Hello Oxen Report Readers,

Yesterday, we had a fairly successful day. We got into American Commercial Lines Inc. for our Buy Pick of the Day at the day’s open. We were able to buy into the stock at 19.56, and we exited for a 3% gain at 20.04. The stock, however, moved all the way to 20.64, which was a solid 5%+ gain on our entry price. Hope some of you were able to get involved. Secondly, we opened a position with Hansen Medical Inc. at 2.57 in the mid-afternoon. We are looking to hold this one through Friday, unless we can pick up 5-7% over the next two days. The release of Boston Scientific earnings tomorrow will be big for HNSN.

Today has presented us with some good opportunities to do an Overnight Trade since the market is undervaluing.

Overnight Trade of the Day: Macerich Co. (MAC)

Analysis: I am surprised to be dipping into the REIT market for an overnight trade because these stocks are anything but attractive to me for the most part. Yet, we have been seeing the retail side of REITs doing rather well this quarter. Most of these companies have seen attractive growth, especially those with shopping mall exposure. One company that is a retail REIT that is announcing in after hours today that I believe is signaling some very positive possible growth for tomorrow is Macerich Co. (MAC). This company, which is a retail development trust, has a number of the indicators I look for in these trades.

For one, Macerich is in an industry that is reporting positive earnings, yet it has not grown at such a large rate

that it does not have a lot of upward possibilities. In the retail REIT, there has not been a negative surprise on EPS estimates since January 25. Since then, there have been seven straight positive surprises, which is even more attractive because companies like Kimco and Simon Property were among those beating. Macerich has that sort of industry wide undervalue from EPS estimates that we have seen from the significant beats.

Further, MAC, itself, seems to have a pretty significant undervalued EPS for this quarter. It is only expected to report an EPS of 0.91, but last quarter it reported an EPS of 0.97. The companies in the industry, however, for the most part have seen a lot of positive growth in quarter-to-quarter results that would suggest that MAC should be moving above 0.97, as well. I could find very little information that would deter me in this position. They are in the same exact markets as all these companies, and the trend is not company specific but industry wide.

MAC has the other intangibles I like. For one, it has a high beta. The stock can be very volatile, which is what we want for a single day trade. Further, the stock has significant enough volume to make a move. Enough interest is there for the stock to actually go somewhere, but it is not too high where we can’t see enough movement because there are too many individuals involved.

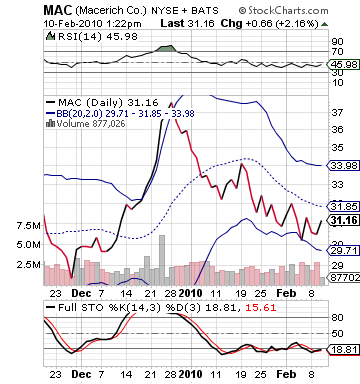

The technicals on MAC are also pretty extraordinary. MAC has been significantly oversold for the past month and a half. It has gone from 38 to 30, which is a change of just over 20%. The stock is right at that lower bollinger band. Yet, we see the bands narrowing, which means this stock is either going to have a major breakout or its going to dive lower. Tonight’s report should be a significant indicator of which way that will be.

Get in today on some lows around 31, and let’s see what we can do.

Good luck!

Entry: Looking for entry to hold through day around 31.00 – 31.10

Exit: Exiting in the morning after earnings.

Stop Loss: None.

Good Investing,

David Ristau