Good Monday Oxen Report readers,

Good Monday Oxen Report readers,

The market is looking like it is ready for a rally today as the market has dropped over 6% since hitting its high of 2010 back on January 15. On Friday, we picked up a Long Play of M/I Homes Inc. (MHO). We got into that one at 10.35 and are looking for 4-6% increase with a sell expiration on Wednesday after earnings are released. If I get 5% before Wednesday, though, I will look to sell MHO.

Let’s get into some plays for Monday…

Buy Pick of the Day: Ultra Proshares Oil and Gas ETF (DIG)

Analysis: Nothing has been able to get the market going since that high, but the downturn may be looking upwards. On little news that would spark a rally, the market as of 8:15 AM had futures that were up above 55 points on the Dow. At 8:30 AM, we got some neutral economic data that did very little for the market’s direction. One of the big earnings market movers is ExxonMobil (XOM), which despite a 23% profit decline beat estimates on Wall St. and has investors a bit excited.

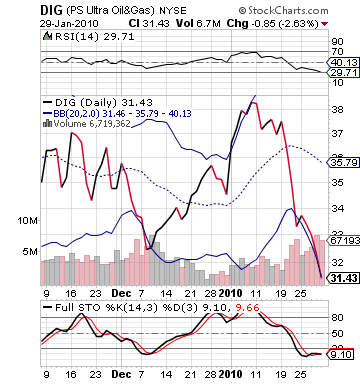

With the market looking up for the day, that should translate into a good day for the oil market. Oil has been on a steady decline from the 80s all the way down to now at $73 per barrel. The oil ETFs have been closely following this downward trend, and one, in particular, presents a perfect buying opportunity for the day. Ultra Proshares Oil and Gas ETF (DIG) is a great buy after the ETF has taken a 20%+ nosedive in the past three weeks. The ETF is extremely undervalued. If oil and the market can rise, then DIG is a great opportunity.

Will oil keep going up today? The first reason we can expect a solid day out of oil is that President Obama’s announcement that we would reach a record deficit has weakened the dollar significantly, which always gives a boost to oil prices. Further, it is time for a correction. Fundamentals have said that oil should be much lower than it is right now, but market fundamentals say we can only decline for so long before we get at least some sort of rebound (no matter how short lived it is).

"This is not a trend higher but a reaction after three weeks of falls. The fundamentals have not improved, the market is still over-supplied and demand is not there yet," said Eugen Weinberg from Commerzbank. Further, the earnings beat by XOM will help DIG since it is weighted in the stock heavily.

A lot of good things are pointing towards some upward movement for DIG. Lastly, the technicals on DIG are absolutely outstanding. The ETF has seen that 20% nosedive, which has pushed the ETF all the way down to its lower bollinger band. The ETF is vastly oversold on fast stochastics and slow stochastics, and it is extremely undervalued on RSI. There is not a technical indicator in the bunch that does not point to a correction.

Get in early and ride this one up!

Entry: We are looking for an entry of 31.80 – 31.90.

Exit: We are looking to exit on a 2-4% increase.

Stop Loss: 3% on bottom of entry.

Short Sale of the Day: Ultrashort Proshares Real Estate (SRS)

.png) Analysis: For many of the reasons that I like DIG, I like SRS to fall. I am definitely behind this market today and probably over the next couple of days. The market is in need of a correction. SRS, being an inverse ETF, therefore is in dire need of some selling pressure. The stock has risen over 16% in the past two weeks and is ready to have some sellers. One main reason that I think SRS should see some pressure today versus just a usual down day is that the housing market is doing pretty well, residentially.

Analysis: For many of the reasons that I like DIG, I like SRS to fall. I am definitely behind this market today and probably over the next couple of days. The market is in need of a correction. SRS, being an inverse ETF, therefore is in dire need of some selling pressure. The stock has risen over 16% in the past two weeks and is ready to have some sellers. One main reason that I think SRS should see some pressure today versus just a usual down day is that the housing market is doing pretty well, residentially.

Many of the residential construction companies are not in the holdings of SRS, but they do still have a major influence on its movement. These companies, late last week, reported very outstanding earnings that should give way to some downward pressure on SRS that has not been seen too greatly as of yet. Further, in after hours today, Plum Creek Lumber, which is held by SRS will be reporting its earnings. PCL had a nice beat last quarter and can provide some pressure.

Technically, SRS has been riding its upper bollinger band for the past week, and it is extremely overbought. Technically, the stock is ready for some selling pressure. On the downward day, we should see some quick selling, which will over emphasize the downward pressure. This will be good to keep the ETF down and allow us to make some money.

Get into this one in the range and watch it fall!

Entry: We are looking for an entry of 8.15 – 8.25.

Exit: We are looking for a 2-3% decrease to cover.

Stop Buy: 3% on top of entry.

Good Investing,

David Ristau