Greece is the word these days.

We are getting a sell-off every morning as Europe goes through the daily ritual of waking up and seeing the cost of default protection rise and rise. This morning Greece is with STUPID (Spain, Turkey, UK, Portugal, Italy & Dubai – coined by Zero Hedge) as five-year sovereign credit default swap spreads were recently at 4.23 percentage points, compared with Wednesday's closing level of 3.97 percentage points. That means the annual cost of insuring €10 million of Greek government debt against default for five years had risen €26,000 to €423,000. In a nutshell, that's 4.23% annually to insure Greek bonds from default so Greece needs to offer 4.23% more interest on their bonds than an Aaa nation to attract investors.

Of course, my new "I'm with STUPID" T-shirt franchise is going like gangbusters as we are getting orders from all over the US, especially California, as our own triple-A credit rating may not last the year. Japan is a strong customer (mostly small and extra-small) and sales are strong in France and, of course, Mexico and all of South America.

Keeping up with the STUPIDs is no easy feat as Portugal's CDS spreads jumped 15% overnight to an all-time high 2.26 while Spain gained 10% to 1.68%. (Have I mentioned I like TBT lately?) The moves followed news Wednesday that the European Commission had put Greece under more pressure to cut its deficit; that the Portuguese government sold only €300 million of treasury bills at an auction, compared with an indicative offer of €500 Million; and that the Spanish government had raised its budget deficit forecasts for 2010 through 2012.

As we expected in yesterday's post, Greek workers were none too pleased with the EU's budget plan for their country and is rejecting the idea of wage freezes on top of wage cuts. Greece's biggest union is moving towards a mass strike and the public-employee union is planning a job action next week as well. Tax collectors are striking, customs workers are striking, which is screwing up the airports and shipyards and delaying commerce all over Europe – shades of things to come perhaps?

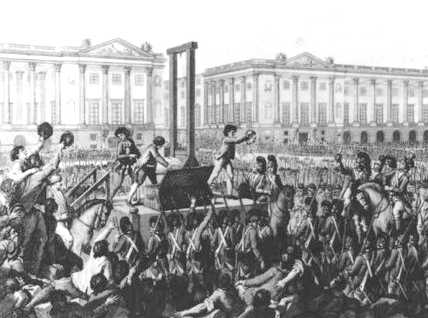

Napoleon said: "A revolution is an idea which has found its bayonetes" and John Kennedy said: "Those who make peaceful revolution impossible will make violent revolution inevitable" and what we are seeing here is backlash as workers of the world have been pushed to the brink for many years and now, as the governments are asking them to take that one final step into the abyss – they are, not surprisingly, pushing back. That's why my 2010 Outlook was titles "A Tale of Two Economies."

As we expected, Jobless Claims were a disappointment this week with another 480,000 people involuntarily joining the revolutionary masses (and we will get one whopper of an adjustment tomorrow to the unemployed totals!). Also as we expected, productivity is up nicely – up a whopping 6.2% in Q4 as workers literally kill themselves to keep their jobs. The 138M remaining workers were rewarded with a 4.4% reduction in unit labor costs, which is how US corporations managed to put up those astounding cost savings in Q4 as that's roughly $60Bn in additional profits wrung off the backs of workers in a single quarter. Go capitalism!

In Economic panics throughout history, the wiping out of the savings accounts of lower earners and the middle class has often led to social revolution, sometimes violent upheavals – Nick Clooney

Let the ruling classes tremble at the Communist revolution. The proletarians have nothing to lose but their chains. They have a World to win. Workingmen of all countries unite! – Karl Marx

I began a revolution with 82 men. If I had to do it again, I would do it with 10 or 15 and absolute faith. It does not matter how small you are if you have faith and a plan of action. – Fidel Castro

In just the past 30 years we've seen governments fall in Peru, Iran, Poland, Afghanistan, Czechoslovakia, Romania, Yugoslavia, Philippines, Africa (several and constant) and even Russia yet somehow we run our governments as if "that would never happen here." I'm telling you, my top 10% friends, that the people are as mad as hell and they are NOT going to take it any more. We cannot keep going down this path – it is simply not sustainable.

In just the past 30 years we've seen governments fall in Peru, Iran, Poland, Afghanistan, Czechoslovakia, Romania, Yugoslavia, Philippines, Africa (several and constant) and even Russia yet somehow we run our governments as if "that would never happen here." I'm telling you, my top 10% friends, that the people are as mad as hell and they are NOT going to take it any more. We cannot keep going down this path – it is simply not sustainable.

We went bearish yesterday and I'm feeling pretty good about that decision this morning but I am telling you (and then I'll get on with my market overview) that this is just the tip of the iceberg. We can't afford to have this government at a standstill – this government needs to be in meeting with other World governments and we need to act in concert, the way we did to save the banks. But the banks have been saved and now there are no puppet-masters willing to pull the strings to draw our leaders back together on behalf of the people. This is why James MacGregor Burns said: "A revolution is an act of violence whereby one class shatters the authority of another." Change is in the air but the separation between the upper and lower classes is so great that I don't think most of the top 10% can even see it coming…

As we expected, Asia quickly gave back all of yesterday's gains this morning, rejected at the same bounce levels we were. This was despite "good" news from TM, who claim they will made a profit and project further profits despite the recalls but I'm still waiting to buy them at $65. SNE did well with cost cutting and auto makers did well but that didn't stop the markets from falling this morning with the Hang Seng and India both dropping over 1.5% while the Nikkei and Shanghai gave up about half a point.

Europe is down about 1.5% just ahead of the US open and our futures are off about half that much. We tested, but failed, our projected upside levels yesterday of Dow 10,300, S&P 1,105, Nasdaq 2,225, NYSE 7,100 and Russell 625 and today we test our downside target levels of Dow 10,165, S&P 1,088, Nas 2,200, NYSE 7,000 and RUT 620. Gold and the S&P have both held 1,088 like champs so they will be the first sign of a fatal breakdown toward our 10% levels but copper seems to be leading the way as it looks to test $2.85, which would just be sad if they fail.

Oil is already below $76 so everything is going according to plan – forgive me if that doesn't make me very happy though…