Courtesty of My Budget 360:

Many Americans are not buying the recent stock market rally.

Many Americans are not buying the recent stock market rally.

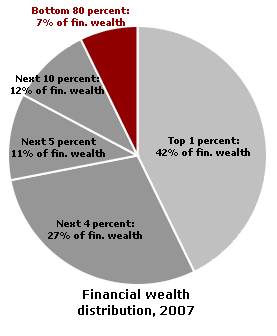

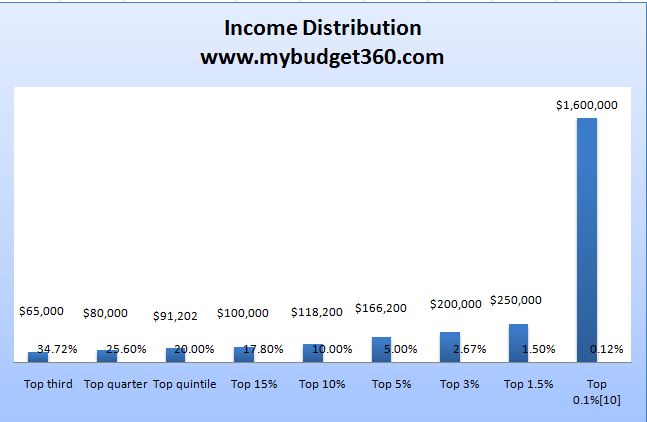

This is being reflected in multiple polls showing negative attitudes towards the economy and Wall Street. Wall Street is so disconnected from the average American that they fail to see the 27 million unemployed and underemployed Americans that now have a harder time believing the gospel of financial engineering prosperity. Americans have a reason to be dubious regarding the recovery because jobs are the main push for most Americans. A recent study shows that over 70 percent of Americans derive their monthly income from an actual W-2 job. In other words, working is the prime mover and source of their income. Yet the financial elite have very little understanding of this concept. Why? 42 percent of financial wealth is controlled by the top 1 percent. We would need to go back to the Great Depression to see such lopsided data.

Many Americans are still struggling at the depths of this recession. We have 37 million Americans on food stamps and many wait until midnight of the last day of the month so checks can clear to buy food at Wal-Mart. Do you think these people are starring at the stock market? The overall data is much worse:

Source: William Domhoff

If we break the data down further we will find that 93 percent of all financial wealth is controlled by the top 10 percent of the country. That is why these people are cheering their one cent share increase while layoffs keep on improving the bottom line. But what bottom line are we talking about here? The Wall Street crowd would like you to believe that all is now good that the stock market has rallied 60+ percent. Of course they are happy because they control most of this wealth. Yet the typical American still has negative views on the economy because they actually have to work to earn a living:

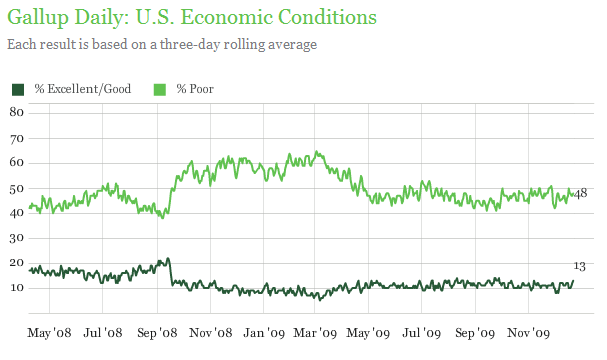

The above daily poll asks Americans about their view on the health of the economy. Only 13 percent believe the economy is good or excellent. Funny how that correlates with the top 10 percent who control 93 percent of wealth. Many Americans were sold the illusion of the bubble. They were sold on the idea that their homes were worth so much more than they really were. And many used this phony wealth effect to go out and spend beyond their means. They started spending as if they were part of this elite 10 percent crowd. But once the tide rolled out, it was clear they were not. And the horribly built bailouts demonstrate who is controlling our political system. This was not the rule of a capitalist system but a corporate run government.

Just think about the bailouts and which companies were saved. We ended up bailing out the worst performing and troubled companies thus keeping alive companies that should have completely failed. Did we bail out Google? Proctor and Gamble? Of course not. These companies actually produce something that people want. Banks and especially the Wall Street kind merely keep that 42 percent happy by making sure their stock values stay high so they can keep on making money while the average Americans is sold up the river.

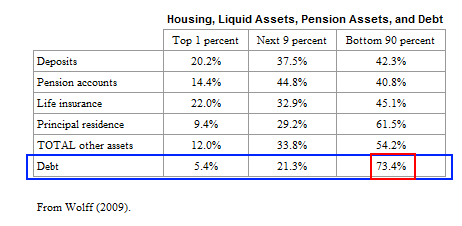

Yet many were brought into the easy money fold by going into massive amounts of debt. And who has most of the debt? That is right, the average American:

Yet many were brought into the easy money fold by going into massive amounts of debt. And who has most of the debt? That is right, the average American:

The bottom 90 percent have been saddled with 73 percent of all debt. In other words much of their so-called wealth is connected to debt. Debt is slavery for many especially with egregious credit card companies taking people out with absurd credit card tricks and scams. Yet the corporate propaganda machine is strong and mighty. Have you ever received an inheritance? A large one? Probably not because only 1.6% of all Americans receive an inheritance larger than $100,000. If this is the case, why in the world do politicians worry so much about the tax impacts of this? Because they want to keep the corporatocracy alive and well so their spawn can get a piece of their pie. They give the illusion to average Americans that if you only work hard enough you too can join this elusive club of cronies. The data shows otherwise.

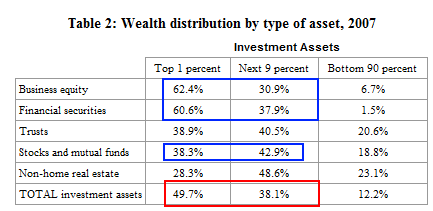

But, if we start looking at investment assets, the true wealth in the country, we start realizing why Wall Street is all giddy about the recent stock market government induced rally.

But, if we start looking at investment assets, the true wealth in the country, we start realizing why Wall Street is all giddy about the recent stock market government induced rally.

Of investment assets 90 percent of Americans own 12.2 percent. The rest goes to the top 10 percent. Welcome to the new serfdom. The bailouts that went out to the filthy rich were more about protecting their tiny corner of the world than actually making the economy better. That is why it is interesting to see companies fire people and Wall Street cheer for the increase in earnings per share. Good for the few at the expense of the many. Yet the propaganda out of Wall Street and our government is what is good for Wall Street is good for you. Just like that 1.6% inheritance issue, the vast majority of Americans won’t deal with that and their primary concern is simply a job. A job that has provided stagnant wages for a decade while the ultra wealth get richer and richer in a phony form of corporate socialism.

If you break down the data you realize that most Americans don’t have time to speculate in stock markets:

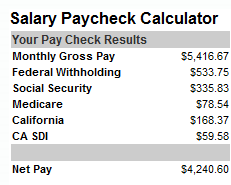

Only 34% of U.S. households make more than $65,000 per year. What is that after taxes? Let us use a state like California for example:

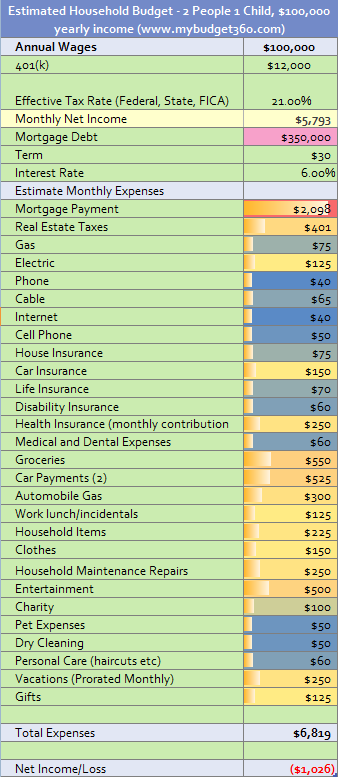

Now if we breakdown this data further you will realize that most of the money is consumed by cost of living necessities, not Wall Street speculation. Just to show this example let us look at a family budget for someone in California making $100,000.

Now if we breakdown this data further you will realize that most of the money is consumed by cost of living necessities, not Wall Street speculation. Just to show this example let us look at a family budget for someone in California making $100,000.

Notice after running the budget we are in the hole for $1,000? That is because of many costs that typical families have. We can debate the merits of where they are spending money but the point is this; are these people really making beaucoup money from the stock market? They are putting away $12,000 a year into their 401k. As we have now found out, 8 percent a year is never guaranteed in the stock market although the corporate powers would like you to believe that so they can have other suckers to unload stocks onto.

“Yet the median household income in the U.S. is $50,000 and not $100,000. They have even less to invest.”

They are more concerned on working to have a paycheck to pay for necessities. They are more concerned about paying their house off by the time they retire and hopefully, have a little bit of retirement funds coming in. The sad fact is most Americans rely on Social Security when they retire. All those ads of unlimited golf and daily trips to Tahiti are propaganda of how Wall Street lives and they want to sell you the sizzle, and clearly not the steak. They live their lives paper pushing and sucking the life out of the productive part of our economy. The average American should now realize this since this financial crisis was primarily caused by them. They are now on a massive campaign to blame Americans for this. This is hypocrisy to the next level.

Many Americans have paid for their mistake by losing their home through foreclosure. We have 300,000 foreclosure filings a month. Many have taken a hit to their overall stock virtual portfolio (if they have one). Yet the corporate cronies have protected their horrible economy crushing debts at the taxpayer expense. Unlike you, many hold bonds on the companies and not common stock like many Americans. Bondholders have been protected at all costs during this crisis. Goldman Sachs through AIG received 100 cents on the dollar for their horrible bets. The banks have unlimited back stops thanks to taxpayers. This is how the top 1 percent rule the new feudal state.

Welcome to the 2010 serfdom. Time to wake up and restructure the system. Many people are starting to wake up to this massive scam.