Pharmboy, member of our team at PSW, has been writing a book on Technical Analysis. Here is the first chapter for your enjoyment/educational experience. – Ilene

Understanding Market Cycles: The Art of Market Timing

Courtesy of Pharmboy

Experts and the main stream media say that market timing is impossible. That much is true, but when TA is used, timing market movement is very profitable on a consistent basis. As a technical trader, the purpose is to find the best trades and to time the entry and exit points. After all, any trader can find the best trade in the world, but if it is not timed well, it may turn into a loss. Every stock or asset class goes through a classic market cycle. Figure 1 is a diagram of the four stages of the market cycle:

Figure 1. Four stages of the market cycle.

When looking at the charts of any stock or index, notice that it moves in cycles. By observing cycles, what to expect next is easier to comprehend. Figure 2 shows two stocks that have completed each of the four stages.

Figure 2a and b. Market stages of two companies.

2a. Amylin

.png)

2b. MEMC

.png)

For a long-term investor or trader, understanding market cycles can greatly benefit their portfolio.

Stages of a Market Cycle

- Accumulation Phase – This is the bottom (or near the bottom) of a particular stock, sector, or general market. At this stage, prices do not move upward but rather stay within a neutral trading range. At this level, the smart money begins to buy up large blocks of shares to accumulate a large position for their portfolio. They are patient enough to wait years, if needed, because it is difficult to determine how long a stock or sector will be in this stage. Regular individual retail investors do not even consider buying at this level because, in most cases, they have recently sold into the lows. At PSW, this is the stage where stocks are nominated to the Watchlist and the biggest discounts are found. Long-term oriented investors should be buying to realize the greatest long-term gains.

- Mark Up Phase – This phase follows the Accumulation phase. The way to determine if this phase is occurring is to see a stock or sector that has “broken out” of its neutral range. This means that it must break above the upper trend line of the neutral range. From this point on, an obvious increase in volume should be seen. Most of the institutions and individuals who are aware of this early trend will jump on board and bring along significant buying power with them. Another way to tell if the stock is in this stage is to see if higher lows and higher highs are forming. Toward the end of the mark up phase, full market participation will be noted as everyone from the shoe shiner to the cab driver will most likely have made an investment. This is a set up for the next phase.

- Distribution Phase – This is the top of the market for a particular stock, sector, or general market. Supply overwhelms demand after the smart money sells their shares to the “greater fools” who buy at the top. Because there are no other buyers left to raise the price, a stock or sector cannot advance higher, and thus, will collapse under its own weight. The sentiment is extremely bullish. This phase is marked with extreme greed and fear. The best way to identify a top is through chart patterns, most notably, the head-and-shoulder and double top formations combined with breakdowns at the 200-day moving average (MA). This phase is usually marked by the greatest volume levels for a stock until it reaches the Accumulation phase once again.

- Mark Down Phase – Prices are in free fall and stocks are in full liquidation mode. This group is made up of people who held beyond the Distribution phase and did not sell, or those who bought at or near the top and refuse to sell at a loss. Either way, a loss will be incurred or the size of it will be determined when an investor wishes to sell it. A trader should not buy at this stage and those that try to find a bottom will be disappointed.

- Return to Accumulation Phase

Phase Strategies

· Accumulation Phase

o Investors: Cash » Buy

o Traders: Cover/ Buy

· Mark Up Phase

o Investors: Buy

o Traders: Buy

· Distribution Phase

o Investors: Sell » Cash

o Traders: Sell/ Short

· Mark Down Phase

o Investors: Cash

o Traders: Short

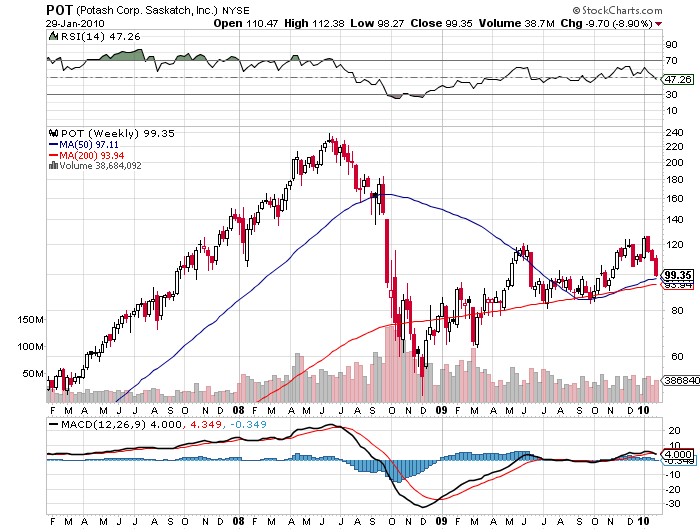

The Agricultural Chemicals/Fertilizer sector is a good example of how it is possible to profit from their recent market cycle. As shown in

Figure 3 is an example of all the companies in an industry rising and falling in the same time frame.

Figure 3. Market cycles of Potash (3a), Mosaic (3b) and CF Industries (3c).

3a. Chart for POT

3b. Chart for MOS

.png)

3c. Chart for CF

.png)

Sentiment Cycle

In addition to the actual price cycle, there is also a sentiment cycle which accompanies each stock, sector, or overall market. By definition, the market balances buyers and sellers, so that there is a balance between positive and negative sentiment. Thus it is impossible for a high proportion of market participants to have negative sentiment. However it is possible to argue that when a high proportion of financial commentators and advisors express a bearish (negative) sentiment, some people consider this as a strong signal that a market bottom may be near. The predictive capability of such a signal (e.g., market sentiment) is thought to be highest when investor sentiment reaches extreme values.[1] Indicators that measure investor sentiment may include.

- Investor Intelligence Sentiment Index: If the Bull-Bear spread (% of Bulls – % of Bears) is close to a historic low, it may signal a bottom. Typically, the number of bears surveyed would exceed the number of bulls. Conversely, if the % of Bulls is at an extreme high and the number of Bears is at an extreme low, historically, a market top may have occurred or close to occurring. This contrarian measure is more reliable for its coincidental timing at market lows than tops.

- American Association of Individual Investors (AAII) sentiment indicator: Many feel that the majority of the decline has already occurred once this indicator gives a reading of minus 15% or below.

- Other sentiment indicators include the Nova-Ursa ratio, the Short Interest/Total Market Float, and the Put/Call ratio.

Figure 4 shows the general range of emotions investors experience as related to market risk.

Figure 4. Point of Maximal Financial Risk

Via Tycoon Research

The trader is their own worst enemy because emotions give room for destructive impulse trading. By understanding each cycle and what emotions follow, traders can be better prepared. Market cycles are normal, necessary to balance the financial markets and restore equilibrium to forces of supply and demand. Understanding these market cycles and being able to recognize where we are in the cycle can help us to be better investors.

[1] Trying to Plumb a Bottom, By MARK HULBERT, http://online.barrons.com/article/SB122652105098621685.html