They say that breaking up is hard to do.

Well, not for this market it seems as we make new highs on ever decreasing volumes. While I have been very skeptical of this rally, at some point you have to give in and go with the flow. As I said at the end of yesterday's post, "We still have a bearish short-term stance but we will continue to watch our technicals and play the hand that’s dealt" and that's what we did as our 9:42 Alert to members contained 2 bullish was to cover our short plays with the TNA Apr $52/53 bull call spread at .45, which finished the day at .60 (up 33%) and the DIA Apr $106 calls at $1.08, which finished the day at $1.40 (up 29%) so not bad for scrambling for covers!

That's how we can hold our bearish positions as the tide moves against us. As our final upside resistance levels begin to break, it may be time to break up, and not just cover, our short positions. BUT, not until next week, when we'll know, we'll know that it's true and not just some pumped up reaction to this week's $150Bn Jobs Bill, which is really a $150Bn debt bill with 1/2 the money going to benefits extensions and $25Bn just to offset rising Medicaid costs that our states can no longer afford. That leaves $50Bn for actual jobs or enough to put 1M people back to work at $50,000 for one year if it is used with 100% efficiency.

We have 25M unemployed, discouraged and underemployed workers and that's a lot bigger of a hole than a $150Bn band-aid is likely to fill. Still, we missed the last 250 points of the run-up and we're committed to miss 50 more (10,700) but, come next week we'll have to follow Mr. Cramer's advice, as he said yesterday: "Don’t be so skeptical that you write off very big, very real trends,” Cramer said, “that I still think, even from these levels, could make you a lot of money." Let's take a look at "these" levels then:

We're still following the uptrending channel I drew on Tuesday's S&P chart with the MACD line up 50% in 3 days of trading – a difficult trick to keep up. Aside from the Jobs Bill, we're getting a nice boost this morning from a "leak" that the supremely doveish Janet Yellen will be Obama's pick for Vice Chairman of the Fed so yay for the markets but boy are we loving our TBTs!

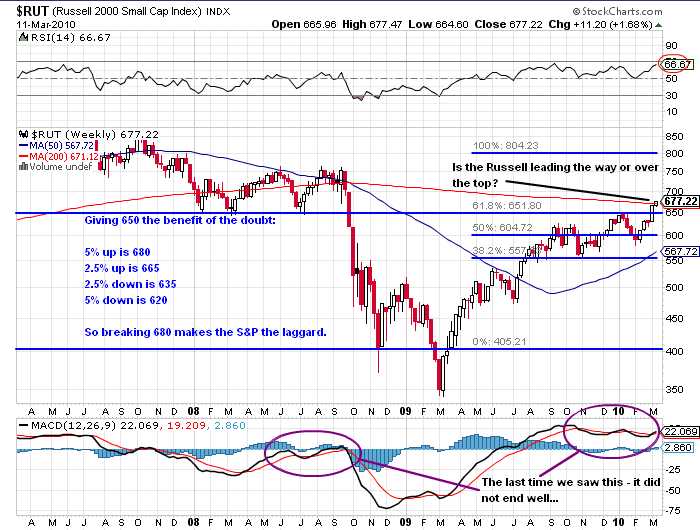

Oops, I just realized I was calculating 5% as 30 points, when it's 32.5 so it's 682 on top and 618 on the bottom of the Russell range. Anyway, that's not important, what is important is that the Russell is over the 200 week moving average and so is the Nasdaq by 7.5% (2,206 is the line), while the Dow is 5% below their 200 wma of 11,138 and the NYSE is 7.5% below 7,972. This is very worth watching as clearly if the Nasdaq and the Russell keep going, the other majors have a long way to go to catch up.

The SOX are close to the red line at 373 and the Transports have a long way to get to 2,331 from 2,062 (11.5%) so IYT makes a good upside protective play if we're going to buy into the bull premise but I do question the sustainability of a rally with oil over $80 and we're at $83 again this morning. Nonetheless, there's nothing wrong with a long bullish play like the Sept $70/75 bull call spread for $3.40, selling the Sept $64 puts for $1.40, which puts you in the $5 spread for net $2 (150% upside) and IYT is already at $78.28 so you make that 150% if IYT doesn't FALL 5% by September expiration – isn't that a nice way to be bullish?

The SOX are close to the red line at 373 and the Transports have a long way to get to 2,331 from 2,062 (11.5%) so IYT makes a good upside protective play if we're going to buy into the bull premise but I do question the sustainability of a rally with oil over $80 and we're at $83 again this morning. Nonetheless, there's nothing wrong with a long bullish play like the Sept $70/75 bull call spread for $3.40, selling the Sept $64 puts for $1.40, which puts you in the $5 spread for net $2 (150% upside) and IYT is already at $78.28 so you make that 150% if IYT doesn't FALL 5% by September expiration – isn't that a nice way to be bullish?

So I'm not too worried about missing a move prior to Dow 10,700 as there are dozens of new upside plays we can look at this weekend as we commit more cash to the rally but into hedged positions that will let us ride out the dips (if we ever do dip!). We are not the mythical sideline money because we already have tons of long plays but they are so deep in the money now we may not want to stick with them for fear of getting nose bleeds – I'll be looking over our Buy List this weekend too.

The Nikkei added another 1% today but the Hang Seng stayed flat and the Shanghai fell 1.25%. China gave Google a strong warning that they "will have to bear the consequences" if it stops censoring its Chinese search site which is, of course, sending GOOG higher pre-market since this rally clearly doesn't care about little things like losing 20% of the plantet's potential eyeballs. Japan revised their Q4 GDP down this morning from the 4.6% which rallied the Nikkei down to 3.8%, not even 20% off so nothing to worry about, right? Mari Iwashita, chief market economist at Nikko Cordial Securities, sees the economy growing only an annualized 0.4% in the first quarter, but then expanding 1.7% in the second quarter. Wow, that's terrible – no wonder the Nikkei is rallying – because bad news means MORE FREE MONEY! See, now you're getting the hang of this market!

Europe is up more than half a point this morning and our futures are looking good as well (9am) on rumors that the EU will be giving FREE MONEY to Greece (remember them?). European Industrial Output also rose, led by energy production, which jumped 2.6% as oil producers raced to ship out as many $80+ barrels of oil as the market would bear (oops, mustn't say bear!). The European Commission said last month that the euro-area economy will probably expand 0.2 percent in the first quarter after growing 0.1 percent in the previous three months. For the full year, the economy may expand 0.7 percent after shrinking 4.1 percent in 2009, the Brussels-based commission forecast. 0.7%! I know I'm excited, aren't you?

Europe is up more than half a point this morning and our futures are looking good as well (9am) on rumors that the EU will be giving FREE MONEY to Greece (remember them?). European Industrial Output also rose, led by energy production, which jumped 2.6% as oil producers raced to ship out as many $80+ barrels of oil as the market would bear (oops, mustn't say bear!). The European Commission said last month that the euro-area economy will probably expand 0.2 percent in the first quarter after growing 0.1 percent in the previous three months. For the full year, the economy may expand 0.7 percent after shrinking 4.1 percent in 2009, the Brussels-based commission forecast. 0.7%! I know I'm excited, aren't you?

So we have lots of FREE MONEY being dropped by our fearless (or is that clueless?) leaders. US Retail sales were up 0.3%, led by a 3.7% increase in food spending but gas sales were up just 0.3% despite the 15% increase in the price of gasoline so you can draw your own conclusion about demand but we're still shorting oil above $82. Consumers also cut back on other necessities to pay for food and oil like car parts (down 2%) and health and personal care items (down 0.7%) but hey, a guy's gotta eat, right?

So rah, rah markets – what an amazing rally, woo-hoo – everything must be great because the markets are making new highs. At least for now…

Have a nice weekend,

– Phil