of Wall Street best-sellers Conquer the Crash and Elliott Wave Principle and editor of The Elliott Wave Theorist monthly market letter since 1979.