Here’s THE EPICUREAN DEALMAKER‘s reading list – TED is an avid book collector who has bought far more diverse and intellectually exciting books than he’s ever going to read. The mere act of buying all those books is very impressive so we should pay attention. – Ilene

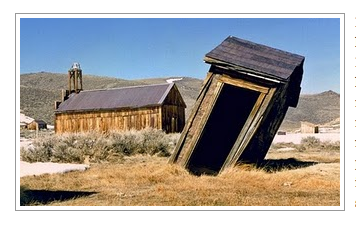

Pulp Fiction

Courtesy of THE EPICUREAN DEALMAKER

[A WSJ’s Ten Wall Street Blogs You Need To Bookmark Now blog – congrats!]

I suspect that many of you, O Dearly Beloved and Most Patient of All Possible Readers, have grown weary of all the self–indulgent twaddle Your Normally Relevant (Or At Least Mildly Amusing) Bloggist has been posting recently in these pages. I know that I have. That being said, I have been assured that "with great power comes great responsibility"—or some such bullshit or other—so I have felt compelled to draw some necessary attention to a few of the gears and levers behind the otherwise seamless facade of this two-bit opinion emporium. I promise to drop such self-referential crap posthaste and return to my proper métier—flinging obloquy, calumny, and invective into the blogosphere with the wanton abandon of a short order cook on speed—as soon as humanly possible.

I suspect that many of you, O Dearly Beloved and Most Patient of All Possible Readers, have grown weary of all the self–indulgent twaddle Your Normally Relevant (Or At Least Mildly Amusing) Bloggist has been posting recently in these pages. I know that I have. That being said, I have been assured that "with great power comes great responsibility"—or some such bullshit or other—so I have felt compelled to draw some necessary attention to a few of the gears and levers behind the otherwise seamless facade of this two-bit opinion emporium. I promise to drop such self-referential crap posthaste and return to my proper métier—flinging obloquy, calumny, and invective into the blogosphere with the wanton abandon of a short order cook on speed—as soon as humanly possible.

Before I do, however, I must beg your indulgence one last time.

I do this for two reasons. For one, I am sure like many of you I have been intrigued by the confessional pieces in The Atlantic Wire by Michael Lewis and Felix Salmon as to what and how they read from among the vast quantities of material they are assaulted with every day. (And, in my case, my interest is not limited simply to the fact that Felix repaid my substantial bribe with a shameless plug for Yours Truly. Who could have guessed, for example, how woefully out of touch with the zeitgeist du moment Mr. Lewis appears to be?) Second, my recent list of online resources I normally consult elicited an appeal from more than one correspondent to share my taste and recommendations in more earthbound information; namely, books. This strikes me as a reasonable request, and in addition one which answered might disabuse the casual visitor to these shores of the notion that I restrict my intellectual stimulation to purely online sources.1

That being said, I will continue my unstated but essential policy of restricting my personal revelations to material cognate to the stated mission of this blog site; namely, the periodic examination and evisceration of topics, issues, and personalities central to the global financial markets. For, to be honest, to do otherwise would be to be at once both misleading and disingenuous.

Misleading, for I am one of those (un)happy souls whose taste in reading is so protean, so diverse, and so discombobulated that a normal mortal encountering my unabridged reading list can do nothing less than shake his or her head in stubborn disbelief or succumb to a fatal aneurysm. Disingenuous, for I am also one of those sorry saps who still spends weekends browsing bricks-and-mortar bookstores and adding so many intriguing titles to my currently staggering backlog of unread material as to make it unlikely I will have finished reading my 2009 purchases before 2025.

In short, I am a book collector, and, like most exemplars of that sorry species, I have no possible hope in Hell of ever reading all the titles I have acquired in pursuit of my pathetic compulsion. I can assure you, for what it’s worth, that an abridged catalogue of the titles I have obtained in the last six months would impress the shit out of you, both for their diversity and apparent intellectual heft. But by the same token I must admit that the likelihood I will ever read the majority of them—or even understand the few that I do—is vanishingly small. Fortunately—I suppose—my wallet has, to date, been adequate to support my intellectual pretensions, even if the free time I can devote to reading non-work-related material and my capacity for understanding it have not.

So I hope you will forgive me if I restrict my catalogue to the limited selection of finance-related tomes below. I do not pretend this list is comprehensive—or even any good—but, hey, you’re the clowns who asked for it. Make a list, check it twice, and make sure to tell Amazon.com or your local bookseller that TED sent ya. (I have kickback arrangements in place with 75.6% of all virtual and real-world booksellers east of the Continental Divide. Those bloodsuckers owe me something.)

- Roger Lowenstein, When Genius Failed — The saga of Long-term Capital Management. Hedge fund hubris on a skewer.

- Andrew Ross Sorkin, Too Big to Fail — Lehman Brothers, AIG, and the Great Global Clusterfuck of 2008, in exhaustive but entertaining real-time detail. Reads like what it’s really like to be in the room with a bunch of high-powered assholes in an exceedingly tight spot. Therefore, I believe it to be actually and literally true.

- Bryan Burrough and John Helyar, Barbarians at the Gate — The classic saga of the LBO of RJR Nabisco. Unforgettable.

- Richard Bookstaber, A Demon of Our Own Design — A tendentious screed on derivatives, made worthwhile by the fact that the author actually knows what the hell he’s talking about.

- Jonathan Knee, The Accidental Investment Banker — Inside baseball on what it’s really like to be an investment banker. At least 60% true, from my perspective, which is as ringing an endorsement as you’ll ever hear from me.

- Ken Auletta, Greed and Glory on Wall Street — Ancient history of (a very different) Lehman Brothers, but still an au courant primer on the greed and egotism of Wall Street’s finest, as well as a revealing exposé of the ineluctable tension between corporate finance bankers and sales and trading.

- Nassim Nicholas Taleb, Fooled by Randomness — Notwithstanding the author’s sorry descent into pompous self-caricature in The Black Swan, this slim volume is chockablock with interesting, entertaining, and valid insights.

- Robert Eccles and Dwight Crane, Doing Deals — Another ancient (1988) primer on the structure and workings of investment banks which, mirabile dictu, is still accurate and valid. The more things change …

In addition, I have a few promising volumes either in my possession or on my to-buy list from which I expect great things.2 These include:

- Donald MacKenzie, An Engine, Not a Camera: How Financial Models Shape Markets

- Julie Froud, Sukhdev Johal, Adam Leaver, and Karel Williams, Financialization and Strategy: Narrative and Numbers

- Justin Fox, The Myth of the Rational Market

- Michael Lewis, The Big Short

Enjoy the hell outta them, why don’tcha? I plan to, if I ever get around to reading them.

1 And yes, if you must know, like Lewis and Salmon I read print newspapers, like the Financial Times and The Wall Street Journal, daily and The New York Times on weekends. I get most of my current market data from an exceedingly expensive Bloomberg terminal, and I supplement my regular online reading list with a liberal sprinkling of serendipitous links from my Twitter feed. Beyond that, you have no legitimate reason whatsoever to know what else I do or do not read, and I have no intention of telling you. Have a nice day.

2 Having a day job, and not having valid press credentials or a disclosable address to which publishers can send me free review copies, you might imagine I do not have the time or opportunity to read many of the huge number of recent releases on the financial crisis which have become available of late. You would be correct. Besides, interesting or not, in my opinion 99.9% of the material ever written on Wall Street does not meet the threshold of a hardcover book price. Yes, that’s right: when it comes to Wall Street books I’m a cheapskate, and I wait for the paperback edition. So sue me.

© 2010 The Epicurean Dealmaker. All rights reserved.