Pictures of a Market Crash: Beware the Ides of March, And What Follows After

Courtesy of JESSE’S CAFÉ AMÉRICAIN

There are a fair number of private and public forecasters that I know who anticipate a significant market decline in March.

Let’s review where we are today.

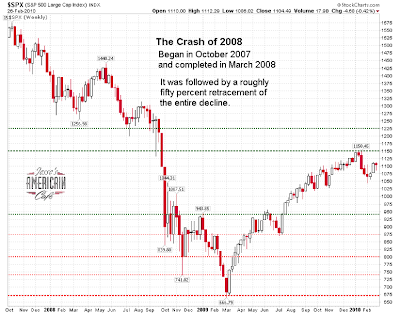

The Bear Market of 2007-2009, marked by the Crash of 2008, was a massive decline in equity prices precipitated by the bursting of the credit bubble centered around housing prices and packaged debt obligations of highly questionable valuations.

Even today, I think most people do not appreciate the sheer magnitude of the decline, and the damage it has done to the real economy. This is the result, I believe, of three factors:

1. An extraordinary expansion of the Monetary Base by the Federal Reserve not seen since the aftermath of the Crash of 1929, and a swath of financial sector support programs from the Fed and the Treasury, resulting in a spectacular fifty percent retracement from the bottom.

2. A comprehensive program of perception shaping by the government in conjunction with the financial sector to raise consumer confidence and prevent a further panic.

3. An understandable preoccupation with the details of breaking news, and a short term focus on particular events and even exogenous controversies, without a true appreciation of the ‘big picture,’ in part because of some very effective public relations campaigns.

This is resulting in a remarkable case of cognitive dissonance in which the victims of a spectacular man made calamity are opposing remedies and aid as too costly, as they walk around bleeding in the carnage.

For those who read the contemporary literature in the early Thirties, this is nothing new. In the early Thirties there was no sense of the magnitude of what had happened, except for a few notable exceptions, and the sense of ‘life goes on’ seems almost eerie to a modern reader. Indeed, Herbert Hoover could dismiss a delegation of concerned citizens with the advice that they were too late, the crisis was past.

The parallels with the Thirties and the Teens (today) are many, and uncanny.

There is the reformer President, elected to redress the policies of his Republican predecessor. In the Thirties they had FDR who was a decisive and experience leader. In the Teens the US has a community organizer much more in the sway of the Wall Street monied nterests, who is trying to work through indirection and persuasion.

There is a Republican minority in the Congress which opposes all new programs and actions in both cases. In the Thirties they were over-ridden by a powerful President, who created a "New Deal" set of legislation, much of which was later overturned by a Supreme Court which had been largely selected by the previous Republican Administrations.

Indeed, the remaining New Deal programs that were successful, the reforms of Glass-Stegall and the safety net of Social Security, are being overturned and are under attack in an almost bucket list fashion.

So what next?

Another leg down in the economy and the financial markets is a high probability.

Although one cannot see it just yet in the fog of corrupted government statistics, the economy is not improving and the US Consumer is flat on their back.

There are still far too many otherwise responsible people who are not taking the situation with the high seriousness it deserves. They would like to see the US economy collapse, inflicting serious pain and deprivation because it may:

1.suit their investment positions and feed their egos,

2. satisfy their philosophical and emotional needs to see punishment administered, almost always to others, for the excesses of the credit bubble, even if they are unwitting victims, and/or

3. the sheer nastiness and immaturity of a portion of the population.They know not what they do, until they do it, and see the results. It is often a good bet to assume that people will be irrational, almost to the point of idiocy and self-destruction. And some of them never wake up until they are overrun, and then will not admit their error out of a stubborn sense of pride and embarrassment.

There most likely will be a new leg down in the financial assets, as reality overcomes often not-so-subtle propaganda. It may start in March, or we may just see a ‘market break’ that provides a subtle warning for a large decline to begin in October 2010, with a multi year progression to lows that are as of now almost unimaginable, at least in real terms.

The Fed is acting in a way so as to mask quite a bit of this. One would hope that they would not re-enact the policy error of their predecessors and raise rates prematurely out of fear of inflation.

But the error might be emulated by a failure to stimulate the economy effectively and reform the highly inefficient and impractical financial system. The global trade system is a farcical construct that favors a few national elites and multinational corporations. Public policy discussion has been trumped by a handful of economic myths and legends that, even though disproved every day, nevertheless remain resilient in public discussions and reactions.

A more serious market crash might cause people to recognize the severity of their problems, and the thinness of the arguments of the monied interests for the status quo which is most clearly unsustainable.

The outcome is difficult to predict precisely because there are multiple paths that events might take at several key decision points, and some of them might be rather disruptive and upsetting to civil tranquility.

But as the dust continues to settle, the probabilities will continue to clarify.