Hedge Fund Slams Rick Bookstaber For Comments On The Gold Bubble

.png)

Courtesy of Gus Lubin at Clusterstock/Business Insider

QB Partners fits the description of hedge funds that Rick Bookstaber accused of pumping the gold bubble and — even worse — of fueling the bubble with publicity.

The New York fund leapt to the defense of gold by sending an email to Business Insider with a message for Bookstaber.

Attached was the point-by-point rebuttal they gave to Nouriel Roubini in December when he had the nerve to diss gold.

Here are the highlights of QBAMCO’s Message To The Gold Haters >

See Also:

Rick Bookstaber: Hedge Funds Are Pumping The Gold Bubble And Luring Investors Off A Cliff

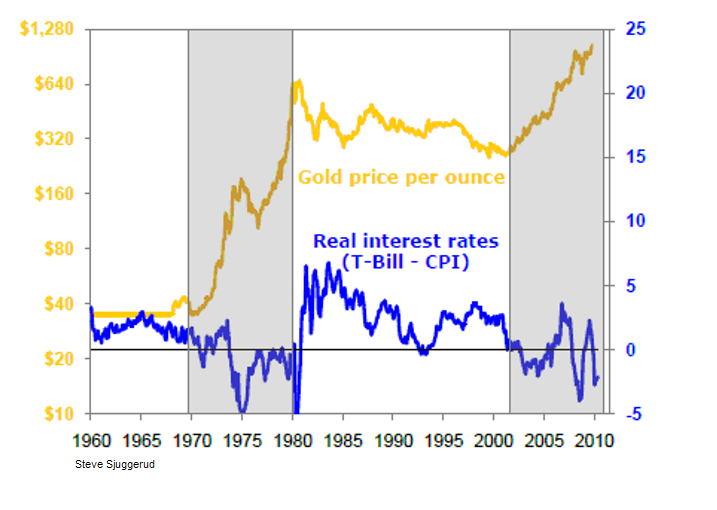

See also this chart (below) via Jesse’s Americain Cafe, and the comment by bidwhacker at Clusterstock

The economic cycle is definitely not the right framework for determining when to be in gold. Gold bull and bear markets can extend across economic upturns and downturns.

Absent an "economic meltdown" as you call it, the best tool for determining when the gold price will advance (at least since Nixon broke the last vestiges of the gold standard) is real interest rates:

Gold bull markets happen in an environment of negative real interest rates…This is the closest thing to an one-variable indicator for the gold market. But as you point out, it only good over longer periods of time and not a perfect correlation. The way I like to look at it is, when you have negative real interest rates, the odds are strongly with you that gold prices will go up.