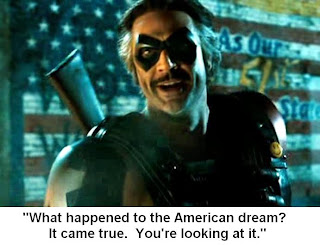

Rorschach’s Journal: Last Night, a Comedian Died in New York…

Courtesy of Jesse’s Café Américain

Courtesy of Jesse’s Café Américain

Somebody pushed AIG out a window, to collect the insurance. They saw the opportunity to extort billions from the Congress by bringing the US financial system to the point of collapse. And they took it. Somebody knows who did it.

Somebody knows.

NY Times

Goldman Helped Push A.I.G. to Precipice

By GRETCHEN MORGENSON and LOUISE STORY

February 6, 2010

…Well before the federal government bailed out A.I.G. in September 2008, Goldman’s demands for billions of dollars from the insurer helped put it in a precarious financial position by bleeding much-needed cash. That ultimately provoked the government to step in.

With taxpayer assistance to A.I.G. currently totaling $180 billion, regulatory and Congressional scrutiny of Goldman’s role in the insurer’s downfall is increasing. The Securities and Exchange Commission is examining the payment demands that a number of firms — most prominently Goldman — made during 2007 and 2008 as the mortgage market imploded.

The S.E.C. wants to know whether any of the demands improperly distressed the mortgage market, according to people briefed on the matter who requested anonymity because the inquiry was intended to be confidential.

In just the year before the A.I.G. bailout, Goldman collected more than $7 billion from A.I.G. And Goldman received billions more after the rescue. Though other banks also benefited, Goldman received more taxpayer money, $12.9 billion, than any other firm.

In just the year before the A.I.G. bailout, Goldman collected more than $7 billion from A.I.G. And Goldman received billions more after the rescue. Though other banks also benefited, Goldman received more taxpayer money, $12.9 billion, than any other firm.

In addition, according to two people with knowledge of the positions, a portion of the $11 billion in taxpayer money that went to Société Générale, a French bank that traded with A.I.G., was subsequently transferred to Goldman under a deal the two banks had struck.

Goldman stood to gain from the housing market’s implosion because in late 2006, the firm had begun to make huge trades that would pay off if the mortgage market soured. The further mortgage securities’ prices fell, the greater were Goldman’s profits.

In its dispute with A.I.G., Goldman invariably argued that the securities in dispute were worth less than A.I.G. estimated — and in many cases, less than the prices at which other dealers valued the securities.

The pricing dispute, and Goldman’s bets that the housing market would decline, has left some questioning whether Goldman had other reasons for lowballing the value of the securities that A.I.G. had insured, said Bill Brown, a law professor at Duke University who is a former employee of both Goldman and A.I.G.

The dispute between the two companies, he said, “was the tip of the iceberg of this whole crisis.”

“It’s not just who was right and who was wrong,” Mr. Brown said. “I also want to know their motivations. There could have been an incentive for Goldman to say, ‘A.I.G., you owe me more money.’ ”

Goldman is proud of its reputation for aggressively protecting itself and its shareholders from losses as it did in the dispute with A.I.G.

In March 2009, David A. Viniar, Goldman’s chief financial officer, discussed his firm’s dispute with A.I.G. in a conference call with reporters. “We believed that the value of these positions was lower than they believed,” he said.

Asked by a reporter whether his bank’s persistent payment demands had contributed to A.I.G.’s woes, Mr. Viniar said that Goldman had done nothing wrong and that the firm was merely seeking to enforce its insurance policy with A.I.G. “I don’t think there is any guilt whatsoever,” he concluded.

Lucas van Praag, a Goldman spokesman, reiterated that position. “We requested the collateral we were entitled to under the terms of our agreements,” he said in a written statement, “and the idea that A.I.G. collapsed because of our marks is ridiculous.”

Still, documents show there were unusual aspects to the deals with Goldman. The bank resisted, for example, letting third parties value the securities as its contracts with A.I.G. required. And Goldman based some payment demands on lower-rated bonds that A.I.G.’s insurance did not even cover.

Still, documents show there were unusual aspects to the deals with Goldman. The bank resisted, for example, letting third parties value the securities as its contracts with A.I.G. required. And Goldman based some payment demands on lower-rated bonds that A.I.G.’s insurance did not even cover.

A November 2008 analysis by BlackRock, a leading asset management firm, noted that Goldman’s valuations of the securities that A.I.G. insured were “consistently lower than third-party prices.”

To be sure, many now agree that A.I.G. was reckless during the mortgage mania. The firm, once the world’s largest insurer, had written far more insurance than it could have possibly paid if a national mortgage debacle occurred — as, in fact, it did.

Perhaps the most intriguing aspect of the relationship between Goldman and A.I.G. was that without the insurer to provide credit insurance, the investment bank could not have generated some of its enormous profits betting against the mortgage market. And when that market went south, A.I.G. became its biggest casualty — and Goldman became one of the biggest beneficiaries.

Longstanding Ties

For decades, A.I.G. and Goldman had a deep and mutually beneficial relationship, and at one point in the 1990s, they even considered merging. At around the same time, in 1998, A.I.G. entered a lucrative new business: insuring the least risky portions of corporate loans or other assets that were bundled into securities.

A.I.G.’s financial products unit, led by Joseph J. Cassano, was behind the expansion. To reduce its own risks in the transactions, the company structured deals so that it would not have to make early payments to clients when securities began to sour. That changed around 2003, however, when A.I.G. began insuring portions of subprime mortgage deals. A lawyer for Mr. Cassano said his client would not comment for this article. A.I.G. also declined to comment.

A.I.G.’s financial products unit, led by Joseph J. Cassano, was behind the expansion. To reduce its own risks in the transactions, the company structured deals so that it would not have to make early payments to clients when securities began to sour. That changed around 2003, however, when A.I.G. began insuring portions of subprime mortgage deals. A lawyer for Mr. Cassano said his client would not comment for this article. A.I.G. also declined to comment.

Alan Frost, a managing director in Mr. Cassano’s unit, negotiated scores of mortgage deals around Wall Street that included a complicated sequence of events for when an insurance payment on a distressed asset came due.

The terms, described by several A.I.G. trading partners, stated that A.I.G. would post payments under two or three circumstances: if mortgage bonds were downgraded, if they were deemed to have lost value, or if A.I.G.’s own credit rating was downgraded. If all of those things happened, A.I.G. would have to make even larger payments.

Mr. Frost referred questions to his lawyer, who declined to comment.

Traders loved Mr. Frost’s deals because they would pay out quickly if anything went wrong. Mr. Frost cut many of his deals with two Goldman traders, Jonathan Egol and Ram Sundaram, who had negative views of the housing market. They had made A.I.G. a central part of some of their trading strategies.

Mr. Egol structured a group of deals — known as Abacus — so that Goldman could benefit from a housing collapse. Many of them were actually packages of A.I.G. insurance written against mortgage bonds, indicating that Mr. Egol and Goldman believed that A.I.G. would have to make large payments if the housing market ran aground. About $5.5 billion of Mr. Egol’s deals still sat on A.I.G.’s books when the insurer was bailed out.

“Al probably did not know it, but he was working with the bears of Goldman,” a former Goldman salesman, who requested anonymity so he would not jeopardize his business relationships, said of Mr. Frost. “He was signing A.I.G. up to insure trades made by people with really very negative views” of the housing market.

“Al probably did not know it, but he was working with the bears of Goldman,” a former Goldman salesman, who requested anonymity so he would not jeopardize his business relationships, said of Mr. Frost. “He was signing A.I.G. up to insure trades made by people with really very negative views” of the housing market.

Mr. Sundaram’s trades represented another large part of Goldman’s business with A.I.G. According to five former Goldman employees, Mr. Sundaram used financing from other banks like Société Générale and Calyon to purchase less risky mortgage securities from competitors like Merrill Lynch and then insure the assets with A.I.G. — helping fatten the mortgage pipeline that would prove so harmful to Wall Street, investors and taxpayers. In October 2008, just after A.I.G. collapsed, Goldman made Mr. Sundaram a partner.

Through Société Générale, Goldman was also able to buy more insurance on mortgage securities from A.I.G., according to a former A.I.G. executive with direct knowledge of the deals. A spokesman for Société Générale declined to comment.

It is unclear how much Goldman bought through the French bank, but A.I.G. documents show that Goldman was involved in pricing half of Société Générale’s $18.6 billion in trades with A.I.G. and that the insurer’s executives believed that Goldman pressed Société Générale to also demand payments.

Goldman’s Tough Terms

In addition to insuring Mr. Sundaram’s and Mr. Egol’s trades with A.I.G., Goldman also negotiated aggressively with A.I.G. — often requiring the insurer to make payments when the value of mortgage bonds fell by just 4 percent. Most other banks dealing with A.I.G. did not receive payments until losses exceeded 8 percent, the insurer’s records show.

Several former Goldman partners said it was not surprising that Goldman sought such tough terms, given the firm’s longstanding focus on risk management.

Several former Goldman partners said it was not surprising that Goldman sought such tough terms, given the firm’s longstanding focus on risk management.

By July 2007, when Goldman demanded its first payment from A.I.G. — $1.8 billion — the investment bank had already taken trading positions that would pay out if the mortgage market weakened, according to seven former Goldman employees.

Still, Goldman’s initial call surprised A.I.G. officials, according to three A.I.G. employees with direct knowledge of the situation. The insurer put up $450 million on Aug. 10, 2007, to appease Goldman, but A.I.G. remained resistant in the following months and, according to internal messages, was convinced that Goldman was also pushing other trading partners to ask A.I.G. for payments.

On Nov. 1, 2007, for example, an e-mail message from Mr. Cassano, the head of A.I.G. Financial Products, to Elias Habayeb, an A.I.G. accounting executive, said that a payment demand from Société Générale had been “spurred by GS calling them.”

Mr. Habayeb, who testified before Congress last month that the payment demands were a major contributor to A.I.G.’s downfall, declined to be interviewed and referred questions to A.I.G. The insurer also declined to comment for this article. Mr. van Praag, the Goldman spokesman, said Goldman did not push other firms to demand payments from AIG….

Read the rest here.