I am looking at a couple of long term plays to buy into today. By long term, I mean 4-5 days…haha. I think that the market has presented some outstanding opportunities for some big money making. Over the past ten trading days, we have had only two up days. That has taken a lot of stocks down, down, down. Investing 101 is buy low and sell high. I have found two companies that have been dropping in value and are now extremely undervalued, but I think present the ability to see some significant movement upwards in the next week leading into their earnings reports.

I am looking at a couple of long term plays to buy into today. By long term, I mean 4-5 days…haha. I think that the market has presented some outstanding opportunities for some big money making. Over the past ten trading days, we have had only two up days. That has taken a lot of stocks down, down, down. Investing 101 is buy low and sell high. I have found two companies that have been dropping in value and are now extremely undervalued, but I think present the ability to see some significant movement upwards in the next week leading into their earnings reports.

Let’s get into both of these picks that you should pick up today…

Long Term Play #1: M/I Homes Inc. (MHO)

Analysis: M/I Homes is going to be a great play for next week. The company reports their quarterly earnings on Wednesday morning. One of the only sectors where we have seen some rather astounding earnings is in the residential construction area. Nearly all of these companies are exceeding expectations by significant margins. In the past month, we have seen four of the major residential companies report 100+% beats on EPS. Lennar was over 100, KB, Meritage, and Ryland were all over 400%. This was my initial attraction to M/I Homes. Yet, there has to be more to be a longer play than just an overnight trade.

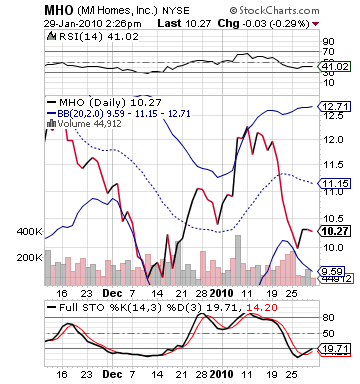

MHO is particularly special because of the downturn has faced over the past couple of weeks. The stock has dropped over 15% in value over the last two weeks as the market has sold off. It regained a tiny bit of ground on some of these earnings beats, but it is still heavily oversold, undervalued, and near its lower bollinger band. Basically, the pressure is just too great to the low side for it continue down much further.

Going into earnings, with all the beats we have seen, I am pretty bullish. I think investors will be willing to get behind MHO. It is a similar company to those that have reported. It has a nice range of lower income to moderate income homes. It may be a bit less prestigious than most of those that have reported. Where we should be even more excited is on the EPS estimates the company is receiving. M/I is estimated to report at -0.41, which will be a pretty significant gain over one year ago when the company lost -5.00+ on EPS. What does not excite me is that this is a company that consistently misses on earnings. Yet, Ryland and others were missing targets before this past quarter. Ryland turned a profit even, after hitting -1.20 EPS last quarter. The same is true for the others, as well. These are huge turn arounds.

M/I should be the same, but it has not yet gotten the type of pricing in that one should expect. That means we have an undervalued stock about to flourish.

Get in today and ride this puppy up and away!

Entry: We want to enter in the 10.20 – 10.30 range at some point before closed.

Exit: We are looking to exit on Wednesday during the day after a Wednesday morning report unless 5-6% is reached before Wednesday morning. Otherwsie, we will hold and sell for gains on Wednesday.

Good Investing,

David Ristau