A lot of people ask us how our Alerts work.

There's not much to it actually. Alerts are free to Premium Members but they are just Emails that come from our normal daily Member Chat from myself, Optrade or the Oxen Group. Opt and Oxen usually send out trade alerts but I tend to concentrate on things I consider important enough to send out in case someone is away from their computers or (Heaven forbid!) on some other site. One Alert I send out almost every morning are our daily level watches and then, if something big changes, I'll send out another one but I don't do it often as I don't like to bother people with Emails. We have special feeds for members who want to have every comment sent to them anyway.

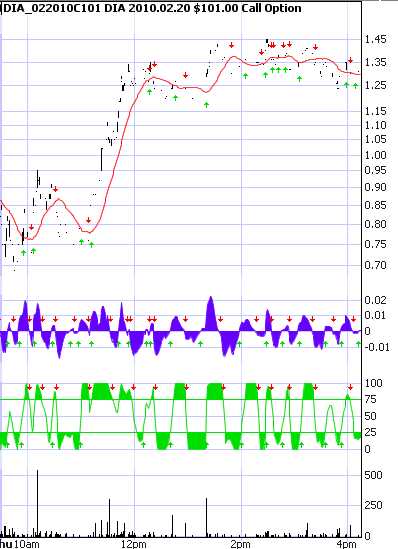

Usually I send out my first alert just after the bell so we can see what the market looks like at the open. Sometimes we see a good play, sometimes we don't. Today looked uncertain so posted two possible DIA plays at 9:33 in Chat that were sent out on our Alert system (it's just an Email!):

So that's it. This comment from Member Chat gets converted into an Email and ends up in your in-box a few minutes later. On top are my normal level selections for the day with comments about what to look for. As I had mentioned in the morning post, I didn't even feel it was possible to make it to our 10,300 levels so I didn't even bother cluttering this post with them this morning. We looked a little weak so I was more concerned about the downside but we held our downsides like a champ and bounced back nicely.

In chat, we took quick profits on the $99 puts and my follow-up comments were:

9:37: "Boy, we can almost count on these morning sell-offs lately. EU funds I think so I still want that upside play."

9:37: "Boy, we can almost count on these morning sell-offs lately. EU funds I think so I still want that upside play."

9:56: ".95 was plenty for the puts. For me, that’s a .15 buffer to enter the longs, now .75 but I don’t want them unless they either get back to .70, (where I’ll risk 1x with 1x at .60 and 2x at .50) or back over 10,020 with a stop right there."

11:19: "Let’s watch that 10,058 line, we either get through it or it’s a good place to buy the DIA $99 puts again."

11:48: "We’re moving now!!! Too much, too fast I think but maybe we get to 10,165 on this run."

1:41: "DIA $100 puts at.62 are good protection with a stop if we break over 10,165 and that’s it for the $101 calls at $1.35 as that is PLENTY for one day."

We had an excellent signal at about 11:15 as all of our indexes began popping over our levels simultaneously and we made a nice, non-greedy exit as we hit our target levels at 1:41, not too far off the day's highs and up 68% from our .80 entry.

I highly recommend to day traders that you get a charting system that gives you live views of multiple charts on the same page. Think or Swim does this nicely and you can play with their platform by setting up a free practice account, which is also a good thing as it let's you practice options trading and various strategies without all that nasty downside that we like to call "gaining experience."

We finished the day at 10,144 and I didn't like the action (low volume commodity-based rally) so we stayed bearish into the close, assuming our 10,165 levels would be rejected or, in the very least, not quickly crossed so we will be able to make adjustment in time for our next Morning Alert. Here's a visual of our other upside index targets that we'll be looking for to go bullish tomorrow:

We need to get a lot more action out of the Russell to get really happy and IWM calls will be the way to go if the Dow breaks out over 10,165 as it's the Russell that will be doing the catch-up work. IWM gained $1 today to $60.58 and needs to gain more than $1 to break the RUT so selling the $61 puts for $1.05 is a nice play with a .65 buffer built in. We can also take the $61/62 bull call spread for .35, which pays $1 (285%) on Friday if RUT is over our 620 mark and we can use Dow 10,165, S&P 1,080, Nasdaq 2,175 and NYSE 6,900 as our stop indicators (2 of 4) so probably risking .10 to make .65 with that one.

That is, of course, if we do open higher, which would annoy me and send me scrambling for covers that pay 3:1 like this one!

Have fun out there,

– Phil