I didn't get to do a wrap-up last week so we have a lot of trades to go over and, with expiration looming and the Fed tightening, I thought it would be good to just get the list out on Friday so we can adjust our rolls to March where neccessary (in bold under appropriate positions).

In our Feb 7th Wrap-Up, I was gung-ho bullish saying "It's Only a 55-Point Drop You Wimps!" and we had been BUYBUYBUYing at the bottom all week, especially Wed-Fri as the market spiked through our projected support at Dow 10,000 but not enough to change our minds as we bottom-fished on AAPL (2 trades), ABX, ACOR, AKAM, AMED, BRK/B (2), C, CCJ (3), CSCO, DELL, FXI, GE, GOOG, IBM, LLY, LOW, NLY, TBT (5 times!), TM (3), TNA, USO (yep, we wen long oil) and UYG. To say we were weigting bullish by that Monday was an understatement as we has finished the weekend in a bullish stance and were relying on our disaster hedges to protect us.

Those disaster hedges are an interesting set to look at, especially now that we've recovered 400 points:

-

DXD July $27/33 bull call spread at $2.50, now $2 – down 20%

- We can roll the $27 calls to the $25 calls for $5 to widen the spread and drop our b/e from $29.50 to $28.50

- EDZ July $3/8 bull call spread at $2.10, now $1.60 – down 23%

- EDZ Apr $10 calls sold for .70, now .15 – up 78% (pair trade)

-

SDS 2011 $36/40 bull call spread at $1.30, now $1 – down 18%

- We can roll the $36 calls to the $33 calls for $1.10

- TBT Jan $35/45 bull call spread at $6.30, now $7.40 – up 17%

- TBT March $50s sold for .65, now $1.22 – down 87% (pair trade)

This is what is great about disaster hedges. The potential upside on these spreads, if the market headed south was up about 100% on the 4 trades so a commitment of 5% of your virtual portfolio to each one (20%) would give you back 40% of your virtual portfolio in cash if the markets tanked. Already, after 2 weeks, we have the markets heading in the opposite direction and what is the cost? Not even 20% of the 20% you may have allocated, a 4% insurance premium while the 80% of the virtual portfolio that is bullish caught a huge rally up and this insurance is still good through July!

Monday (2/8) Market Movement

Monday (2/8) Market Movement

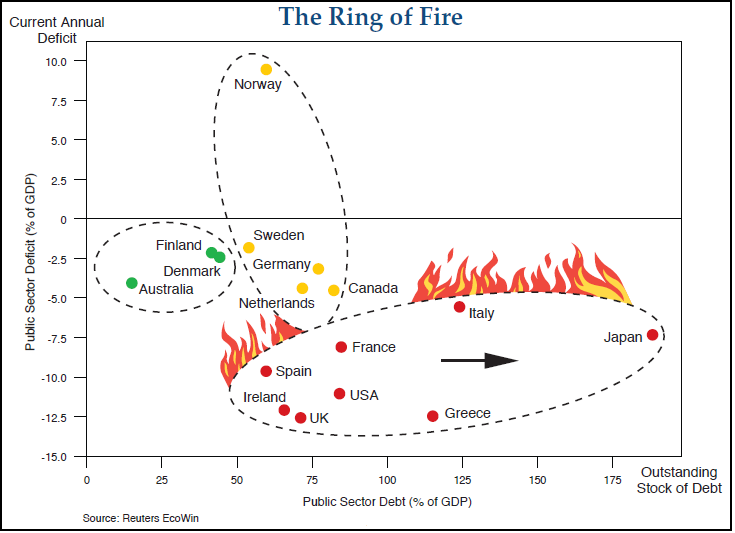

I pointed out how much chart people love patterns and how everyone was saying we were doomed but my conclusion was: "I did some soul-searching on the situation in Greece, as outlined in our Weekend Reading post and I am comfortable with last week’s gut reaction that we have now adequately priced in both Greece and Portugal’s problems." I pointed out how the panic had been driven by a coordinated attack of statements by the boys at PimpCo – capped off by Gross's "Ring of Fire" presentation. Note that this week, PIMCO snapped up emerging market bonds – priced for the fire sale from the fire they started! I didn't need a crystal ball to know this was going to happen because on 2/8 I said:

The same way we gave the hyenas a bone back in November of 2008 and they attacked any financial institution that showed even a hint of weakness, the pack is now all over any country that is vulnerable to panic. It’s a simple game, short the bonds (sell bonds at low rates), drive rates high, buy back the bonds, collect high yields.

It was a down day but, needless to say, we were buying:

- DIA Feb $102 calls at .50, out at .55 – Up 10%

- AXP at $37.60, now $38.83 – up 3.3%

- AXP March $35 puts sold for .95, now .33 – up 65%

- SPWRA March $19 puts sold for $1.60, now $1 – up 38%

- NYX 2012 $25s at $3.20, now $4.30 – up 34%

-

NYX June $26 calls sold for .85, now $1.36 – down 60% (pair trade)

- 200 DMA is $26.50 so we're not worried on this one yet

- MRK several complex spreads – on target

- GSK May $32.50/37.50 bull call spread at $3.70, now $4.30 – up 16%

- GSK March $37.50 puts sold for $1.10, now .45 – up 59%

- WFR Jan buy/write at $7.50/10 – on target

- DIA Feb $102 calls at .49, now $2.15 – up 338%

You can see what I mean by utilizing the disaster hedges. Since we knew that, with a small move down, we were going to gain 20%, we were able to take aggressive bullish plays which we would stop out before they lost 20%. Even if the market was so bad that ALL of our 80% bullish side lost 20%, that would only be down 16% vs a 20% gain on our hedges so we'd still be up 4%. On the other hand, here we have an example of how 80% of your virtual portfolio can gain 30% or more, which is up 24% on the total virtual portfolio vs the 4% loss we see on the hedges. That's a combination of the concept of keeping your virtual portfolio well-balanced and having a positive risk/reward ratio to the trades you have. More on that HERE.

You can see what I mean by utilizing the disaster hedges. Since we knew that, with a small move down, we were going to gain 20%, we were able to take aggressive bullish plays which we would stop out before they lost 20%. Even if the market was so bad that ALL of our 80% bullish side lost 20%, that would only be down 16% vs a 20% gain on our hedges so we'd still be up 4%. On the other hand, here we have an example of how 80% of your virtual portfolio can gain 30% or more, which is up 24% on the total virtual portfolio vs the 4% loss we see on the hedges. That's a combination of the concept of keeping your virtual portfolio well-balanced and having a positive risk/reward ratio to the trades you have. More on that HERE.

Testy Tuesday (2/9) – Faber Says US Treasuries Are Junk

"If the US were a corporation, it would have bonds that are junk rated." – How's that for a fine way to start your morning? Nonetheless we were getting the positive moves we expected in the international markets and we were looking for NYSE 6,793 and Russell 596 to be retaken to keep us bullish – that turned out to be no trouble at all but we were already very bullish from Monday's set and we made no trades that day other than a quick in and out on the DIA.

My comment on the day's movement was: "That was an interesting day, we finished only a little higher than we opened after a wild ride but, generally, we were rejected at 2.5% and fell back to about 1.5%, which is very normal. I’m still mostly bullish back to 10,300. If we don’t make steady progress, then I’ll be concerned." (We were at our famous 10,058 line at the time) My comment on finding out that Goldman had cooked Greece's books and then had the nerve to cut Greek Banks to a sell in the aftermath was: "Why is it, whenever there is any sort of financial crime on this planet – Goldman Sachs is at the scene holding a bloody knife? At what point do people wake up and do something about these guys?"

Wintery Wednesday (2/10) – Are We Now Corrected?

I reminded members in morning post to make use of our Buy List saying: "Often people forget the fundamentals of investing and the biggest fundamental of them all is: "Where else are you going to put your money?" There many fine companies out there with P/E ratios that are below 15. That means if you give them a dollar, they will return 6.6% in earnings." I also said we should be "tight and bouncy" as we move back to test 10,300 and, possibly, the declining 50 dma at 10,397, which is right where we topped out on 2/18. I used the following chart to illustrate the point:

It does look like our range is solid though and we’ll see how well is holds up over the next couple of weeks. The second chart I posted for Members this weekend was the chart of the Dow during 2004, a year I feel we may be repeating as we struggle to get out of the recession backed by plenty of government stimulus. Through October of 2004, the trend was choppy and down and that’s why we’re pursuing mainly market-neutral strategies for now… Until Greece is fully resolved, we can still expect the market to jerk up and down in our ranges and it still looks like healthy consolidation to me – all within our expected ranges so far.

- DIA Feb $101 calls at .79 average, out at .95 – up 20%

- IBM complex spread – on target

- TBT at $48.50, now $50 – up 3%

- ITMN Jan buy/write at $3.40/6.70 – on target

- GLW March $18 puts sold for $1, now .67 – up 33%

- TBT Jan $50s for $5, now $5.40 – up 8%

- TBT March $50s sold for $1, now $1.22 – down 22% (pair trade)

We finished that day down 20 but, obviously, we were still buying all bull trades. The Greece news was just yanking the markets up and down so I did more studying that night and concluded in a special post: "Bailout? Greece Don't Need No Stinking Bailout!" – at least not in such a way that we should care more than we care about NY, NJ, IL, CA….

Thursday (2/11) – Are We Thawing Out or Melting Down?

Just as we were getting over our fear of Greece, the Congressional Oversight Panel put out a Report projecting "$200-300Bn" in losses on CRE who "are about to get hit by a tidal wave of commercial-loan failures."

-

SRS July $6/8 bull call spread at $1.25, now $.95 – down 24%

- Man I hate this ETF! Rolling both legs down $1 (to the $5/7 spread) adds .15 but gives us a .85 better b/e point

- SRS Jan $10 put sold for $3, now $3.60 – down 20%

-

IYR June $40/March $40 spread at $1.50, now $1.10 – down 26%

- May as well buy back March puts for .22 and wait for pullback to sell again.

- DIA $99 calls at .80, out at .95 – up 18%

- DIA Feb $101 calls at .80, out at $1.35 – up 69%

- FCX Feb $70 puts at $1.16 avg, out at $1.25 – up 7.7%

- USO Feb $36 puts at .60, out at .70 – up 16%

- AYE July $22.50/25 bull call spread at .90, still .90 – even

- PM Jan $50/55 bull call spread for $1.60, now $2 – up 25%

- PM June buy/write at $44.02/45.01 – on target

- TBT Jan $41/47 bull call spread at $3.50, now $4 – up 14%

- TBT March $52s sold for .64, now .54 – up 16% (pair trade)

- DIA $100 puts at .62, out at $1.10 – up 77%

- UYG Jan buy/write at $3/4 – on target

Fortunately, we sensed a dip coming the next day as my closing comment to Members was: "I’m still generally suspicious that we’ve had such a strong day on very low volume (136M at 3:40) when there was a storm. An amazing coincidence if nothing else…. The fact that it was led by BS commodity sector making a radical move up on NO news at all (in fact, when data was postponed) makes the coincidence even more amazingly amazing to the point of being kind of impossible to believe…"

We had a lot of fun day-trading the DIAs that day and I detailed the signs we look for in "Day Trading ETF Options," which is great to reference to see what it is we look for when entering and exiting these quick trades.

Fifty Basis Point Friday – China Puts First Pin in the Bubble

Hey, remember when those crazy Chinese raised rates and sent the Hang Seng down 5% the next week? Thank goodness our Fed would never…. What? They did??? Oh, nevermind….

Actually I was proud of China for trying to rein in the commodity/inflation monster. “This is all about controlling the boom, so that we don’t have a bust in the second half,” said Stephen Green, head of China research at Standard Chartered Bank Plc in Shanghai.

We were thrilled with the chance to get out of what were looking like wrong-way short positions we had taken on Thursday and my outlook in the morning post was: "We’re going to be thrilled with today’s drop and get back to cash (on our unhedged positions) over the weekend – there’s no need to risk it after such a fantastic week!"

- DIA Feb $99 puts at .70, out at .65 – down 7%

- DIA Feb $101 calls at .71, out at $1 – up 41%

- AAPL July $185/190 bull call spread at $3, now $3.30 – up 10%

- AAPL July ratio backspread – on target

- BRK/B March $74/76 bull call spread at $1.10, now $1.30 – up 18%

- DIA $101 puts at $1, out at .80 – down 20%

As we were back to cash and as it was a holiday weekend, I didn't get around to doing a Wrap-Up, so I'm catching up here. Unfortunately, I'm out of time (7:15 on Friday) so I'll end here for now. We didn't actually trade much this week as we had set ourselves up very bullish and we were just happy to ride the wave this week. We did add a lot of dividend payers last weekend but I won't have time for in this post so we'll have to wait for the weekend for this week's exciting wrap-up!