Pattern recognition is the basis for human thought so it’s always fun to look at charts like this one from InTheMoneyStocks and think we may see something we recognize. It’s interesting that looking at some of our other PSW Chart School posts from the weekend that look at virtually the same charts but spot different patterns. Fallond, makes a convincing case that we have confirmed sell signals and Corey at Afraid to Trade also feels we’re in the middle of our correction.

MarketTamer is looking for Dow 9,750, which is the middle of our worst-case targets at around the 10% rule, something I touched on in my own Weekend Wrap-Up, where I did my own humble best to paint a picture that’s worth 1,000 words. Fortunately (although maybe not for you), coming up with 1,000 words has never been a problem for me so I will stick mainly to the Fundamentals, thank you very much!

I did some soul-searching on the situation in Greece, as outlined in our Weekend Reading post and I am comfortable with last week’s gut reaction that we have now adequately priced in both Greece and Portugal’s problems. Our outlying concern is a spread to Spain, Italy and France, which I don’t believe is likely as the cost of bailing out Greece, Portugal, Spain, Italy, France, Turkey and the UK would not even be what the US spent to bail out AIG. The same way we gave the hyenas a bone back in November of 2008 and they attacked any financial institution that showed even a hint of weakness, the pack is now all over any country that is vulnerable to panic. It’s a simple game, short the bonds (sell bonds at low rates), drive rates high, buy back the bonds, collect high yields.

Sure the fact that this sort of activity can disrupt the lives of millions of people might give some people pause but I’m sure someone like PimpCo’s Mahamed El-Erian feels like he’s doing God’s work when he is done loading up on bloated rate bonds and then suddenly announces, as he did this morning (and we predicted he would last week): "The risk of Greece defaulting is low." El-Erian said that, although the Greek government is in need of external financial aid, it likely will not default.

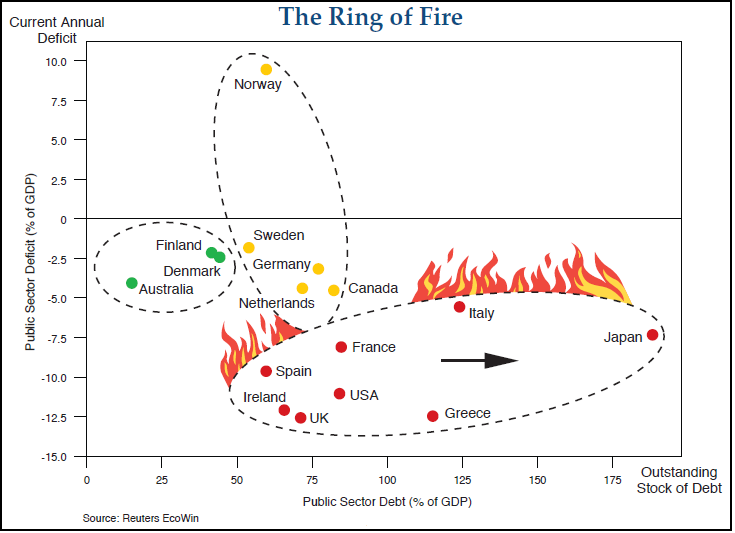

Oddly enough, it was just this past Thursday that PimpCo’s Michael Gomez said: "Stay away from the Euro" which (funny coincidence) drove Greek bonds and CDS swaps to record levels at the same time his boss decided to buy them. And let’s not forget Big Daddy Bill Gross’ "Ring of Fire" commentary that started this whole ball rolling downhill two weeks ago. And, of course, PimpCo consultant at large Alan Greenspan was on "Meet the Press" this weekend talking the bond book as well and predicting a slow (re. low inflation, poor market growth) recovery. This time the part of Greenspan’s sidekick, Jim Cramer, was played by former GS CEO Hank Paulson, who is on week 3 of his image rehab tour. While both men may have made a few good points, they both picked the Colts to win yesterday so really, how can you take any of their predictions seriously?

Speaking of Treasury Secretaries making half-assed predictions – Tim Geithner told ABC news this weekend that the U.S. is in no danger of losing its Aaa debt rating even though the Obama administration has predicted a $1.6 trillion budget deficit in 2010. “Absolutely not,” Geithner said, when asked whether a downgrade is a concern. “That will never happen to this country.”

Speaking of Treasury Secretaries making half-assed predictions – Tim Geithner told ABC news this weekend that the U.S. is in no danger of losing its Aaa debt rating even though the Obama administration has predicted a $1.6 trillion budget deficit in 2010. “Absolutely not,” Geithner said, when asked whether a downgrade is a concern. “That will never happen to this country.”

Well I certainly feel better – don’t you? For a minute there, I was starting to think that borrowing $1.6Tn on top of a $14Tn deficit in a $14Tn economy might result in people wondering how we might be able to pay it back and possibly rate us lower than say – a country with a surplus but I guess Timmy has a much nicer banker than I do as mine tells me it’s not good to borrow more than 6 years worth of projected revenues, especially when there’s no actual income at all.

Timmy and other G7 finance ministers got together this weekend in the Arctic to avoid the usual masses of protesters and all but Canada’s Jim Flaherty skipped the Saturday night feast where the Inuit served seal to their guests. Other than finding a use for what the Inuit call "the other white meat," the G7 forgave Haiti’s debts and pledged to (surprise) keep up the stimulation for the foreseeable future, which pumped up commodity prices in last night’s futures.

None of this cheered Asia up as the Hang Seng fell another 114 points this morning and the Nikkei couldn’t hold 10,000, dropping 105 points to 9,951 as they were disappointed that more was not accomplished by the Finance Ministers. This misses the obvious point (well, to us) that they are FINANCE MINISTERS, not leaders and are not actually able to accomplish anything in two days. Those who want a quick fix will be sorely disappointed as the EU wants their member states to get their own houses in order first and foremost. “The market is still pretty nervous,” said Chris Hall, who helps manage $3.3 billion at Argo Investments Ltd. in Adelaide, Australia. “Greece is still just one part of a bigger concern about the growing size of budget deficits.”

None of this cheered Asia up as the Hang Seng fell another 114 points this morning and the Nikkei couldn’t hold 10,000, dropping 105 points to 9,951 as they were disappointed that more was not accomplished by the Finance Ministers. This misses the obvious point (well, to us) that they are FINANCE MINISTERS, not leaders and are not actually able to accomplish anything in two days. Those who want a quick fix will be sorely disappointed as the EU wants their member states to get their own houses in order first and foremost. “The market is still pretty nervous,” said Chris Hall, who helps manage $3.3 billion at Argo Investments Ltd. in Adelaide, Australia. “Greece is still just one part of a bigger concern about the growing size of budget deficits.”

Europe is half-point bouncy looking this morning, just ahead of the US open and we went into the weekend slightly bullish but mainly in cash. Today is most likely a watch day for us but I often say that right before we put up a dozen trades so who knows….

We don’t have much data this week – just Wholesale Inventories tomorrow, Balance of Trade Wednesday, Retail Sles and Business Inventories on Thursday and Michigan Sentiment on Friday – very dull, on the whole so we can concentrate on earnings, which have been excellent so far. With hundreds of companies set to report this week, the’re plenty of time for bottom fishing so grab your clubs and let the seal hunt begin!

.jpg)