It's hard to believe that just one year ago today investors thought the world was ending!

Well, not all investors – we were BUYBUYBUYing at the time, as I recapped back in September whan we did our "Market Crash – Year One Review." Click on Cramer's picture for the Daily Show's March 4th, 2009 review of the magical moments that led us down to the bottom and here's another great video from the evening broadcast on March 9th and, of course, there is my own legendary appearance on LiveStock from March 6th, but that's summarized in the crash link, so save yourself 3 hours, although the first 10 minutes are worth it for people who want to learn about our buy/write strategy as I explained the logic of it as I recommended FAS at $2.41 using those hedges.

And what a wild year it has been as we've made an epic recovery. The only question is – have we come too far too fast? Should we be up 75% from our March 9th lows? We are still down 25% from our highs but let's keep in mind that we made those highs thinking AIG was MAKING money, that FNM and FRE were great stocks for your retirement virtual portfolio, that Kirk Kirkorean was going to rescue GM, that BZH wasn't some kind of scam, that BSC, LEH et al were "the smartest guys in the room." I urge you to click on Cramer and listen to the idiocy of the analysts who would tell you everything is all right even as it was all falling apart around them – why does everyone suddenly trust them again?

How could we not love this market? Markets do this sort of thing all the time don't they? It's all part of the "efficient pricing model" that always lets you know what a stock is truly worth like when GE was "worth" $30 in 2008 and "worth" $6 in 2009 and is now "worth" $16. This is not some biotech folks – this is GE, they've been around for 100 years and they have $170Bn in global sales. Did they really drop 80% in value in 2009? No. That's why it was easy to pick a bottom – the valuations got ridiculous and, as fundamentalists, we siezed on the opportunity to BUYBUYBUY despite the negative sentiment.

Now, we are in a very different situation. Now we have the MSM telling us to BUYBUYBUY despite the 75% run-up, as if a return to Dow 14,000 and S&P 1,500 is inevitable. My problem with this is that those levels were based on profits that never actually happened so how can we return to them? Clearly the solution our government has chosen is to continue to allow companies to report profits that never actually happened so we can slip back into our fantasy world where 30M unemployed, discouraged and under-employed Americans are somebody else's problem as are the 4M families facing foreclosure this year and the 20M families that are behind on their mortgage payments, who may be joining them.

I have not been a fan of the recent move up as we were led by commodity stocks, real estate and financials. People, these are the SAME guys who led us to our doom last time! Is it really that hard to remember?? I'm sorry but if I get into one more conversation where someone tells me "this time it's different" I will FREAK OUT! I'm getting interviewed and my views are considered "radical" because I'm still a bit concerned about the soundness of the banks who have Trillions of dollars on loan to unemployed people and businesses who serve unemployed people and on houses and CRE that is not selling and even to countries that themselves have debts they can't possibly pay. My views are radical because I'm CONCERNED?

I would be a lot less worried if other people were worried but what really worries me is how NOT worried the MSM is (or at least how they edit and present the views of the people who they decide to allow access to). And, if the average person didn't believe what they see on TV – I would not be worried but, sadly, they do! It is possible for a group of people – for a whole society, in fact, to believe something that is totally untrue. The people of Pompeii were proud that Vulcan had chosen to make his home in their mountain, for example…

So the people of America have chosen to believe that spending $80 for a barrel of oil and importing 11 Million Barrels a day and sending $321Bn a year OUT of the country to some of the very same people we are spending another $600Bn a year fighting a war against is the sign of a healthy economy. Keep in mind that $321Bn is only about 1/2 of our oil spending in total. In addition to the stimulus last year we also had oil that averaged $50 a barrel for the first half of 2009. With 19Mbd consumed in the US, that was putting $17Bn PER MONTH right back into consumer's pockets vs $80 oil or, to put it another way – we now have $17Bn less money per month to spend than we did in June. Of course, refining mark-ups and other rising commodities make it more like $50Bn a month but, since that extra $50Bn is counted into our GDP – it's a GOOD thing, right?

That's my premise for being cautious, the same one I had back in 2007 and 2008 as oil went over $80 and I kept saying it was going to destroy the economy. I was wrong for a very long time – keep that in mind – but then, I was very tragically right as we finally hit a wall and the economy fell off a cliff. But the wall wasn't caused by the sudden spike to $140 – the wall was caused by people running out of credit cards and second mortgages they were using to pay for all the oil. If we're shipping $321Bn out of the country at $80 – how much did we have to borrow to subsidize $140? And that money is NEVER coming back!

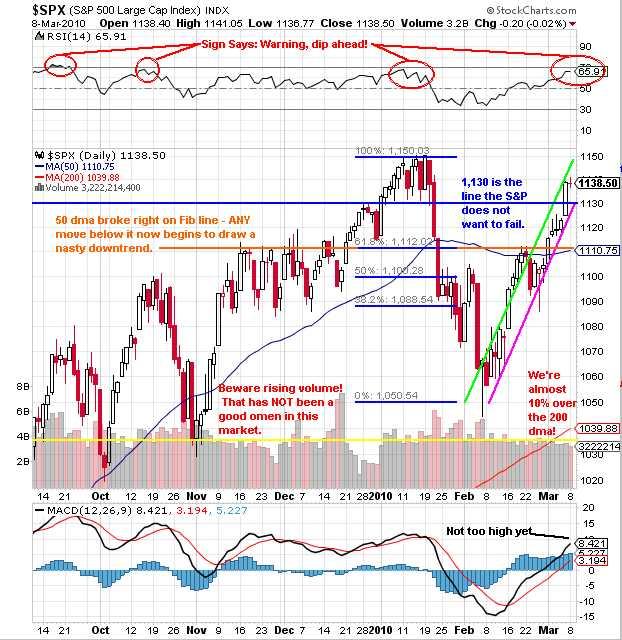

Since we originally had to borrow money to pay for $80 oil and now we, the people, are all tapped out – how can we be expected to do it again? It's an unsustainable model BUT – it may take a while before we hit the wall so we will party on – but you can be damn sure we will ALWAYS have our eyes on the nearest exit! That being said, let's take a look as the S&P chart and the key resistance points we'll be watching this week:

The critical channel for the week is going to be between 1,130 and 1,150 and the most important takeaway from the chart is that we are now 10% over the 200 dma – that doesn't happen too often. I did the multi-chart in yesterday's post so we know where we generally stand. I have been bearish since last week – I am still bearish until we break 1,150 and then I will be VERY reluctantly bullish because I'm fairly certain it will all end in tears but knowing that in 1999 didn't stop us from having a fabulous year – even more so for those who cashed out at Christmas!

Can we party in 2010 like it's 2009, where a monkey with a dartboard could have picked a stock that was going to double? Well CSCO has an "It"-type announcement at 1pm and hopefully Cisco's "it" isn't Segway's "it," which didn't actually change anything except the way really rich people play polo.

Asia was flat as a board this morning and not much happened other than the Yen getting strong again as Japanese companies brought profits home before the fiscal year ends. This is happening at the same time as the Pound is getting weaker on poor housing data so currency traders may want to reverse this bet now that things are calming down. Moody's has also made some negative noises about British Banks (and their bonds) so not a good day for the UK, on the whole. Also of note in Asia, China's head of Foreign Exchange said "gold is unlikely to be China's investment of choice" as they diversify their reserve holdings BECAUSE IT'S TOO RISKY! Gee, imagine that…

Copper failed $3.40 but is still a far cry from rational (below $3.20) so we'll be watching them closely and gold fell all the way to $1,110 in pre market – which will be fantastic for our GLL play if it sticks. Oil fell all the way to $80.16 overnight but is, of course, recovering now that the NYMEX crooks have punched in for the day. $81.50 is the mark to make over there and once again we'll be looking to short oil at $82 the day before inventories if they are foolish enough to take it that high.

Not much else today. Greece and Dubai are still unresolved while Spain, Italy and Ukraine are getting harder to ignore. As with yesterday, we'll be watching our levels to see what sticks but, so far, it's looking like a slippery slope.