Under the ratings company’s so-called baseline scenario, the U.S. will spend more on debt service as a percentage of revenue this year than any other top-rated country except the U.K., and will be the biggest spender from 2011 to 2013, Moody’s said today in a report. “We expect the situation to further deteriorate in terms of the key ratings metrics before they start stabilizing,” Cailleteau said. “This story is not going to stop at the end of the year. There is inertia in the deterioration of credit metrics.”

Under its adverse scenario, which assumes 0.5 percent lower growth each year, less fiscal adjustment and a stronger interest-rate shock, the U.S. will be paying about 15 percent of revenue in interest payments, more than the 14 percent limit that would lead to a downgrade to AA, Moody’s said. Financing costs above 10 percent put countries outside of the AAA category into a so-called debt reversibility band, the size of which depends on the ability and willingness of nations to reduce their debt burden by raising taxes or reducing spending.

The U.S. has a 4 percentage-point band, while the U.K. has a 3 percentage-point band. “Those economies have been caught in a crisis while they are highly leveraged,” Cailleteau said, referring to the level of private and public debt as a percentage of gross domestic product. “They have to make the required adjustment to stabilize markets without choking off growth.”

So happy Monday to you! The Pound is certainly not taking this news well and has plunged to $1.505 from $1.52 in early morning trading and the Euro has flopped back to $1.37 but we are still maintaining 90.7 to the Yen so it’s actually a strong dollar day so far. Copper, which is one of our key indicators, has fallen back to $3.32 – which is great for our short plays on FCX and gold is hovering under the $1,110 line (the bullish line for gold) while silver, our tie-breaker, is just over the line at $17. Oil has been skating along at $80.67 for the weekend and gasoline is still strong at $2.25 (go VLO!) with nat gas down at $4.34

So happy Monday to you! The Pound is certainly not taking this news well and has plunged to $1.505 from $1.52 in early morning trading and the Euro has flopped back to $1.37 but we are still maintaining 90.7 to the Yen so it’s actually a strong dollar day so far. Copper, which is one of our key indicators, has fallen back to $3.32 – which is great for our short plays on FCX and gold is hovering under the $1,110 line (the bullish line for gold) while silver, our tie-breaker, is just over the line at $17. Oil has been skating along at $80.67 for the weekend and gasoline is still strong at $2.25 (go VLO!) with nat gas down at $4.34

Perhaps the US should be more like China, who were going to have a budget deficit of 3.5% of GDP – which is above their target 3% but China moved swiftly to fix the problem – BY CHANGING THEIR ACCOUNTING, which is BRILLIANT! And why not, Greece did it, Spain does it even Italy and the Ukraine do it – let’s do it, let’s cook our books (with thanks to Cole Porter).

It’s not clear why China’s finance ministry is so attached to the 3% target. China has no obligation to keep its deficits below that level, and many foreign economists have urged the government to run bigger deficits. China also does not face pressure from global financial markets to run tight government finances, as its enormous pool of domestic savings means it has little need to borrow from abroad. But China’s government has in the past frequently faced questions from investors and its own public over whether official data accurately represent the state of the world’s fastest-growing major economy.

I know I may have mentioned liking TBT at some point, we took up some aggressive long positions on Friday as they dipped back to $48 and I do like them at this price, even though our usual buy-in is $46.50 with an exit over $49. Getting back to China – According the the WSJ, Google does look to be pulling out of the Chinese market as they are unable to resolve the censorship issue over there. This will give BIDU a hell of a pop this morning (and a good short on that pop!) as Google has 36% of China’s search market and BIDU pretty much has the rest (58%) but don’t be surprised if you see MSFT playing kissy-face with China as they try to push Bing in the People’s Republic.

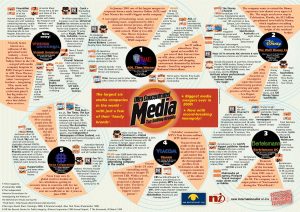

Google’s closure of Google.cn would leave the Internet in China—which has about 400 million users, more than any other country, and is adding about 250,000 more each day—almost entirely dominated by local companies. That helps the Chinese government’s efforts to control information, because it can more easily control local companies, but it means foreign participation in one of the fastest-growing parts of China’s economy will be limited, and it leaves Chinese users increasingly isolated, unlike Americans who have 6 – count ’em – 6 corporate sources of media to choose from!

Google’s closure of Google.cn would leave the Internet in China—which has about 400 million users, more than any other country, and is adding about 250,000 more each day—almost entirely dominated by local companies. That helps the Chinese government’s efforts to control information, because it can more easily control local companies, but it means foreign participation in one of the fastest-growing parts of China’s economy will be limited, and it leaves Chinese users increasingly isolated, unlike Americans who have 6 – count ’em – 6 corporate sources of media to choose from!

There is an excellent article by Ambrose Pritchard in the Telegraph about the dynamics of US and China’s economic posturing and it’s very interesting to read the British readers’ comments at the bottom. Once you have that perspective THEN you can read about Wen Jaibao’s warning to Washington that U.S. efforts to boost its exports by weakening the dollar amounted to "a kind of trade protectionism." Also on China, a great story in the LA Times profiling China’s "ghost airports" like Libo, a $57M airport that opened in 2007 and handled a grand total of 151 passengers last year.

We’ve been montitoring ovebuilding in China for quite some time concerns that China and India will be slowing growth to curb runaway inflation took the Shanghai down 1.2% today, falling back below the 3,000 mark while the Hang Seng pulled back 0.6% but Bombay and the Nikkei held flat, waiting to see what the US would do with the news and boosted by a strong dollar. Keep in mind the reason I liked US equites and the dollar for 2010 was because of the simple premise – "Sure we’re a mess, but have you seen the other guys?"

EU finance ministers are meeting this week to see if they can put out the still-raging Greece fire. Employment is DROPPING across the Euro-Zone so the ministers know that whatever they ultimately do for Greece will very likely have to be done a dozen more times as the dominoes begin to tumble. The problem with an economic turnaround that centers on revitalizing the top 10% is that the top 10% tend to have very clever ways to avoid paying taxes in addition to the legitimate write-offs many have (and this includes corporations) from losses during the crash. That means the governments are pouring Trillions of stimulus dollars into the economy but the lack of jobs growth presents them with an ever-shrinking tax base even as the interest bills are coming due.

EU finance ministers are meeting this week to see if they can put out the still-raging Greece fire. Employment is DROPPING across the Euro-Zone so the ministers know that whatever they ultimately do for Greece will very likely have to be done a dozen more times as the dominoes begin to tumble. The problem with an economic turnaround that centers on revitalizing the top 10% is that the top 10% tend to have very clever ways to avoid paying taxes in addition to the legitimate write-offs many have (and this includes corporations) from losses during the crash. That means the governments are pouring Trillions of stimulus dollars into the economy but the lack of jobs growth presents them with an ever-shrinking tax base even as the interest bills are coming due.

As I mentioned in the weekend post, I am trying to get more bullish but, as evidenced by the newsflow we discussed in Member Chat over the weekend – I still can’t get there! We’ll see what the pump monkeys can accomplish today – it’s a shame to be so close to Dow 10,700 and S&P 1,150 and not punch it up to new highs (and I charted how critical that would be this weekend). We’ll see if oil can hold $80 and copper $3.20 and gold $1,100 but, if not, we lived by the commodity rally and we’ll die by the commodity rally as the only commodity we think is poised to rise from here is interest rates as risk rears it’s ugly head.