Yay, more free money!

Yay, more free money!

Oh not for you (unless you are a banker) but for all of Ben’s best buddies as the Fed Chairman promised yesterday to maintain "exceptionally low levels of the federal funds rate for an extended period." He can do this because, according to Bernanke:

Increases in energy prices resulted in a pickup in consumer price inflation in the second half of last year, but oil prices have flattened out over recent months, and most indicators suggest that inflation likely will be subdued for some time. Slack in labor and product markets has reduced wage and price pressures in most markets, and sharp increases in productivity have further reduced producers’ unit labor costs. The cost of shelter, which receives a heavy weight in consumer price indexes, is rising very slowly, reflecting high vacancy rates. In addition, according to most measures, longer-term inflation expectations have remained relatively stable.. the range that most FOMC participants judge to be consistent with the Federal Reserve’s dual mandate of price stability and maximum employment.

See! I bet you didn’t realize how well things were going, did you? Oil going from $70 to $80 in 15 days isn’t inflation – it’s SUBDUED! Up from $37 last February and March – SUBDUED – As in, DUED, where’s my money???

I mean come on people – he says it right here in one of the early paragraphs (before people start to nod off) – the cost of shelter (ie. your home’s declining value) is heavily weighted in the CPI and since your home is worth less (worthless?) and will remain so for some time – that offsets all the other nasty inflation that is eating into your paycheck.

Aside from the fact that this assumes your home is something you will be buying at a discount TOMORROW as opposed to something you overpaid for yesterday, the whole measurement that Bernanke uses to define success is ridiculous. Housing makes up 42.7% of the CPI, Transportation makes up 17%, Food makes up 15% Medical Care is 6% and Clothing is 3.7%. That’s 85.4% so we’ll call "other" 14.6%.

Now, let’s say you, like most Americans, already own your home. That means what you pay on a monthly basis doesn’t change. Let’s say though, that the cost of Transportation goes up 20% (3.4 out of 100) and Food goes up 20% (3) and Medical Care goes up 30% (1.8) and Clothing goes up 10% (0.4) – that would be an increase in the CPI of 8.6 BUT (and it’s a big but) if you are lucky enough to lose 20% of the value of your home (and we all did), that knocks 8.5 back off the CPI and PRESTO – we have "just" a 0.1% increase in CPI – PRICE STABILITY! See, the $70,000 that dropped off the value of your home offset the $5,000 annual increase in the cost of gas, food, clothing and medicine (because $70,000 mortgages out to about $5,000 a year).

Now, let’s say you, like most Americans, already own your home. That means what you pay on a monthly basis doesn’t change. Let’s say though, that the cost of Transportation goes up 20% (3.4 out of 100) and Food goes up 20% (3) and Medical Care goes up 30% (1.8) and Clothing goes up 10% (0.4) – that would be an increase in the CPI of 8.6 BUT (and it’s a big but) if you are lucky enough to lose 20% of the value of your home (and we all did), that knocks 8.5 back off the CPI and PRESTO – we have "just" a 0.1% increase in CPI – PRICE STABILITY! See, the $70,000 that dropped off the value of your home offset the $5,000 annual increase in the cost of gas, food, clothing and medicine (because $70,000 mortgages out to about $5,000 a year).

It’s one thing to sit there in front of Congress and play number games that paint over what a terrible situation the American people are in but it’s quite another thing TO BASE OUR ECONOMIC POLICIES ON BS STATISTICS!

By the way – Do you know what percentage of the CPI is allocated to taxes? ZERO! Isn’t that AMAZING? They can raise your property taxes, they can raise your school taxes, they can raise sales tax, they can raise income tax… And it doesn’t increase your CPI one bit! I’m in New Jersey and my property taxes jumped 30% this year – if your state is in trouble (and who’s isn’t), you can expect the same. The funny thing about increasing property taxes is it also increases the effective cost of your home (as does increasing utility costs) which then lowers the amount a prospective buyer can afford on a monthly basis, which then lowers the effective price you will ultimately be able to sell your home for. So a $300 monthly increase in your property taxes drops the price a buyer can afford to buy your home for $50,000 (check it out – use the calculator!).

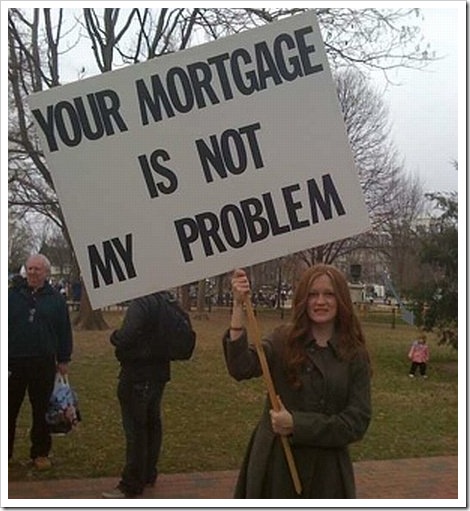

No wonder more and more people are walking away from their homes. If you have house you paid $500,000 with a $450,000 mortgage ($2,500/month) with $700 a month in taxes and $500 in utilities and $300 in repairs – that’s $4,000 a month – and the appraiser tells you you’ll be lucky to get $350,000 for it… Why should you stay? Have you looked at what you can buy for $2,500 a month these days? You can get some nice homes – probably a lot nicer than the one you are in. Maybe you can find a nice townhouse with lower taxes and utilities that can shave $1,000-$1,500 a month off your monthly payments – now THAT’s using the CPI to your advantage, right?

No wonder more and more people are walking away from their homes. If you have house you paid $500,000 with a $450,000 mortgage ($2,500/month) with $700 a month in taxes and $500 in utilities and $300 in repairs – that’s $4,000 a month – and the appraiser tells you you’ll be lucky to get $350,000 for it… Why should you stay? Have you looked at what you can buy for $2,500 a month these days? You can get some nice homes – probably a lot nicer than the one you are in. Maybe you can find a nice townhouse with lower taxes and utilities that can shave $1,000-$1,500 a month off your monthly payments – now THAT’s using the CPI to your advantage, right?

I wrote an article recently that highlighted several ways to shave $100,000 in payments off a $200,000 mortgage that anyone can do with their current mortgage but let’s add "walking away" to the list. In business school, they teach you to cut your losses and corporations walk away from real estate every single day – why then, is there a stigma attached to it when it’s an ordinary consumer making a wise business decision? Heck, when an Industrial Corporation shuts down plants and exits their leases their stocks go UP on the brilliant cost cutting – shouldn’t consumers be similarly applauded when government policy pushes homeowners to the point where it’s simply not worth supporting their money partner’s (the bank’s) asset investment anymore.

That’s right – the bank is your PARTNER when you buy a home. In fact, they took out insurance in case you can’t pay. They bought the asset and you agreed to pay them a good rate of return on their investment. You both looked at the appraisal (in fact, you couldn’t have bought the home without their final approval) and you looked at the costs relative to your income and you both decided it was a good investment that you would be able to pay off over time. Well, guess what – YOU WERE BOTH WRONG! But why are you the only one who is suffering?

That’s right – the bank is your PARTNER when you buy a home. In fact, they took out insurance in case you can’t pay. They bought the asset and you agreed to pay them a good rate of return on their investment. You both looked at the appraisal (in fact, you couldn’t have bought the home without their final approval) and you looked at the costs relative to your income and you both decided it was a good investment that you would be able to pay off over time. Well, guess what – YOU WERE BOTH WRONG! But why are you the only one who is suffering?

You and the bank were in a partnership, perhaps you should consider dissolving that partnership. I am advocating this now after watching Bernanke spin his BS yesterday and watching our clueless Congresspeople nod like toy dogs on a car’s dashboard while the Fed justifies putting YOU in debt for the rest of your life to rescue the banks so THEY don’t have to skip a bonus. "Oh Phil," you may say, "what if the the banks had gone under – that would have been terrible."

Why would that be terrible? And I’m talking to you little people in the bottom 90% now, not my rich subscribers – Why do you give a rat’s ass if the banks fail? What do they have of yours? Maybe $10,000 in savings if you are the average American. What do you have of theirs? A $200,000 home with a $150,000 mortgage (also if you are the average American). So, if the bank disappears tomorrow – who wins? The only reason you think it’s a bad thing is because you believe that the bank can go under and not give you your money but somehow you still have to honor your obligation to pay them. That makes no sense, does it?

Sure our convoluted laws are written in the bank’s favor but let it all really hit the fan and see how fast those laws are reinterpreted by a jury of your peers. Your bank is an investment partner. You both saw a $500,000 home you liked and the bank said: "Hey, if you put up $50,000 and pay all the closing and transfer costs, I’ll put up $450,000 for the "asset" which you can pay me back with interest over time while paying all the taxes on my asset and maintaining my asset until the time I collect (at 6%) $971,000 from you over 30 years for my $450,000 investment. THEN I’ll give you the deed to the house." Since you have been brainwashed from birth to believe that owning a home is the only way you can consider your life a success, you agree to this insane arrangement and that’s all fine as long as the "value" of the home goes up because, in theory, you are building up some retirement savings.

What happens when that underlying assumption is false. Then you are simply throwing money down a gigantic pit with no end in site, all in an effort to make sure the bank gets a 215% return on their investment. Let’s say you’ve been in the $500,000 home for 6 years and it’s now worth $350,000 and you are paying your $4,000 a month to stay in it. If you walk away you have still left the bank with your $50,000 deposit plus 7 years of $2,500 monthly payments ($210,000) AND the house. So the bank already got you for $260,000 on your $500,000 home and unless they can’t get $240,000 for it – at least THEY get out of the deal even. Why is it we cry for the banks?

Man, they have you and Congress and the President totally conned with their armies of lobbyists and PR people don’t they? It’s not your home they don’t want you to walk away from, it’s the 23 years of $2,500 payments ($690,000) they don’t want you to walk away from because they WILL NOT GET ANOTHER SUCKER TO MAKE A DEAL LIKE THAT IN THIS ECONOMY! Get it – you are the fish on the hook and they don’t want to let you go. That’s what this is all about. It’s not about morals and it’s not about "screwing" the banks – it’s about locking you into an unaffordable payment plan in which your joint asset has taken a huge hit but your business partner insists that YOU and YOU ALONE bear the ENTIRE loss. Not only that, your partner insists on making their PROJECTED profits for the next 23 years DESPITE the MASSIVE change in the underlying asset that you purchased TOGETHER.

Does that sound ridiculous? Is your partner being unreasonable? THEN DISSOLVE THE PARTNERSHIP!

OK, now that I’ve got that off my chest, let’s take a look at the markets….

We have a big snow storm in NY and Bernanke is testifying to the Senate today. I used to say the Senators were generally smarter than the Representative – at least they generally serve longer and get a chance to learn something about the committees they are on but this particular Congress has caused me to lose all faith in our elected representatives, who have sold this country right down the road to special interests at exactly the time that the people need them the most.

We have a big snow storm in NY and Bernanke is testifying to the Senate today. I used to say the Senators were generally smarter than the Representative – at least they generally serve longer and get a chance to learn something about the committees they are on but this particular Congress has caused me to lose all faith in our elected representatives, who have sold this country right down the road to special interests at exactly the time that the people need them the most.

Speaking of which, another 496,000 voters lost their jobs last week, that’s 36,000 (8%) more than estimated. Looking at the report data, the item that strikes me is the U1 Benefits being paid as of Feb 6th is 5,479,942 that’s up 196% from last year’s 1,847,439. Nice job stability Ben!

Fear not my top 10% comrades – everything is fine up here on top, though, as Durable Goods were up 3%, that’s 100% more than what "expert" economists had predicted but right in line with my "Tale of Two Economies" theory as economists tend to be idiot acedemics who don’t understand the joys of "zero down-zero payments for 12 months" or the fact that if I lay off just one employee, I can buy Tina that new washer and dryer she’s been wanting (sorry Greg!). Ah capitalism – you efficiently drive us to make the wise decisions….

Asia was generally down this morning other than the Shanghai, which magically rose 1.25% to 3,060. Here’s Bloomberg’s "China" page – maybe you can figure out why because I sure can’t. India is forecasting 8.2% GDP growth, which is great because it means that consumers will only fall 8.8% behind their 17% food inflation rate – clearly India went to the Ben Bernanke school of Fine Federal Fiddling. Ron Paul tried to make the point that our 4.7% GDP growth isn’t all that impressive in the face of a 10% growth in the money supply but unfortunately raised other issues to which Uncle Ben made the general comment that Pauls allegations were "bizarre" but what Bernanke did not realize is that Ron Paul got him to agree to turn over a great deal of records for examination and Barney Frank made it an actionable item.

Also under intense scrutiny today is Greece, where bonds are once again falling on downgrade threats, driving the Euro ($1.34) and the Pound ($1.52) to 10-month lows against the dollar and the Yen (89). Overall European Economic Sentiment fell slightly as the European Commission said that European domestic demand remains weak and it’s not yet clear to what extent the Euro region will benefit from a global recovery. As governments seek to bolster the recovery, they also are trying to stem investor concern about widening budget deficits in Greece and other nations.

We will be having that same problem today as the US seeks to sell $32Bn in 7-year notes to suckers investors who wish to tie up their assets in dollars at 3.5% interest for the next 7 years. Who these anxious buyer are remains a great mystery, as does how it is possible that they can coexist in the same financial eco-system as gold bugs, housing speculators, carry traders and other commodity hoarders but the game continues until the authorities come to break it up and, since this game is run by the "authorities" – we could be in for a long run indeed!

Overall, we could not be more pleased with our oil and gold shorts as we topped out right at our $80 target, giving us fantastic entries on USO puts as well as the futures. Copper will test the $3.20 line today and we have to be very pleased with our short play on FCX as well, now down around $71 from our $77.50 entry. TBT sold off nicely and is ripe for a re-entry ahead of the longer-term Treasury cycle and we should be getting excellent entries on our new $100,000 Virtual Portfolio, that is designed to make a nice, conservative, well-hedged 25% annual return – as opposed to the more aggressive $100KP, which is up 8% for the week and will be doing even better this morning with 200 USO $37 puts that were picked up yesterday at .52.

So another fun day of market watching and more BS from Ben but this time the markets may not be biting as we have the FHFA Housing Price Index at 10 and a Congressional hearing on the "Foreclosure Problem," which is never a good thing to remind investors of. Meanwhile we’ll be watching our ranges, same as yesterday and I do think our 5% levels will hold and tomorrow I expect a push back up.